Vancouver — In 2003, spending on precious metals exploration in Alaska amounted to a disappointing US$12 million. However, a considerable improvement is expected for 2004, owing to the increase in the price of gold, which, in turn, has enabled juniors to raise millions in equity financings.

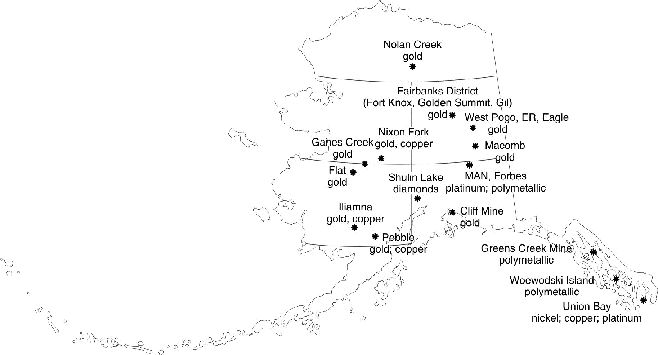

Staking is especially active in the Pogo area, in northeastern Alaska, and in the Pebble area, in the southwest (see map, page 15).

However, permitting is time-consuming and fraught with snags, as was recently witnessed by

In March, the U.S. Environmental Protection Agency gave a discharge permit to Teck and Sumitomo, allowing construction to go ahead. But an environmental group, the Northern Alaska Environmental Center (NAEC), then filed an appeal, citing concerns about potential contamination of the Goodpaster River drainage area.

Teck Cominco promptly halted construction, preparing itself for a delay in development of up to a year. Fortunately, the problem was resolved after the company agreed to take protective measures to ensure the health of the drainage area and agreed to create a citizens’ advisory group to review the project periodically. Construction has since resumed.

Teck has budgeted US$75 million for development spending in 2004, most of which is earmarked for Pogo.

Reserves at Pogo are pegged at 7 million tonnes grading 16.1 grams gold per tonne. The mine is expected to produce 400,000 oz. gold per year over 10 years. The first gold pour is slated for late 2005.

AngloGold has launched a large-scale reconnaissance program, beginning with sampling. The company plans to spend US$2 million in the state, or about two-thirds of its North American exploration budget. The work will entail reconnaissance prospecting, as well as drilling of more than 19,000 ft. on properties in the vicinity of Pogo and at Livengood.

Vancouver-based

Vancouver-based

Northern Dynasty can acquire the 36 claims covering the Pebble deposit by paying Teck Cominco US$10 million in cash or stock by Nov. 30, 2004, and purchasing the Hunter-Dickinson group’s 20% interest in shares at an independently appraised value. After that, the junior can earn a half-stake in the surrounding property by drilling 18,290 metres before Nov. 30.

Northern Dynasty and Teck Cominco now hold a total of 150 sq. miles of claims surrounding Pebble.

An independent inferred mineral resource estimate pegs the Pebble deposit at 26.5 million oz. gold and 16.5 billion lbs. copper contained in 2.7 billion tonnes of material averaging 0.27% copper, 0.015% molybdenum and 0.3 gram gold per tonne, based on a cutoff grade of 0.3% copper-equivalent. The inferred resource was based on 38,301 metres of drilling in 169 holes. The new estimate is nearly triple the 1 billion tonnes grading 0.3% copper and 0.4 gram gold (at the same cutoff grade) estimated in March 2003 by Australian-based Snowden.

Northern Dynasty says a large open-pit mine at Pebble would cost US$1 billion to develop, employ 2,000 workers during two years of construction and 700-1,000 workers during production. A 65-mile road would be needed to connect the mine to a port on Cook Inlet. Iliamna, 15 miles from the project, has an airport with two paved runways.

This year’s work program includes infill drilling, engineering, mine design, and environmental baseline studies.

A surge in claim staking by other juniors occurred once the economics and the scale of the Pebble project became apparent. The economics were boosted by higher copper, molybdenum and gold prices. By the first quarter, more than 500 sq. miles had been staked.

Tucson, Ariz.-based

The company has flown an airborne magnetic survey to determine drill targets for later this summer. Four significant magnetic anomalies have been identified, all of which will be followed up during the upcoming field season. The company plans to spend US$3 million this year and recently completed a US$1-million financing. Follow-up geotechnical and ground geophysical work is under way, with drilling scheduled to follow.

Liberty Star’s exploration manager, Phil St. George, is no stranger to the Alaskan exploration scene. He managed the Donlin Creek gold project for NovaGold and is credited with the initial Pebble discovery while working for Cominco.

Also active in the area is newly formed

Placer Dome has a 30% stake in Donlin Creek, with joint-venture partner

Placer Dome and NovaGold increased the gold resource at Donlin Creek in April 2003. At a cutoff of 1.5 grams gold per tonne, the measured and indicated gold resource is estimated at 11.1 million oz. Inferred resources stood at 14.3 million oz. gold.

A preliminary economic assessment by AMEC E&C determined the mining, processing and metallurgical requirements for development. The study showed that a conventional open-pit mine would be economic. Donlin Creek is envisaged as a 20,000-to-30,000-tonne-per-day operation capable of producing 1-1.4 million oz. gold per year.

NovaGold is also busy at its Rock Creek project, near Nome, where production could be closer at hand — maybe as early as next year. An in-house study suggests Rock Creek could produce 100,000 oz. a year at a cash cost of US$150 per oz. Capital costs including working capital are pegged at US$30 million for an open-pit mine. Norwest and AMEC E&C Services have been contracted to conduct an independent scoping study.

Meanwhile, NovaGold intends to restart placer mining at its nearby Nome project, where mining was suspended in 1998 as a result of low gold prices. The gold resource at Nome is about double that of Rock Creek, but production would be around 50,000 oz. a year at higher costs. The property contains a measured and indicated resource of 1.2 million oz. gold and an inferred resource of 1.1 million oz. More than 4 million oz. have been extracted from the property since 1900. The company has budgeted US$500,000 for delineation drilling and engineering work in 2004.

Toronto-based

In the first quarter, Fort Knox produced 75,980 oz. gold-equivalent at a total cast cost of US$290 per oz. For the year, output is projected to be 340,000 oz. at US$220 per oz.

Decreased production is the result of the company’s decision to suspend mining of the True North pit for several months so that the mining fleet can be used for a tailings dam lift at Fort Knox, where a major pit expansion is under way.

Last year’s exploration at the Fort Knox pit confirmed that the mineralized zones were continuous enough to justify a major pit-wall “layback.” The layback will take three years and cost about US$60 million. Mostly, this will involve stripping to free the ore and prolong the life of the mine. This year’s budget is US$39 million.

Historically, Tintina has lode-produced more than 3.5 million oz. gold, and placer production exceeds 31 million oz.

The company plans to conduct an induced-polarization survey, grid-based soil sampling, and rock sampling prior to drilling the West Ridge target.

Teryl has a 20% interest in the Gil project, with the remainder held by Kinross. Teryl’s holdings also include the Fish Creek claims, in which

The 2003 program at Gil consisted of reverse-circulation and core drilling, trenching, rock sampling, geologic mapping, reclamation, and environmental monitoring — all aimed at increasing the level of confidence in the grade and continuity of mineralization at the Main and North Gil deposits. Drilling expanded mineralized boundaries in portions of both zones, and identified several high-grade quartz vein targets.

Exploration work along Sourdough Ridge, in the western portion of the Gil claim block, outlined two significant calc-silicate units exposed on surface for 300 ft. in a northeasterly direction. Drilling confirmed strong gold values.

Meridian can earn up to a 70% interest in the Golden Summit from Freegold by spending US$5 million on exploration over four years, completing a bankable feasibility study, and financing the project into production.

Initial drilling will target the strike extension of previously intersected high-grade mineralization at the historic Cleary Hill mine. Drilling will probe below previously mined levels on the property, which contains several other historical, small-scale gold producers.

In southeastern Alaska, Idaho-based

The project is estimated to cost US$85 million, which will be spent in 2004-2005. The yearly production rate will be around 100,000 oz. gold, when the proposed mine reaches full production. In addition, 7.3 million tons of material averaging 0.12 oz. gold per ton exist on the property. The cash cost of production is expected to be US$195 per oz. over a mine life of 10 years.

The company expects the project to have all received all permits by the third quarter. After the final updated feasibility is complete and the final permits are in hand, construction would begin. Startup would be sometime in 2006.

Calgary-based

The Cliff mine produced more than 50,000 oz. gold from a high-grade underground lode deposit between 1910 and 1942.

Western Warrior drilled the property last fall, completing 4,855 ft. in six holes to depths of 800 ft. Intercepts ranged from 0.006 to 1 oz. gold per ton.

Be the first to comment on "Alaska emerges as gold giant"