Although the major produced 6 million oz. gold, or 8% more than in the previous year, cash costs increased 25% to US$268 per oz. and production costs climbed 28% to US$336 per oz.

Some cost increases are attributable to stronger operating currencies and a weakening U.S. dollar.

AngloGold purchased Ashanti’s operations in the second quarter of 2004.

Several mines posted record production gains in the fourth quarter, namely Morila, in Mali, Siguiri, in Guinea, and Geita, in Tanzania.

Morila produced 90,000 oz. gold in the fourth quarter, up 53,000 oz. over the previous quarter. But it finished the year having produced 204,000 oz. (considerably less than 318,000 oz. in 2003). In the fourth quarter, the total cost of producing an ounce of gold was US$204, and the average for the year was US$263, whereas the 2003 average was US$179.

Siguiri produced 20,000 oz. more gold in the final quarter than in the third, and cranked out 83,000 oz. for the year. Total production costs were down US$51 but remain high at US$520 per oz. The mine lost US$11 million (adjusted operating loss) during the quarter.

The Geita mine produced 190,000 oz. gold in the fourth quarter, or 42,000 oz. more than in the previous quarter, and 570 million oz. in all of 2004, up 72% from 2003. All the gold produced became attributable to the company in May 2004. The total cost of producing an ounce of gold was US$328 in 2004, compared with US$223 in 2003.

Great Noligwa in South Africa was the company’s largest producer in the quarter (203,000 oz. gold) and indeed all year (795,000 oz., though the 2003 total was even higher, at 812,000 oz.). Total production costs were US$260 in 2004, or US$47 higher than in 2003. The adjusted operating profit in the fourth quarter was US$33 million, making it AngloGold Ashanti’s biggest moneymaker.

Six of eight South African mines saw output diminish in the final quarter, especially Tau Tona, which produced 131,000 oz. gold, compared with 144,000 oz. in the third quarter.

The second most profitable mine, Sunrise Dam in Australia, posted an adjusted operating profit of US$20 million. The mine produced 114,000 oz. in the fourth quarter and 410,000 oz. gold for the year. The average production cost in 2004 was US$326 per oz.

AngloGold Ashanti’s three gold mines in Ghana — Obuasi, Bibiani and Iduapriem — collectively produced 29,000 oz. less gold in the fourth quarter than in the third.

The Obuasi mine posted an adjusted operating loss of US$12 million for the fourth quarter, when it produced 90,000 oz. gold at a total cash cost of US$320 per oz. The price received per ounce was only US$314. Total production costs were up by US$30, to US$448 per oz., compared with the third quarter. The total cost of producing an ounce of gold in 2004 was US$426.

The Bibiani and Iduapriem mines showed an adjusted operating loss of US$4 million and US$7 million, respectively, due to production problems. Bibiani saw a failure in the south pit wall. The problem has since been rectified and mining has resumed.

AngloGold Ashanti restructured its hedge book in the third quarter and finished the year with a net hedge of 10.49 million oz. (down 2.2 million oz.). This total represents an estimated 31% of production over five years.

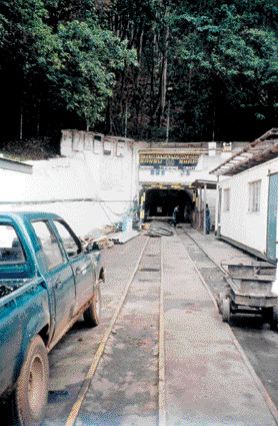

The company plans to deepen the Cuiaba mine in Brazil at a cost of US$121 million in order to increase production by 60,000 oz. per year and extend the mine life by six years.

AngloGold Ashanti received an abnormal tax credit of US$59 million in the final quarter of 2004, owing to a change in the estimated deferred tax rate.

The company declared a final dividend of US30 for the third quarter of 2004, bringing the total dividend for the year to 56.

Be the first to comment on "AngloGold Ashanti faces challenges at Ghana mines"