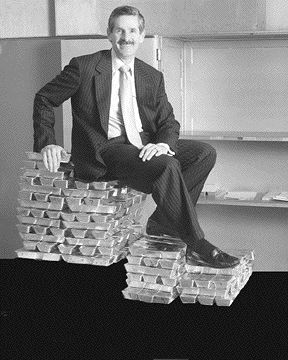

Newly appointed CEO Ian Telfer has wasted little time putting his personal stamp on the new

Telfer has forsaken Goldcorp’s trademark policy of hoarding a third of its gold production in favour of “growing by acquisition,” a practice he honed as CEO of Wheaton River. Telfer assumed the reins of the new Goldcorp less than a month ago; he replaces Robert McEwen, who championed hoarding. McEwen remains as Goldcorp’s chairman.

Under the new regime, Goldcorp will sell its current gold bullion inventory of 240,000 oz. early in the second quarter of 2005. That golden nest egg converts to around US$104 million, based on an afternoon gold fix of US$432.15 per oz. in London on March 22, the day of the company’s announcement.

Goldcorp will use US$70 million of the proceeds to acquire the Bermejal gold project in Mexico from a joint venture consisting of

“By financing this acquisition through the sale of our gold bullion inventory, we are converting 240,000 ounces of gold in the bank vault into 2.4 million ounces of gold in the ground,” says Telfer.

At the end of 2004, Bermejal’s indicated reserves totalled 93.6 million tonnes grading 0.79 gram gold per tonne, equivalent to 2.4 million oz. gold. The estimate, by Peoles, used a cutoff grade of 0.35 gram gold and a gold price of US$400 per oz. The estimate conforms to National Instrument 43-101 standards.

Tests by Peoles and Goldcorp during due diligence indicate that the deposit’s run-of-mine ore is amenable to heap leaching. Goldcorp plans further metallurgical, geotechnical, and engineering studies.

The Bermejal deposit is 2 km south of Wheaton’s Los Filos gold project, where feasibility studies are nearing completion. Plans call for Bermejal to be exploited in unison with Los Filos, with ore trucked from two open pits to a proposed central heap-leach pad. Geotechnical and design studies on the new pad location have begun; designs for Los Filos’s crushing and agglomeration plant remain unchanged.

Telfer says combining Bermejal with Los Filos will create the largest gold mining operation in Mexico, with average annual production in excess of 300,000 oz.

At the end of 2004, Los Filos had a measured and indicated resource of 88.2 million tonnes grading 0.89 gram gold, based on a gold price of US$400 per oz. The estimate includes a crush/leach resource of 51 million tonnes grading 1.28 grams gold.

Closer to home, Goldcorp has acquired a half-interest in the Sidace Lake property, near Red Lake, Ont. Under an existing option deal, Goldcorp has spent more than $1.5 million on exploration, and paid $1.05 million in cash. The company can boost its stake to 60% for $600,000 in cash.

Early last year, drilling by the partners uncovered a new zone of gold mineralization. The discovery hole yielded a 0.7-metre interval grading 4.8 grams gold per tonne, and a 2.7-metre section lower in the hole running 10.1 grams gold. The hole targeted a folded extension of the quartz-sericite schist found at the property’s Main zone.

The latest batch of nine holes from Sidace Lake are highlighted by hole 62, which returned 8.2 metres of 4.7 grams gold, beginning at a depth of 517 metres. The interval included 3.4 metres grading 10.2 grams gold.

Hole 62B was wedged off hole 62 at a depth of 422 metres, and encountered several mineralized intervals, including 1.5 metres running 15.4 grams gold, at a depth of 703 metres. The hole cut the zone about 30 metres from hole 62.

Another three holes were sunk perpendicular to the fold’s central lobe, and returned:

r 24.8 metres (from 301 metres) grading 2.7 grams gold, including 16 metres of 3.6 grams, in hole 63;

r 59 metres (from 126 metres) grading 1.55 grams gold, including 14.8 metres of 3.5 grams and 1 metre of 24.8 grams, in hole 64; and

r 6 metres (from 84 metres) grading 1 gram and a lower 6-metre section of 2.1 grams in hole 65.

Elsewhere, a single hole on the South zone yielded 3 metres grading 3.1 grams gold. Planet says the hole confirms that mineralization trends roughly north-south, following the stratigraphy.

Another 4 holes tested the nearby Upper Duck zone (UDZ). The best result occurred in hole 68, which returned 15 metres (from 30 metres) grading 4.1 grams gold, including a 1-metre section of 59.2 grams. The hole cut a black biotite band hosted by feldspar porphyry; the interval includes visible gold. Planet says drilling confirms that the UDZ and South zones are separate units.

Goldcorp owns 16.7% of Planet Exploration.

Goldcorp’s merger with Wheaton is slated to close in April. In the end, Wheaton shareholders will own 43% of the new company.

Be the first to comment on "Goldcorp cracks the vault for shopping spree (April 04, 2005)"