Exploration is concentrated on the Villalpando del Alto vein, which has averaged 25.2 grams gold and 765 grams silver per tonne over an average width of 0.75 metre and along 120 metres of strike. An exploration raise will test the vertical extent of the vein. The initial 8 metres graded 53 grams gold and 2,621 grams silver per tonne over an average width of 0.84 metre.

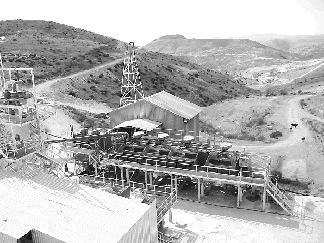

The mine produced an average 58,000 oz. gold-equivalent per year over the past five years. The mill was expanded in 2001 and has since been operating below its 1,400-tonne-per-day capacity. Mexgold hopes to increase production to 100,000 oz. per year. Current metal recovery is 91-92% for gold and 85% for silver.

Proven and probable reserves, estimated by using channel samples collected from drifts, crosscuts and raises, stand at 1.49 million tonnes grading greater than 3.81 grams gold-equivalent per tonne. The average grade is 5.36 grams gold and 162 grams silver per tonne over a width of 1.26 metres.

To reduce dilution, Mexgold has begun test-mining using shrinkage stoping, rather than the cut-and-fill, which had been used. An inferred resource of 1.19 million tonnes grading 5.21 grams gold and 345 grams silver per tonne remains in the pillars. The mine has been allowed to flood below the 8-level down to level 12. This was done prior to Mexgold’s becoming the owner; however, several high-grade shoots are open at depth, and de-watering is an option.

The El Cubo mine area contains about 40 mineralized veins, wich are directly related to faults. The largest is the northwest-trending, steeply dipping Villalpando vein, which contains 40% of the known resources. Some of the mineralized veins strike northeast and dip 70-90. Veins are generally 1-2 metres wide, though several 10-to-20-cm-wide veins have been mined selectively, owing to their high grade. Weak stockwork veining and mineralized breccia zones up to 10 metres wide are present.

Mexgold bought the 45-sq.-km El Cubo project in March. It comprises 46 exploitation concessions and lies 475 road kilometres northwest of Mexico City. The company also holds 12 exploration concessions (36 sq. km) in the same region.

The project is operated by Compania Minera de El Cubo, a Mexican subsidiary of Mexgold. Mexgold has 18.7 million shares outstanding, or 29 million on a fully diluted basis.

Mexgold is also drilling its Guadalupe y Calvo gold-silver project in Chihuahua state. Assay results from 19 holes were released at the end of June. Infill drilling is upgrading the estimated inferred resource on the property. Highlights of this drilling include a 3-metre intercept grading 20.3 grams gold and 171 grams silver over 3 metres. Fourteen other holes intersected gold-equivalent grades of 3.2-9.3 grams over widths of 1-4 metres. Three holes failed to intersect mineralization above the cutoff of 3 grams gold-equivalent per tonne.

Be the first to comment on "Resources up as mining continues at El Cubo"