Vancouver — Teck Cominco (TEK.SV.B-T, TCKBF-O) posted net earnings of $448 million, or $2.19 per share, for the first quarter of 2006, more than double the net income of $205 million, or $1.01 per share, reported a year earlier. These earnings set a new record for the first quarter, which is typically weaker than others because of the seasonal shipping window for concentrates from the Red Dog zinc mine in Alaska.

The diversified metal miner and commodity producer shelled out $81 million in dividends, $210 million repaying corporate debt, and $128 million on capital spending at new projects during the quarter. Even so, the company boosted its cash position by $81 million to $3.2 billion, against long-term debt of $1.5 billion (excluding Inco exchangeable debentures). The company has bank credit facilities totalling $1.1 billion, with the unused portion sitting at $920 million.

During a conference call with analysts, president Don Lindsay said the company is reviewing options to deploy its growing cash reserves, such as additional dividends, share-buyback programs and potential acquisitions.

Asked if there was such a thing as “having too much cash,” Lindsay agreed, but acknowledged that colleagues with longer memories of industry downturns didn’t necessarily share that view.

“We’re continuing to look at opportunities, large and small, but with (metal) prices moving up so quickly, it tends to make you cautious.”

Teck Cominco has long been known for its strategy of making bargain-priced acquisitions during industry downturns, and so far has resisted making any high-profile mega-deals, except for a toehold interest in the Alberta oil-sands industry.

One reason for caution, Lindsay said, is that the company isn’t sure whether current metal prices are sustainable.

“We’re very positive about zinc, but moly prices have come down quickly, which doesn’t surprise us from a historical perspective. It wouldn’t surprise us if others came down too.”

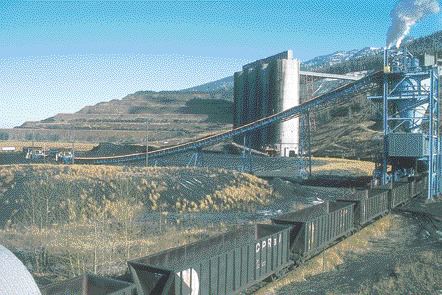

Coal sales and prices are expected to weaken slightly in the coming coal year, too. The company holds a 39% interest in the Elk Valley Coal Partnership, which settled most of its contracts for the 2006 coal year at an average price (across all products) of US$107 per tonne, compared with US$122 per tonne for the 2005 coal year.

Star performer

Zinc has been a star performer, and every US1 increase in prices adds an estimated $10 million to the company’s bottom line. Average LME cash prices for zinc averaged US$1.02 per lb. in the first quarter, up from US60 per lb. a year earlier. Prices have since shot up to US$1.56 per lb.

Red Dog is the company’s cornerstone zinc producer, and operating profit there rose to $138 million in the first quarter, compared with $43 million a year earlier.

Company officials expressed confidence that zinc prices would remain strong into 2007, owing to high demand and consumption, particularly from China, coupled with a severe shortfall of zinc concentrates.

Copper prices averaged US$2.24 per lb. in the latest quarter, up from US$1.48 a year ago, and have since cracked US$3. The company’s 22.5% share of profits from the Antamina copper-zinc-moly mine in Peru rose to $90 million from $73 million in the first quarter of 2005. Operating profit at the 97.5%-held Highland Valley Copper mine in B.C. rose to $205 million in the first quarter from $134 million a year earlier.

Gold production at the Hemlo gold mines fell by 17,800 oz. to 106,900 oz., while cash operating costs climbed to US$412 per oz. from US$317 per oz. in the first quarter of 2005. The company owns 50% of the mines.

The newly constructed Pogo gold mine was supposed to reach commercial production in the second quarter of this year, but will only reach 60% of design capacity at that time because of inadequate tailings filtration capacity. Because of the fineness of the tailings and their high clay content, a third filter must be installed at a cost of $10-$12 million, which will raise capital costs by that amount to about US$360 million. Full production isn’t expected to be reached until the first quarter of 2007.

On the development front, Teck Cominco has launched a prefeasibility study for the Moreles gold project in Mexico. The study should be completed in the first quarter of 2007.

The company and partner Falconbridge (FAL-T, FAL-N) are looking to restart operations at the Pillara mine and concentrator at their equally held Lennard Shelf zinc project in Australia. Annual production is estimated at between 70,000 to 80,000 tonnes of zinc in concentrate during a mine life of four to five years.

At the Fort Hills oil-sands project in Alberta, Teck Cominco and its partners are considering expanding production plans to 170,000 barrels from 100,000 barrels, subject to completion of a feasibility study.

Be the first to comment on "Teck posts record profits"