Vancouver —

Acquisition terms will have Golden Star issuing 0.72 of a common share for each share of St. Jude, representing a share price of $3.10 for the junior (as of the announcement date) or a 38% premium over its 20-day average closing price. Upon completion, St. Jude shareholders would own about 19% of Golden Star.

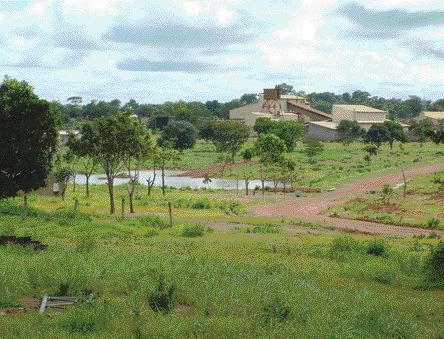

The deal would give Golden Star title to St. Jude’s Hwini-Butre gold project in the Ashanti gold belt of western Ghana, which has a combined in situ measured and indicated gold inventory of more than 1.3 million oz. It would significantly expand Golden Star’s footprint in the region where it already has two producing gold mines, Bogoso-Prestea and Wassa — the latter operation being close to Hwini-Butre.

In a prepared statement, Golden Star President Peter Bradford described the benefit of the deal as “delivering properties in Ghana with high-grade non-refractory gold resources that are within haulage distance to our Wassa gold mine.”

The major would also gain exposure in north-central Burkina Faso, where St. Jude’s Goulagou-Rounga project hosts a historic inferred resource of over 770,000 contained ounces gold. Additionally, Golden Star would acquire the junior’s Deba-Tialkam gold projects in western Niger.

The agreement has the blessing of both boards, and following execution of a definitive agreement, will go to a vote to St. Jude’s shareholders.

Of note is that

The deal met with mixed reaction from the market. Golden Star shares fell 9%, or 38, to close at $3.92 following announcement of the agreement. St. Jude shares rallied up almost 13% to close at $2.70 per share.

Be the first to comment on "Golden Star grabbing St. Jude (October 17, 2005)"