El Callao, Venezuela —

Highlights from drilling at one deposit, Coacia, include hole 217, which cut 4.8 metres grading 18.45 grams gold per tonne at a down-hole depth of 136 metres — part of a 42.5-metre interval of 8.3 grams gold. Four metres farther down-hole, another 11.1 metres graded 5 grams gold per tonne.

Hole 217 was one of two holes that cut the zone beneath the Coacia resource. The other hit a high grade of 102 grams gold per tonne in a 1-metre sample (true width, in this case, was about one third of a metre).

Choco comprises several deposits that warrant mining. One, Pisolita, has an indicated resource of about 8.8 million tonnes grading 1.37 grams gold per tonne, based on a cutoff of 0.5 gram gold per tonne. Two others, Rosika and Coacia, have a combined measured resource of 3.7 million tonnes grading 2.53 grams gold and an indicated resource of 19.2 million tonnes at 1.64 grams gold (with a 0.5 gram gold per tonne cutoff).

Rosika has been drilled more than the other deposits. Until recently, a population of small miners worked on Pisolita. Drilling will test the deposit at depth.

At the end of August, proven and probable reserves stood at 21.4 million tonnes grading 1.9 grams gold per tonne. The calculation does not include about 90 holes drilled subsequently: 11 into the edge of the resource, 22 condemnation holes, and the rest primarily outside the prospective pit limits.

New drilling 300 metres north of the proposed Rosika pit outline has identified a gold resource named Karolina, which dips at 55 toward Rosika. Several holes cut high-grade intervals, including hole 158, which returned 40 metres at a cut grade of 7.7 grams gold per tonne. The hole included a 14-metre section of 17.4 grams gold (with gold cut to 34 grams per tonne).

Several holes at Karolina intersected multiple gold-enriched zones, including no. 180, which returned 1.1 metres grading 40.8 grams gold, followed 30 metres down-hole by 4.1 metres of 8.4 grams gold and 50 metres farther down-hole by 5 metres of 10 grams gold. Another hole, no. 211, hit five zones from 3.5 to 13 metres wide grading 3.3-9 grams gold per tonne. One of the intersections contained a 3.8-metre intercept grading 21 grams gold per tonne.

Other prospects, including the nearby Villa Balazo, also require further work. At Villa Balazo, several holes have cut economic gold grades over significant widths. Hole 153, for example, intersected 33 metres grading 2.3 grams gold.

Bolivar has budgeted US$6 million for exploration.

The mineralized sections of core from Coacia and Rosika exhibit intense quartz-carbonate alteration and veining with local pyrite, sericite and albite. Veins crosscut intermediate volcaniclastic rock and meta-basalt in a sheared, folded and brecciated deformation zone at or near the contact between the two rock types. The Villa Balazo zone comprises two alteration-deformation zones in meta-basalt, whereas the Karolina upper and lower zones are in metabasalt near a contact between mafic volcaniclastic rock and basalt.

In May, about 580 artisanal miners were working on Bolivar’s ground. However, none of them held legal title to the land, and Bolivar persuaded each of them to leave the area in return for specified sums which totalled US$1 million. A final contingent of 17 people was evicted (although they also were paid to leave) in mid-November.

Under Venezuelan law, the National Guard is responsible for guarding explosives at minesites. At Choco, the Guard is also helping Bolivar deal with illegal miners.

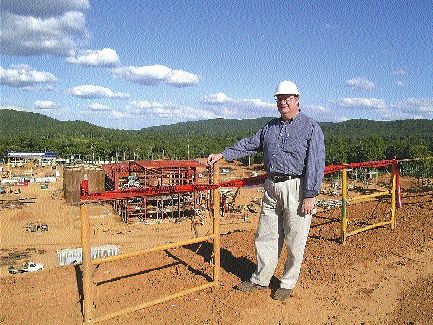

The company plans to run the mine using a staff of 7-8 foreigners out of about 250 employees. Most of the labour force will be from the town of El Callao. The region has been known for its gold production since the mid-1800s. At present, about 500 workers are engaged in building the mine.

Initially, a stripping ratio of 2.7-to-1 is anticipated, and the total production cost is expected to be US$159 per oz., including a 4.7% royalty. The mine life is pegged at 6.5 years, given current reserves.

A lot has been accomplished since the company broke ground at the end of February: waste has been stripped from the open-pit site and the ore is ready to be blasted and carted away; the waste material has been used to build a 3-compartment tailings dam; and infrastructure is at an advanced stage of construction. Bolivar intends to commission the full crusher circuit by early February.

The water reservoir has a volume of 1.4 million cubic metres, and the pumping system to the plant has been installed and tested. The reservoir holds enough water for three days and is not yet full. The region receives 1.2 metres of rainfall per year, most of which falls in December and January. A reclaim line from the tailings dam has also been installed; it will have a pumping capacity of 500 cubic metres per hour. The company is seeking permission to build an underground waterline from the river to the minesite. The waterline would take five weeks to complete. About 5,000 cubic metres of water per day will be needed, and Bolivar plans to recycle at least 60% of the water it uses.

Bolivar bought the Idaho-based 5,400-tonne-per-day Grouse Creek mill from

The plant was shipped from Houston to the port of Puerto Ordaz, which has an airport with frequent scheduled flights to Caracas. The Choco property is crossed by a paved highway that leads into El Callao and connects El Callao with Puerto Ordaz. The mining fleet was mostly bought in the U.S. and shipped over in May.

So far, Promotora Minera de Venezuela (PMV), a unit of Bolivar, has been exonerated from import duty, says John Thomas, a director of PMV and vice president of operations for Bolivar Gold.

The exploitation permit has not been signed, so the mill has been brought in on a temporary import permit, and is being built. A last survey of property markers has been done, and the permit is expected shortly.

A crushed-ore bin has been installed. Plans call for a 100-metre conveyor belt to transport ore from the crusher to the mill; that is in the works. Also, the ball mills have been lined and are ready for action, and three 330-cubic-metre leach tanks have been erected (welding is about 50% complete). Seven carbon-in-pulp tanks are complete and a test of the system will be carried out once the new electrical line has been hooked up (tanks will be filled with rejected material from small miners that grades 11 grams gold per tonne).

Before startup, a 115-kV electrical line needs to be installed. Towers and transformers still need to be erected along the line’s 4.3-km route, though power is promised for mid-December. As at presstime, seven of the 17 towers have been erected and the carbon treatment portion of the mill is 90% complete.

Electricity and fuel are inexpensive in Venezuela and that will help to keep costs down once everything is up and running.

Gold pours will take place once a week.

In the first year, Bolivar expects to send 1.8 million tonnes through the mill, increasing to 3.5 million tonnes thereafter. The mill is being built to handle 4,500 tonnes of ore per day, but an expansion to 10,000 tonnes is being planned with completion expected for October of next year.

The schedule is down to the wire and with Christmas holidays thrown in the challenge is hefty. Bolivar has experience mining in Bolivar state and that adds to one’s confidence that obstacles will be overcome and gold production won’t be far off-track at Choco 10. The project is running about a month behind schedule but is on budget. About US$38.4 million has been spent to date.

Bolivar, through various subsidiaries, owns 70% of the Choco property. The Corporacion Venezolana de Guyana (CVG), a Venezuelan government corporation, holds the remainder through its subsidiary, Ferrominera del Orinoco. Two exploration concessions, Choco 4 and 10, have been converted into nine exploitation concessions.

Chief Financial Officer Robert Doyle says Bolivar has begun to play hardball with the Corporacion Venezolana de Guyana (CVG) concerning its financial committment to the Choco 10 development. Bolivar has threatened to reduce the CVG’s 30% ownership in the operating company, PMG, to 0.2% because it has not fulfilled its financial obligations toward the project. The two parties are currently negotiating.

“We don’t expect this dilution to stick, nor did we intend it to,” says Doyle. “But it will provoke the dialogue to allow us to negotiate CVG’s exit from the property. It is a face-saving exercise. They can not just give up a 30% stake in something that they know is going to be good. So, we now have to create a format for negotiation.”

Bolivar has entered into a bought-deal agreement that allows it to raise $20 million by selling 9 million units at $2.20 apiece. An additional 9 million units at this price will be made available to the underwriters until Dec. 22. A unit consists of one share and half a common share purchase warrant. Each whole warrant entitles the holder to buy one share of Bolivar at a price of $3.25 at any time within five years following the closing of the offering. The company intends to use $10 million of the proceeds on mine equipment that will be needed for imminent mine expansion.

El Callao joint venture

Gold Fields is funding the exploration through to a bankable feasibility study. Bolivar Gold’s equivalent share of the cost will be repaid from production. Gold Fields may earn an additional 15% of the property by forgoing Bolivar’s exploration loan. In addition, Gold Fields bought 12 million Bolivar Gold shares, or 14% of those outstanding.

El Callao Holdings hopes to discover deposits and complete bankable feasibility studies within three years. Exploration is focused on a large land position surrounding the Choco mine property. Regional geological mapping has been carried out, and reconnaissance geochemical sampling over Choco 1, 2 and 12 has uncovered several drill targets. A 15,000-metre first pass of reverse-circulation work on six targets is under way.

El Callao’s holdings amount to 16 sq. km, and the company has applied (via a public tender process) for an additional 22-sq.-km concession adjacent to, and south of, some of its holdings.

Be the first to comment on "Bolivar soon to produce at Choco 10"