The last thing a miner wants during a gold boom is a starving mill. Yet that’s exactly what

Newmont bought the Holt-McDermott assets, next door to its own Holloway mine, for $5.2 million in October 2004. The assets included an underground mine, mill and surface infrastructure. Prior to the purchase, Newmont held a custom milling agreement with Barrick, and each mine contributed about 1,500 tonnes per day to the plant.

In order to return the mill to full capacity as soon as possible, Newmont has launched a $6-million exploration program at the newly amalgamated mine site, 60 km east of Matheson, Ont.

“We’ve identified a number of resources based on work we did in the past in conjunction with Barrick,” says Holloway’s mine manager, Luc Guimond. “We felt it was worthwhile to spend some money to explore those possibilities.”

The program will include underground drilling from both the No. 2 shaft (the original Holloway mine) and the No. 3 shaft (the former Holt-McDermott mine) as well as some surface drilling around the headframe, he says.

Holt-McDermott produced 54,578 oz. gold at a total cash cost of US$197 per oz. last year. Although Newmont’s 2004 results were unavailable at presstime, Holloway, an 84.6%-owned joint venture with

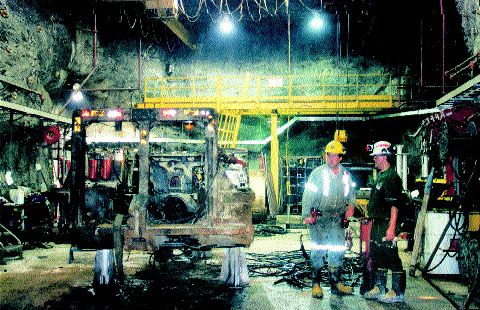

The Holt-McDermott mill, a conventional carbon-in-leach circuit, lies 1.5 km south of the Holloway mine. Built in 1988 with an original design capacity of 1,360 tonnes, the mill was later expanded. In 2001, a second expansion added another ball mill, allowing daily throughput to increase to 3,000 tonnes.

The mill currently operates at 50% capacity 24 hours a day, seven days a week. The secondary ball mill is idle.

The Holt-McDermott and Holloway deposits, both of which contained roughly 1.5 million oz. gold, lie side-by-side along the Destor-Porcupine fault zone, which stretches from Timmins to the Quebec border. Gold zones along this structure are associated with splays and faults, and tend to dip steeply along the contact between altered mafic volcanic and ultramafic rocks (Holloway) or within basalts (Holt-McDermott). Most deposits extend at depth for more than a thousand metres, with grades improving with depth.

Aside from boosting mill feed through minesite exploration, there may be opportunities for Newmont to custom-mill ore from other gold deposits along the fault zone if any of the exploration projects in the area prove economic.

One of the most advanced of these projects is

Open-pit potential

Apollo bought the former producer in 2002 and soon recognized that the deposit had open-pit potential. A subsequent prefeasibility study outlined shallow proven and probable reserves of 2.95 million tonnes grading 4.81 grams gold per tonne (457,100 oz.). Deeper exploration from a drift at the 235-metre level has also been encouraging. A feasibility study, including both open-pit and underground mine planning, is under way and expected to be ready in the third quarter.

A few kilometres farther east along the fault, closer to the Holloway mine, lies the Michaud gold property, a 50-50 joint venture between

The Michaud property is one of 10 projects that constitute Moneta’s Golden Highway project. Golden Highway comprises 614 claims along the Destor-Porcupine fault zone. Moneta’s goal is to find another deposit comparable in size to Holloway or Holt-McDermott. The company plans to carry out diamond drilling and ground geophysics (primarily induced-polarization) this year in selected areas. These are areas that are: within highly altered and sheared mafic to ultramafic volcanics; peripheral to known gold mineralization along a mafic/ultramafic-sedimentary contact; on under-explored volcanic terrain with felsic intrusives and splays off the main fault zone; and on recently staked ground centred on the nearby Arrow fault.

— The author is a Toronto-based freelance writer specializing in mining and the environment. She is principal of GeoPen Communications, www.geopen.com.

Be the first to comment on "Newmont to spend $6m in search of Holloway mill feed"