Although Saskatchewan kimberlites carry much lower grades than those being mined in the Canadian Arctic, the sheer size of the Fort la Corne kimberlites renders them highly attractive targets.

The Fort la Corne kimberlite field, in the province’s central region, comprises some 73 known kimberlite bodies, ranging from 2.7 to 250 hectares in surface area. They are among the largest diamond-bearing kimberlite bodies in the world and individually range from 3 to 675 million tonnes in mass. Taken together, they constitute about 9 billion tonnes.

In terms of size, the Fort la Corne kimberlites are comparable to

At 118 hectares (1.2 sq. km), Orapa AK1 is the largest body in a cluster of 50 kimberlites and the world’s second-largest diamond producing pipe. When open-pit operations began in 1971, Orapa contained about 800 million tonnes of kimberlite to a depth of 660 metres. Reserves and resources for the open-pit mine at the end of 2000 totalled 653 million tonnes grading 49 carats per 100 tonnes, equivalent to 320 million carats of diamonds. The Orapa resource base, which incorporates three other smaller kimberlites, uses a bottom size stone cutoff of 1.65 mm and revenue of US$47 per carat.

For the sake of comparison, the Ekati diamond mine in the Northwest Territories came on-stream in 1998, based on five pipes containing a proven and probable kimberlite reserve of 65.9 million tonnes grading 109 carats per 100 tonnes (1.09 carats per tonne), equivalent to 72 million carats at an average value of US$84 per carat. Mine plans for the newly constructed Diavik mine in the Lac de Gras area of Canada’s Far North will see four kimberlite pipes deliver 107 million carats averaging US$62 per carat over a span of 20 years. Proven and probable kimberlite reserves at Diavik total 27.1 million tonnes grading 390 carats per 100 tonnes (3.9 carats per tonne).

In 2002, the Orapa mine produced 14.3 million carats from the processing of 16.4 million tonnes of ore grading 86.8 carats per 100 tonnes.

The Orapa AK1 kimberlite consists of two individual intrusive pipes that coalesce near surface. Clear differences exist in the geology of these two pipes. The pipes consist of predominantly well-preserved crater facie infill units that vary from primary pyroclastic deposits to reworked and resedimented epiclastic deposits. Hypabyssal facies kimberlite has only been intersected at depth in the mine. Diatreme facies kimberlite occurs in both lobes.

Unlike the Orapa deposit, which has no overburden, the Fort la Corne kimberlites lie beneath 75-150 metres of unconsolidated cover and have no surface expression. The thick overburden cover in the Fort la Corne area has rendered heavy-mineral till sampling ineffective; instead, companies have relied on magnetic and gravity geophysical surveys.

The 225-sq.-km land holdings of the Fort la Corne (FalC) joint venture contain a total of 63 kimberlite bodies. The Canadian exploration division of De Beers is the operator of the joint venture, with a 42.25% stake;

69 kimberlites

The joint-venture holdings currently cover 52 kimberlite bodies that form a north-northwest elongated cluster 65 km east of Prince Albert, Saskatchewan’s third largest city, with a population of 39,000. The main cluster is 32 km long, extending from Saskatchewan River to Highway 55 near Shipman. A smaller claim block covers 11 kimberlites in a satellite cluster a further 60 km to the northeast, near Snowden. The FalC joint venture originally held 69 kimberlite bodies but has trimmed its holdings in recent years by selling off some of the lower-priority satellite kimberlites in the Weirdale and Foxford areas. Each of the known bodies has been tested with at least one drill hole. Forty-nine of the original discoveries are diamond-bearing, and 34 have yielded diamonds larger than 1 mm.

Kensington recently announced the largest stone yet recovered by the FalC joint venture: a 10.23-carat diamond, discovered during the 2002 bulk-sample drilling program on the 140/141 kimberlite. Although no information is available concerning its quality, the large dodecahedral aggregate stone measures 14 by 10.5 mm in two dimensions and illustrates the potential for big-carat stones. A 3.33-carat diamond had previously been recovered from a 2001 large-diameter drill hole in the 140/141 kimberlite. De Beers valued this stone at US$390 per carat. The next two largest stones were 1.53 and 1.08 carats.

The Saskatchewan diamond play dates back to 1988, when rumours of kimberlite discoveries near Sturgeon Lake, 30 km northwest of Prince Albert, triggered a staking rush. Close to 2 million acres were snapped up. Using aeromagnetic maps published by the Geological Survey of Canada, Uranerz Exploration & Mining staked a large land position covering 28 isolated contour highs in the Fort la Corne area. Airborne magnetic surveys would later reveal 88 magnetic targets in the project area, 71 of which exhibited kimberlite-type signatures.

Seven targets

Uranerz brought Cameco in as a joint-venture partner in 1989. A first pass of shallow exploratory rotary drilling hit kimberlite in each of the seven targets drilled that year. An undisclosed number of microdiamonds was recovered from five of the seven kimberlites in drill-chip samples collectively weighing less than 100 kg. The stones were small but generally of gem quality. Seven larger diamonds exceeding 1 mm in at least one dimension were recovered. The largest stone had a diameter of 1.27 mm and weighed 0.0035 carat.

Drilling in 1989 sampled only the upper few tens of metres of seven kimberlite bodies. More intensive drilling, beginning in 1990, soon revealed that many of the kimberlite bodies were limited to a 100-metre thickness.

De Beers joined the FalC joint venture in 1992 under a 3-year earn-in period. The joint venture was again amended in 1995 to include Kensington, which earned an initial 25% participating interest by spending $3.4 million on exploration over three years. The current ownership has resulted from dilution clauses in the joint-venture agreement. De Beers became operator of the project at the end of 1998.

The Fort la Corne kimberlites were emplaced into a Phanerozoic sedimentary sequence of shale and sandstones along the northeastern margin of a broad sedimentary basin 112-90 million years ago. Little is known of the underlying metamorphic basement. Aeromagnetic and gravity data suggest the basement is geologically similar to the Glennie Domain, which is exposed farther north, in the vicinity of Lac La Ronge. The Glennie Domain is part of the Reindeer zone of the 1.8-billion-year-old Trans-Hudson Orogen and consists of Paleoproterozoic island arc volcanogenic successions separated by reworked Archean granitoids and granitic gneisses. Based on a compilation of field mapping, radiometric dating and lithoprobe seismic data, the Glennie Domain is believed to blanket the apex of a largely buried microcontinent, which

has been named the Saskatchewan Craton. It is suggested that the Saskatchewan Craton provided a thick lithospheric keel, which is a feature of diamondiferous kimberlite camps the world over.

In general, the Fort la Corne kimberlites are laterally extensive, lensoidal or disc-shaped horizons of well-preserved, crater facies pyroclastic kimberlite. They range from simple single-eruptive bodies to large, multi-eruptive events consisting of a series of stacked horizontal layers. Many of the kimberlites appear to have formed in a 2-stage process involving initial excavation of a relatively shallow and wide crater followed by infilling of both primary pyroclastic kimberlite and slumping of kimberlitic material from the margins of the crater.

Limited drilling has revealed that many of the kimberlite bodies are about 100 metres thick, with an irregular, peripheral apron narrowing to a thickness of 30 metres. The roots, or feeder systems, of these large kimberlite bodies were not identified until quite recently.

In early 2001, delineation core drilling by

Shore’s hole 20 provided the first real evidence of an underling root system to the Fort la Corne kimberlites. The FalC joint venture also appears to have uncovered the main feeder vent to the 140/141 body. While further delineating 140/141 in 2001, FalC encountered two exceptionally thick intersections of kimberlite. The first was in hole 141-9; it returned 258 metres of kimberlite. The second deep intersection was seen in hole 141-13, which encountered 339 metres of kimberlite to a 450-metre depth before shutting down while still in kimberlite.

Pyroclastic

The Fort la Corne kimberlites are classified as Group 1 kimberlites based upon a composition including two generations of olivine (phenocrysts and macrocrysts) and a ground mass of monticellite, spinel, perovskite, mica, primary serpentine and carbonate. Texturally, these rocks are classified as pyroclastic kimberlites. Reworked kimberlite sediments are usually found in the upper few tens of metres but can occur occasionally throughout the sequence.

The kimberlite bodies are dominated by olivine crystal tuffs and juvenile lapilli of variable composition, with rare-to-common country rock and mantle xenoliths, minor fine-grained interclast matrix, and rare amounts of garnet, ilmenite and chromite.

In 1999 and the early part of 2000, De Beers conducted an extensive evaluation of the Fort la Corne kimberlite bodies and outlined five targets (122, 140/141, 147, 148 and 150) on the basis of kimberlite size, diamond content and overall economic potential.

The FalC joint venture has spent the past several years focusing on the high-priority 140/141 kimberlite body. Kimberlites 140 and 141 were originally thought to be separate bodies. More recently, the 140 and 141 kimberlites were shown to be part of a single large body with an estimated footprint of 250 hectares and a mass exceeding 500 million tonnes, based on minimum thickness of 50 metres. At least four phases of kimberlite are identified.

Through 2000 and 2001, the joint venture completed a combined program of core and large-diameter (24-inch) drilling to gain a better understanding of the complex kimberlite and to test for diamond content and distribution, with the aim of establishing an average diamond value for the 140/141 kimberlite. Further drilling was also carried out, to a much lesser degree, on kimberlite bodies 122 and 150.

A 59.77-carat parcel of 706 diamonds (including the 3.33-carat stone) exceeding a 1.5-mm cutoff were recovered from a 1,081-tonne mini-bulk sample taken from 11 large-diameter, 24-inch (61-cm) holes drilled into the central portion of the 140/141 body. Sample grades for each of the boreholes ranged from 2.1 to 8.4 carats per 100 tonnes, giving a cumulative average of 5.5 carats. There is evidence of higher-grade zones within the kimberlite, based on individual bulk samples yielding up to 40 carats per 100 tonnes. De Beers valued this small parcel of stones at US$52.60 per carat, reflecting a substantial increase over a 2000 valuation of US$33.67 per carat.

Based on the combined 2000 and 2001 results, and in consideration of geological variations interpreted for the central part of the 140/141 kimberlite, De Beers calculated preliminary grade forecasts ranging from 5 to 12 carats per 100 tonnes, for stones larger than 1.5 mm.

Preliminary modeling by De Beers (considered low confidence until larger parcels are evaluated) suggests that the average value of the 140/141 commercial-size stones will fall somewhere in the range of US$20-220 per carat, resulting in predicted revenues of US$1-26 per tonne.

Considering the overall small diamond parcel recovered to date and the low levels of sampling across the immense 140/141 body, the FalC joint venture resumed delineation and bulk-sample drilling in the fall of 2002, with a program budgeted at $5.2 million.

To gain a better understanding of the geological makeup of this huge kimberlite, 25 additional NQ-size (1.87-inch-diameter) holes were completed. Thicker intercepts included hole 140-21, which returned 264 metres of kimberlite before shutting down while still in kimberlite at a depth of 370 metres, owing to poor drilling conditions. Hole 140-15 intercepted 234 metres of kimberlite and hole 141-36 hit 171 metres of kimberlite.

Tight cluster

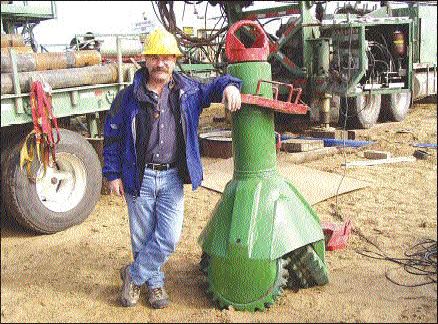

To increase the confidence level of its grade forecasts, valuation and revenue modeling, De Beers completed eight more large-diameter RC holes. Three of the holes were drilled using a 36-inch bit, larger than any other attempted by De Beers in Canada to date, in order to improve the recovery of diamonds. These three holes were positioned on the central part of the northwest eruptive centre in a tight cluster around core hole 141-29 and large-diameter hole 140-04, which returned significant grades and larger stones in 2000. The remainder of the large-diameter drilling program included five 24-inch large-diameter holes positioned over prospective southeastern and central portions of the kimberlite in areas where core drilling indicated favourable potential. In total, 1,272 tonnes of kimberlite were excavated from the RC holes. Final diamond recovery activities are continuing at De Beers’ facility in South Africa. Initial diamond counts may be available in the coming weeks.

A more detailed and extensive ground magnetic and gravity survey of the 140-141 body was completed in October 2002. In addition to expanding the footprint of the kimberlite body, two new intense gravity anomalies, with weak magnetic dipoles, were discovered close to the 140/141 body. Magnetic susceptibility logging has shown that some segments of known kimberlites at Fort la Corne can be non-magnetic.

De Beers will use the results of the most recent program in a conceptual modeling exercise, similar to a scoping study. The exercise is designed to provide economic thresholds for several preliminary mining options based on varying factors such as kimberlite size, depth, thickness, grade and value, in addition to capital and operating estimates.

Star project

Shore Gold owns all of the Star kimberlite, which is 3 km south-southeast of the 140/141 body at the southern end of the main Fort la Corne trend. The Star project covers 15 contiguous mineral claims totalling 46 sq. km, which Shore acquired by staking in 1995. Shore also owns a 100% interest in 114 additional claims in the immediate Fort la Corne area, covering 251 sq. km.

Shore has completed a total of 36 core holes in the Star kimberlite. According to preliminary estimates, the Sta

r body averages a thickness of 88 metres over a surface area of 4 sq. km and exceeds 500 million tonnes, based on a 30-metre cutoff. Caustic fusion analysis on 4,258 kg of split core sampled from 23 core holes drilled in 2000 and 2001 yielded 1,175 microdiamonds weighing 1.379 carats, including 265 stones exceeding 0.5 mm in one direction.

In the fall of 2001, Shore drilled a single large-diameter (24-inch) reverse-circulation (RC) hole into the Star kimberlite, 50 metres southeast of hole 20, to test the potential for commercial-size stones. This hole intersected 192 metres of kimberlite to a depth of 296 metres, before stopping because of mechanical failure. From the 82.7 tonnes of recovered kimberlite rock-chips, 183 diamonds larger than 1.1-mm sq. mesh screen were recovered, with a total weight of 8.52 carats. The implied sample grade was 10.3 carats per 100 tonnes. The largest stones recovered were fragments weighing 0.638 and 0.402 carat.

The Star kimberlite consists predominantly of pyroclastic deposits, with an underlying feeder vent containing diatreme facies kimberlite. The pyroclastic deposits consist of sub-aerial olivine-rich crystal tuffs and mixed olivine-lapilli tuffs, with subordinate kimberlite breccia.

“The Star kimberlite is clearly a multi-eruptive body, in which volcanic pulses appear to occur in close succession,” states Shore.

Overall, the Star kimberlite appears to have a relatively homogenous geochemical signature. Samples from distal sources within the Star body show geochemical features that link them to the root system in hole 20.

Indicator minerals identified in the kimberlite include both peridotitic and eclogitic garnets, as well as abundant ilmenite and phlogopite. Peridotite and eclogite mantle xenoliths are present as nodules up to 4 cm in size.

After hiring AMEC E&C Services to examine the diamond distribution across the Star kimberlite, based on drilling results, Shore elected to go underground to take a 25,000-tonne bulk sample and recover at least 3,000 carats for evaluation purposes and grade modeling.

The company is sinking a 4.5-metre-diameter shaft to a depth of 250-300 metres from surface. The shaft is being collared in the vicinity of the large-diameter, mini-bulk sample hole. “We have done a considerable amount of modeling on the area, and it appeared that any one area was as good as anywhere else,” Shore President Jonathan Challis tells The Northern Miner. “The area we have chosen is where the kimberlite is the thickest.”

From the shaft bottom, three crosscuts will be driven out in three different directions for at least 200 metres towards other drillhole locations. The program will produce about 25,000 tonnes of kimberlite, including 7,000 tonnes from the shaft alone.

Thyssen Mining Construction has begun building the shaft collar. A series of 22 freeze holes have been drilled around the shaft centre, which will provide a 2-metre-thick freeze wall to ensure stable ground conditions as sinking proceeds through the 90 metres of overburden. Shore expects to be in kimberlite by the end of July or early August.

Through a series of financings, Shore is in well-positioned to cover the costs of the underground program, which is estimated at $6-7 million. Last fall, Shore entered into an agreement with Magma Diamond Resources, a privately owned company with expertise in the evaluation and financing of diamond projects. Magma’s major shareholders include the Steinmetz Diamond Group, a diamond marketing and trading group, and Bateman Engineering. Magma invested $1.9 million in the company by subscribing to a private placement of 2.5 million units priced at 75 each, and it currently holds a 7.4% stake. Shore has 34 million shares outstanding, or just over 40 million fully diluted.

“That was an important transaction for us,” says Challis. “It gives us access to outside expertise. The Steinmetz Diamond Group is one of the largest traders in rough diamonds in the world.”

The 25,000-tonne bulk sample will be processed on site by personnel of Lakefield Research in a 10-tonne-per-hour dense-media-separation (DMS) plant designed and constructed by Bateman Engineering. The cost of the plant is being funded by Magma, which will lease it to Shore for the duration of the sampling program. The kimberlite will be treated in batches of about 6-metre advancement, representing roughly 200 tonnes. “This will give us a better idea of what the different phases of kimberlite are like and how homogenous or not they are,” explains Challis.

4 million carats

Shore suggests that a large-scale, 60,000-tonne-per-day open-pit mine and mill would be capable of producing in excess of 4 million carats annually for more than 20 years. The capital cost would be under US$500 million. Preliminary estimates assume operating costs could be less than US$10 per tonne. “What we need to know is what the rock is worth,” says Challis, adding that the recovery of 3,000 carats of diamonds will give a “fair approximation as to what the quality looks like.”

Other companies active in the Fort la Corne area include

In the summer of 2002, Great Western drilled two HQ-size (2.5-inch-diameter) core holes into the southeastern portion of the 29/30 body, intersecting 107 and 74 metres of kimberlite. One of the holes was partially sampled, returning 126 microdiamonds from 170.6 kg, including five stones exceeding 0.5 mm in at least one dimension. The remainder of the core will be submitted for analysis this year.

Juniors positioned in the Fort la Corne area include

Be the first to comment on "News – 23-JUN-03"