The friendly offer calls for Agnico to issue 10.3 million shares to Riddarhyttan shareholders in return for an 86% interest in the company. Last year Agnico spent $14 million for a 14% interest.

By offering 0.1137 Agnico share for each Swedish-listed Riddarhyttan share, the bid values the latter at US$1.42 apiece and represents a 27.3% premium based on the closing share prices on May 11, the day before the bid.

The premium sits at 36.5% if the average closing prices for the 30-day trading period prior to the offer are calculated.

Riddarhyttan’s directors and financial advisors support the offer unanimously.

The offer is conditional on Agnico’s acquiring at least 90% of Riddarhyttan’s outstanding shares and on regulatory and governmental approval. The offer will be submitted to U.S. and Swedish regulators, and then, if passed, mailed to shareholders before the end of the month.

At March 31, Riddarhyttan had US$6 million in cash and no debt. Riddarhyttan’s main asset is the 17.25 sq.-km property that hosts the Suurikuusikko disseminated gold sulphide deposit, 885 km north of Helsinki, Finland.

The deposit is in a greenstone belt comparable to the Abitibi and has an indicated resource of 9.6 million tonnes grading 5.6 grams gold per tonne (or 1.7 million oz.). In addition, there is an inferred resource of 7.6 million tonnes grading 4.4 grams gold per tonne.

Both estimates were prepared according to the Australasian code for reporting mineral resources and reserves, and are based on a cutoff of 2 grams gold per tonne.

Agnico has already been working on Suurikuusikko for the past three years.

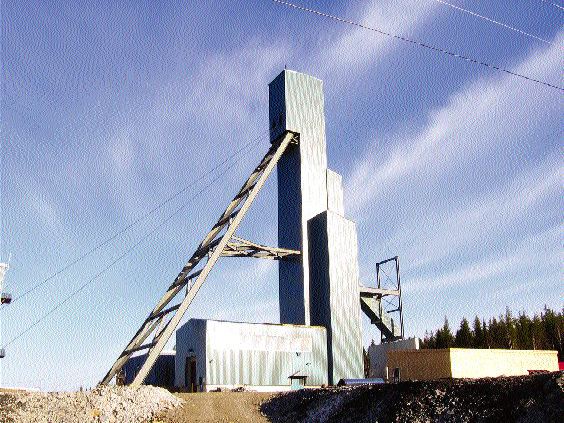

The property has access to a power line and a paved highway, and the town of Kittila (pop. 3,000) is only 10 km away.

Riddarhyttan submitted a feasibility study for an open-pit mine and applied for operating and environmental permits in 2001. A construction permit is still required from the municipality of Kittila.

Drilling is testing the deposit at depth while converting resources from the inferred to the indicated category. The deposit has the potential to become an underground operation once the open-pit phase is completed.

Riddarhyttan is updating its resource estimate and performing metallurgical tests. Previous tests focused on bio-oxidation, though recent results suggest pressure oxidation is the way to go.

Higher prices for byproduct metals had a positive effect on first-quarter cash costs for Agnico, which produces gold, in addition to silver, zinc and copper at its LaRonde mine in Quebec’s Abitibi region.

In addition to 55,310 oz. gold sold at US$430 per oz., the mine produced 1 million oz. silver, 41.1 million lbs. zinc, and 3.9 million lbs. copper, at US$6.85 per oz., US60 per lb. and US$1.47 per lb., respectively. Comparative realized prices in the first quarter of 2004 were US$412 per oz. for gold, US$6.72 per oz. for silver, US47 per lb. for zinc, and US$1.25 per lb. for copper.

LaRonde is Agnico-Eagle’s only producer.

The total cash cost for the quarter was US$67 per oz., compared with US$78 in the corresponding period of 2004.

Agnico-Eagle made a profit of US$10.4 million (or US12 per share) in the recent 3-month period, whereas a year earlier it earned US$12.9 million. The shortfall is attributed to non-cash losses on byproduct metal derivative contracts.

At the end of March, the company had US$117 million in cash and equivalents, up from US$106 million a year earlier.

LaRonde processed 648,615 tonnes of ore grading 3.1 grams gold and 73 grams silver per tonne, 4.13% zinc and 0.39% copper, compared with 625,083 tonnes a year earlier at 3.77 grams gold, 78.9 grams silver, 3.9% zinc and 0.55% copper.

Mining focused on the zinc-rich upper levels; consequently LaRonde produced 12% more of that metal than a year earlier. Gold, silver and copper production fell during the quarter, by 21%, 2.7% and 32%, respectively.

An exploration drift on the 215-level has been extended into the adjacent Bousquet property, and resources there are being defined. Drilling is also under way on the 218-level exploration drift, where grades are highlighted by 8.2 grams gold, 23 grams silver, 0.3% copper and 0.3% zinc over a true width of 13 metres. The area is to be mined over the next three years.

High gold grades are reported from underground drilling at Bousquet and into the adjacent Ellison property. The program intersected a wide alteration zone with grades of up to 24.3 grams gold over 2.8 metres (gold was cut to 34 grams per tonne). Drilling continues to test this zone.

Agnico-Eagle is exploring several targets in the area between Val d’Or and Rouyn-Noranda, including Lapa and Goldex. At the recent annual meeting, Agnico President Sean Boyd emphasized the region’s exploration potential. He said that when the company decided to sink a shaft at LaRonde, the resource was estimated at 6.6 million tons grading 0.13 oz. gold per ton, or about 800,000 oz. gold; however, since startup, the mine has produced 2.6 million oz. gold — and an additional 7.4 million oz. are outlined.

Lapa has a reserve of 4.5 million tons grading 0.26 oz. gold, or 1.2 million oz. A shaft has advanced to 100 metres of a planned 825 metres, and a lot of the holes drilled have cut visible gold.

At the Goldex property, an in-house feasibility study was completed, though this is now undergoing an independent review.

Goldex has a probable reserve of 20 million tonnes grading 2.4 grams gold per tonne. An 800-metre shaft and a couple of exploration drifts are already in place, and final permitting is under way.

Agnico-Eagle has timed its regional expansion well. The recent closure of the Bouchard-Hbert mine enabled the company to hire some of its workers, and workers at the soon-to-close Louvicourt mine may also be added to the Agnico payroll.

Boyd is bullish on the commodities market: “A good demand for commodities is coming out of emerging economies such as China and India, and we expect that to be sustained.”

In March of this year the company optioned the Pinos Altos project in northern Mexico from

Pinos Altos has an indicated mineral resource of 4 million tonnes grading 6.17 grams gold and 131 grams silver per tonne, plus an inferred resource equivalent to 400,000 oz. gold and 8.4 million oz. silver.

Agnico-Eagle is also exploring for diamonds:

Microdiamond results are pending for these pipes.

Discovery holes yielded 27 diamonds from 88 kg of sample from one pipe and 19 diamonds from 85 kg from the other.

Other kimberlite targets are being drilled, and microprobe analysis is under way on indicator minerals found in till samples collected on both the Klock and Cole properties.

Be the first to comment on "Agnico-Eagle bids for Riddarhyttan"