For a company not readily recognized for making its own discoveries, London-based

It may be the most significant copper find in recent years, or as Oscar Groeneveld, chief executive of Rio Tinto’s copper group, told analysts at a recent investor seminar, “although really deep, the Resolution deposit in Arizona is a huge resource of copper with good grades. We currently estimate over one billion tons of reserves at a grade of over 1.5 per cent copper, and we expect to add to this.”

Rio Tinto is earning a 55% interest in the project from

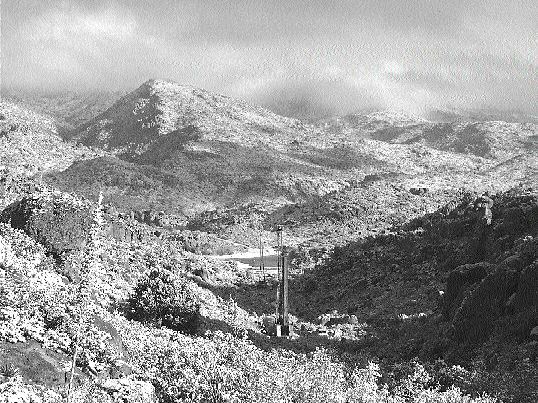

The Superior mine site is 90 miles east of Phoenix, near the town of Superior. BHP acquired the historic producer through the takeover of Magma Copper in early 1996. The underground copper sulphide mine ceased operations later that year after reserves were depleted. The Superior mine and concentrator had originally re-opened in 1990 (after being closed for about eight years) based on a revised mining plan of 1,500 tonnes per day that used a much-reduced workforce to exploit 1.8 million tons of high-grade reserves averaging 6.87% copper.

The new Resolution deposit is deep. The top of the dome-shaped structure is 1,400 metres from surface, or 250 metres below sea level. Over a 20-month exploration period, Rio Tinto drilled 17 holes from five sites. There had been earlier indications of significant grade intercepts based on old drilling done during the days of Magma from the Superior underground workings. As it stands, the deposit measures 1,800 metres long, 1,500 metres wide and 200-450 metres thick.

The project was handed to Rio’s Copper group in December 2002 for further studies. “The studies will take considerable time,” says Groeneveld. “We need to understand the orebody and evaluate the best mining method. We will also need to navigate the U.S. permitting process. We do not expect production before the middle of the next decade.

“The effort we will put in over the next couple of years will be about securing all the land we need at surface for the footprint of what would be a major project, securing water rights and studying the thermoting process, which obviously involves a lot of environmental base-line work.”

Virgin rock temperature of 80C at the base of the conceptual mine will present formidable operating challenges, as will in situ stresses, at this level of 2,000 metres below surface. Rio’s head of exploration, David Klingner, says block caving is the only viable mining option. Initial studies indicate that building a sustaining cave will be possible.

Metallurgical tests would seem to suggest that high-grade concentrates can be produced with good recoveries. “Resolution could provide an excellent platform for future copper production for the group,” says Klingner.

An annual budget of US$100 million, set aside for greenfield exploration, easily enables Rio to pursue about 50 core projects worldwide. The projects are geographically diverse and cover a broad range of commodities, including those markets in which Rio is very familiar, such as iron ore, and those in which it does not have a significant presence, such as nickel. In 2003, the company spent an additional US$40 million on evaluation and exploration near the mine site. At the moment, US$20 million is being spent on an iron ore program in Western Australia, converting resources into reserves.

“To be a great mining company it is necessary to gain access to the great orebodies,” says Klingner. “There are two ways to gain access to such orebodies: we can buy them and we can find them. It is our belief that the ability to find high quality ore bodies is one of Rio Tinto’s competitive advantages. Three of Rio Tinto’s product groups — iron ore, aluminum and diamonds — have been built on the backs of exploration finds.”

Using the experience and expertise gained from the Diavik diamond discovery in the Slave province, Rio continues to be active in the Canadian diamond exploration scene and has made three new highly diamondiferous kimberlite discoveries on the northern tip of Baffin Island.

Meanwhile, in India, Rio Tinto has unearthed four diamond-bearing kimberlite pipes, one of which was actually outcropping, at its Anantapur project in the southern region of Andhra Pradesh. India is the source of some of the most famous diamonds in the world, all of which came from alluvial workings.

Klingner says modern exploration for their bedrock source was not possible until recently. Rio currently has title to 25,000 sq. km of prospective terrain, with pending applications for more than 49,000 sq. km. The company has spent more than US$8.7 million to date in India.

Exploration programs for copper porphyries are under way in Chile, Peru and Argentina. In the San Juan province of Argentina, close to the Chilean border, Rio has drill-tested the Altar prospect with only five holes to date. The best intercept was 98 metres grading 1% copper and 0.12 gram gold per tonne. A classic enrichment blanket containing chalcocite, typical of the South American porphyries, has been identified, and drilling continues.

Jumping continents, Rio Tinto has confirmed major new iron ore resources at the Simandou project in Guinea, West Africa. Drilling has outlined more than 1 billion tonnes of inferred mineral resources grading 66.9% iron, with low silica, aluminum and phosphorous impurities. “This is one of the highest-grade iron ore deposits anywhere,” says Klingner. In addition, there are 875 million tonnes of lower-grade resources averaging 62.3% iron that Klingner still considers attractive. The Guinean government has signed a mining convention giving Rio title for 50 years. Additional exploration licences, in effect, give Rio title to an entire iron ore belt.

An order-of-magnitude study on the Simandou project is under way; it includes further resource drilling, metallurgical work and business opportunity studies.

Turning to nickel, the company has generated both laterite and sulphide prospects. In Sulawesi, Indonesia, Rio holds a 100% interest in the La Sampala laterite that contains a potential geological resource of 320 million tonnes grading 1.43% nickel. Klingner says Sampala compares favourably to Inco’s Goro laterite deposit in New Caledonia, which is generally regarded as the best of the limonitic laterite nickel projects.

Closer to home, Rio has discovered massive sulphide nickel mineralization at its Eagle prospect in Michigan’s Upper Peninsula. “Eagle is showing early promise,” says Klingner. High-grade nickel-copper mineralization was discovered in 2002. During the 2003 campaign, 15 drill intersections into the deposit were obtained. A resource model was to be completed by year-end 2003. Mining and processing options will be assessed based on this model, and the initial project evaluations are to be completed in the first half of 2004.

“Although this deposit is modest in size, it may provide Rio Tinto an entry into the North American nickel business,” Klingner says. It’s described as a Norilsk-style nickel-copper-platinoid metal deposit.

Be the first to comment on "Rio Tinto reports major copper find in Arizona"