Arequipa, Peru — Shine a headlamp into almost any one of the crosscuts that intersect the Caylloma project’s Animas vein and the structure’s potential to be a company maker shines back.

A corresponding exploration drift, one of two driven into Animas by the project’s previous owners, chases Caylloma’s traditional target: a thin, high-grade ribbon of silver that snakes its way through the surrounding andesite.

But the crosscuts expose the upside: polymetallic mineralization that has yet to be systematically explored. Patches of zinc, lead and silver sulphide — not included in the current reserve calculation — pepper the crosscut walls with impressive frequency.

Animas is one of 30 mineralized veins at the Caylloma silver project in southern Peru, a 400-year-old silver producer recently sold to

Narrow, high-grade silver veins (10-15 oz. per ton) were the traditional focus of exploration and development at Caylloma, so when Hochschild encountered polymetallic mineralization grading 2-7 oz. silver, 7-12% zinc and 3-8% lead during a final exploration drive, the family-owned venture decided to divest.

Fortuna, meanwhile, under the direction of financier Simon Ridgway, was seeking a silver story that could emulate

Caylloma, located in the centre of a silver mining district 225 km northwest of Arequipa, boasts a National Instrument 43-101 compliant silver reserve of 7 million oz. and a resource of 14 million oz. It is a classic low-sulphidation deposit hosted by Miocene volcanics.

The veins on the property are related to a district-wide caldera and dome setting. They have a 1-4 km strike length and are up to 20 metres wide. Mineralization comes in two forms: narrow, silver-only traditional veins and wider base-metal-rich polymetallic veins such as Animas. Both types consist of banded quartz, rhodonite and calcite.

In 2003, Hochschild placed the mine on care and maintenance after it had produced more than 250 million oz. silver, including 2.6 million oz. in 2002.

If Fortuna restarts the operation at a rate of 600 tonnes per day, annual production would be 2 million oz. silver, 8,000 tonnes of zinc and 5,000 tonnes of lead at an estimated cash cost of US$4.00 per oz. silver, net of byproduct credits.

But the junior is planning to increase production to at least 1,000 tonnes per day by upgrading the mill and adding a new zinc circuit. The 20-metre-wide Animas vein would contribute the bulk of the ore, while traditional high-grade silver veins would provide the sweetener.

“Animas will give us the tonnage, but the traditional veins will give us the grade,” explains Jorge Ganoza Durant, vice-president of business development for Fortuna. “We are lucky because the metallurgy is straightforward. We can easily blend the polymetallic ore with the traditional ore.”

Production rates could further increase with ongoing exploration, mechanization and more acquisitions in the region, provided Fortuna can come up with the US$14 million-plus needed to pay Hochschild, upgrade the mill and finance exploration, underground development, equipment purchases and acquisitions.

“We are following the Pan American model on this belt,” says Ganoza Durant. “We’ve got the technical expertise on the ground and the financing expertise in Vancouver to do it.”

Indeed, Ganoza Durant and his father Jorge Ganoza Aicardi, who will oversee production as vice-president of operations, are among the company’s most valuable assets. The father-son team is from a Peruvian family that has owned and operated mines in Latin America for four generations.

Jorge junior is a geological engineer whose last job was to spearhead expansion into Nicaragua for sister company

Their expertise and local connections represent a significant part of the upside for Fortuna. Other silver mines within trucking distance of Caylloma, many of which have been in private hands for decades, may be available as satellite operations or possibly stand-alone mines. Negotiations are currently under way to consolidate a 150-sq.-km land position.

Another advantage Caylloma has over some other mining camps in Peru is local support. The lack of agriculture in the arid, high-elevation (4,000-5,000 metres above sea level) environment helps prevent the kind of land-use conflicts that have erupted in other parts of the country. The nearest community, though desperately poor, is a traditional mining town that has initiated a training program for youth that is sponsored by the local mines.

Back in Vancouver, a team led by President Peter Thiersch is raising the financing necessary to get Caylloma back on track. Fortuna expects to raise a total of up to $9 million this fall by issuing 12 million units at a price of 75 per unit. Each unit will consist of one share and one warrant to purchase an additional share at $1.00-1.25. At the time of writing, Fortuna shares were trading at about $1.00.

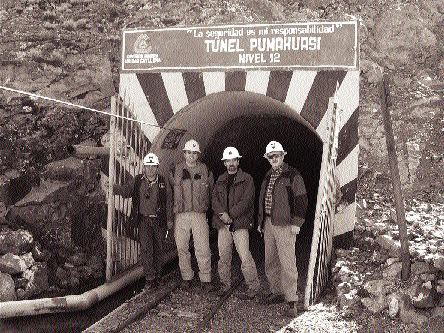

When The Northern Miner visited the project at the end of August, underground drilling had just commenced in the thin air of the Animas exploration drift, cut into a mountain at 4,650 metres above sea level. The program will poke 70 short holes into the 3,800-metre-long by 20-metre-wide vein to test the extent of the polymetallic envelope surrounding the high-grade silver core.

“Within twelve months we will make a decision about what rate of production we can support,” says Ganoza Durant. “That will depend on the size of Animas.”

Fortuna will also allocate part of its US$2-million exploration budget to test surface targets, including known high-grade ore shoots and silver veins on the other side of the valley that have never been explored.

The company will spend another US$1.1 million to upgrade the plant. Other capital investments include US$4.1 million for mine development, infrastructure and equipment, US$1 million for working capital and US$1.3 million for contingencies and other costs, for a total of US$7.5 million, just under half of which will be spent in the first year.

If Fortuna can achieve a production target of 210,000 tonnes of ore annually, the company anticipates net revenues of US$13 million per year and an after-tax profit of US$4 million.

But those estimates will seem modest if the Animas vein proves to be as consistent and extensive as it appears and if negotiations to acquire other deposits in the region are successful.

— The author is a freelance writer based in Toronto, Ont.

Be the first to comment on "Animas vein could be company-maker for Fortuna"