With a full feasibility study completed, new management appointed, most of the financing and permits getting lined up, and copper and zinc prices soaring, the key pieces are now falling into place for Toronto-based PGM Ventures (PPG-V, PGMVF-O) to reopen its dormant Aguas Teidas underground zinc-copper mine, situated on the northern limb of the famed Iberian pyrite belt west of Seville, Spain.

The mine is on a wholly owned, 227-sq.-km mining licence in Spain’s southwestern province of Huelva, 3 km east of the village of Valdelamusa, 25 km west of the gargantuan, mined-out Rio Tinto deposit, and 110 km by paved highway to Seville.

The property is characterized by rolling hills and the climate is typical of arid, sunny Andalucia. While the region is primarily agricultural, it is also substantially degraded by mining activities that stretch back to Phoenician times four millennia ago (gold and silver mining) and to the Roman Empire (mainly gold, silver and copper).

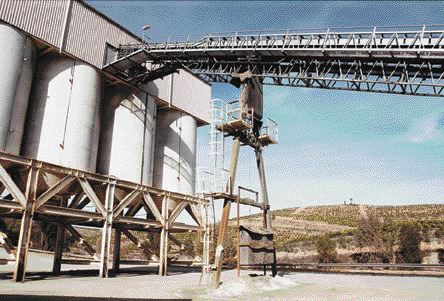

The infrastructure today is excellent year-round. Paved roads lead in all directions from the mine property; power comes off the main grid; water is stored in the Asturias dam, 1 km away; and a neighbouring rail line leads directly south 70 km to the Atlantic port city of Huelva, where Freeport-McMoRan Copper & Gold’s (FCX-N) Atlantic Copper smelter treats ore from the Grasberg mine in Indonesia.

The Aguas Teidas Carboniferous-age, black-shale-hosted, volcanogenic-massive-sulphide (VMS) deposit was discovered in the early 1980s by a joint venture between Billiton and the Spanish company Promotora de Recursos Naturales. The pair were following up on a strong electromagnetic conductor that extended eastward 2 km from a former producing polymetallic mine, also called Aguas Teidas, which closed in 1934 after extracting 420,000 tonnes of ore grading 5.66% copper.

The partners carried out extensive drilling between 1985 and 1990, ultimately defining a 28-million-tonne inferred resource with 32 widely spaced holes that probed a tabular, gently westward-dipping deposit that is now found to be at least 1.6 km long, 100-150 metres wide and 20-70 metres thick.

But Billiton relinquished the property and exited Spain in 1990, allowing Placer Dome to acquire Aguas Teidas a year later. Placer poked another 27 holes into the deposit, expanded the inferred resources to 41 million tonnes, and then also let the property go, setting the stage for Ireland’s Navan Mining to acquire the project in 1995.

Two years later, Navan also bought the Almagrera base metals mining and milling complex, 28 km by road from Aguas Teidas. (Almagrera is now owned by the province of Andalucia, and PGM Ventures has no intention of buying it, owing to its distance and environmental liabilities.)

Between 1999 and 2001, under Navan’s operatorship, Aguas Teidas produced almost 900,000 tonnes of polymetallic ore that was trucked to the Almagrera plant, which was also being fed by its two adjacent mines, Sotiel and Migollas.

Miners accessed the orebody at Aguas Teidas via a concrete-paved decline and used long-hole, open stoping as the primary mining method. Ore was hauled up 300 metres to surface using two trackless, electric Kiruna trucks, which have remained on-site and maintained to the present day.

Navan also drilled another 21 surface and 128 underground holes, and extended the underground workings to 5 km in total length.

However, by 2001, Navan was in dire financial straits owing to low metals prices and numerous problems at its other, larger operations, including the Chelopech mine in Bulgaria (since acquired by Dundee Precious Metals [DPM-T, DPMLF-O]).

Navan went bankrupt in December 2002, a month after passing on its stake in Aguas Teidas to the Spanish mining and drilling contractor Insersa, in lieu of paying it a 4-million-euro royalty.

Enter PGM

In March 2004, led by president Peter Miller and chairman Norman Brewster, PGM Ventures struck a deal with Insersa — which didn’t particularly want to be a mine operator — to acquire up to an 80% stake in Aguas Teidas in stages, with Insersa owning the remainder. PGM Ventures later secured that 80% interest and, with another 2-million-euro payment, increased it last summer to 100%, with no underlying royalties.

In all, PGM Ventures paid about $16 million in cash, shares and work commitments for the mine.

Under PGM Ventures’ operatorship, drillers have collared another four surface and 29 underground holes, guided by mine geologist Ral Hidalgo Fernndez, who also worked at Aguas Teidas under the Navan banner. Drilling at the mine was carried out by Insersa during the operatorship of both Navan and PGM Ventures.

A major milestone at Aguas Teidas was reached in January 2006, when SRK Consulting’s office in Cardiff, Wales, completed a feasibility study.

In the study, National Instrument (NI) 43-101-compliant reserves at Aguas Teidas are divided roughly equally between zinc-rich and copper-rich mineralization. Zinc-rich reserves (which have about double the value per tonne compared to the copper-rich ore) stand at 10.9 million tonnes grading 1% copper, 7.1% zinc, 2.1% lead, 67 grams silver per tonne and 0.8 gram gold per tonne, while the copper-rich reserves total 9.6 million tonnes at 2.4% copper, 0.9% zinc, 0.2% lead, 28 grams silver and 0.5 gram gold.

Another 12.6 million and 10 million tonnes of zinc-rich and copper-rich resources, respectively, have been outlined at similar grades, and a further 2.2 million tonnes of similar-grading material lie in the inferred category.

At an anticipated mining rate of 1.6 million tonnes per year (4,400 tonnes per day), these reserves are sufficient for a minimum 13-year mine life.

Annual output of contained metal, net of smelter retentions, would be about 50,000 tonnes zinc, 24,000 tonnes copper, 12,000 tonnes lead, 900,000 oz. silver and 7,500 oz. gold — generating in excess of US$200 million in revenue annually at today’s metal prices.

Mining would be by longhole stoping and drift-and-fill methods, with ore being transported by truck to surface. The load would be split evenly between six 50-tonne diesel trucks and the two 35-tonne Kirunas, which can travel up a ramp three times the speed of the diesel trucks. SRK and PGM also mulled over the idea of sinking a shaft but rejected it as too expensive.

Underground voids would be filled with paste backfill, allowing for an 87% ore-recovery rate — up substantially from the 55-60% achieved by Navan with no backfill, since it was trucking all its ore to Almagrera.

SRK determined that restarting Aguas Teidas would require a total of US$168 million in capital, with commercial production possibly starting late next year.

PGM Ventures spent $1 million working with New Brunswick-based consultants RPC to improve metallurgical recoveries from Aguas Teidas. Unfortunately, the ore is very fine-grained, and thus requires more expensive fine grinding (20 microns) to liberate the ore minerals, and higher cutoff grades. RPC determined that metallurgical recovery rates in the zinc-rich ore are 85% for zinc, 70% for copper and 70% for lead, while the copper-rich ore would return 85% of its copper.

The ore contains little in the way of deleterious elements but it does run about 0.5% arsenic, contained in the gangue mineral pyrite. That means there’ll be fewer smelter penalties, but a little extra caution will be needed in disposing of the pyritic tailings.

Low cost

SRK estimates that life-of-mine operating costs would ring in at US$28.5 and US$25 per tonne for the zinc-rich and copper-rich ores, respectively.

The mine will likely be a moneymaker: SRK calculates an internal rate of return of 12.4% and a net present value of US$41 million using an 8% discount rate — but that’s at metal prices that are roughly half to a third what they are today. (And there is a real chance that PGM Ventures can snag some generous grants from the Spanish government or the European Union, but the feasibility study con

servatively estimates there will be no grants.)

Unlike Navan, this time around PGM Ventures will build its own on-site processing facility with two separate flotation circuits to handle the two types of ore. The plant will be built to the southwest of the existing mine portal, producing concentrate that would be trucked to the port at Huelva.

From there, the concentrate will be shipped by Swiss-based commodity trader Trafigura Beheer to smelters in Europe. Trafigura signed a 10-year offtake agreement with PGM Ventures in December 2005 for all of Aguas Teidas’ output, including a $27.4-million financing facility consisting of equity, capital cost overrun guarantees and subordinated debt.

One big bonus for PGM Ventures is that the Aguas Teidas mine never formally closed after production ceased in 2001, so most of the mining permits are already in hand, with the notable exceptions of the processing plant and the tailings facility.

PGM Ventures has already been operating a small water-treatment plant at the mine site, so acidic mine water won’t discharge into the nearby Olivargas river.

SRK reckons Aguas Teidas will employ 164 people at the mine and another 93 at the mill. With the region’s long mining history and relatively high unemployment, PGM Ventures should have no trouble finding local staff for the mine. And for any ex-pat engineers and geologists weary of the degradations of the Third World, the pleasantness of living and working in Andalucia would be hard to resist.

Last November, PGM Ventures added four new members to its senior management team: Leo O’Shaughnessy, chief financial officer; Americo Villafuerte, general manager of PGM Ventures’ Spanish subsidiary and PGM’s vice-president of operations; Francisco Fimbres, plant manager at Aguas Teidas; and Kevin Whittaker, CFO of PGM’s Spanish subsidiary.

Last month, PGM hired Agne Ahlenius as mine manager, filling the last vacancy in the senior management team at Aguas Teidas.

Aguas Teidas is the sixth-largest VMS orebody discovered so far in the Iberian pyrite belt in terms of contained metal, and its grade is slightly higher than average for the area. (The Rio Tinto deposit, exhausted only a few years ago after more than a century of bulk mining, remains the largest-tonnage VMS deposit ever discovered in the world.)

While grassroots exploration isn’t a top priority for PGM Ventures right now, it does hold a few smaller, but high-grade, zinc-rich VMS deposits in the area that could provide future mill feed. And the northern limb of the Iberian pyrite belt remains relatively unexplored at depth, and ripe for the use of innovative remote-sensing techniques that can help geologists find those more deeply buried orebodies.

Indeed, in VMS expert James Franklin’s NI 43-101-qualifying report on Aguas Teidas, prepared in 2004, he urges the company to continue to seek out mining opportunities elsewhere in the Iberian pyrite belt, beyond the limited scope of the Aguas Teidas orebody.

Bought deal

On the financial side, PGM Ventures raised some $10 million in equity over the winter and closed out April with a $30-million bought deal arranged by co-lead underwriters MGI Securities, Orion Securities, and Canaccord Capital. Due to close in mid-May, the private placement consists of 10 million units priced at $3.00 apiece, with each unit comprised of a share and three subscription receipts, each exercisable into a share. If PGM doesn’t get certain operating permits, it will have to buy back these subscription receipts for 75 each.

The financing is being opposed by Northcote Holdings, which claims to own 11% of PGM Ventures and says it will try to replace PGM’s board should the financing go through. There doesn’t appear to be much support for Northcote’s position, so the financing should be completed smoothly.

The money raised will be earmarked for construction at the Aguas Teidas mine, which could get under way next month. The company is in discussions with Aker Kvaerner for an engineering, procurement and construction management contract to build the new mine and mill, and with bankers for another US$100-million financing.

PGM got into some hot water with regulators at the TSX Venture Exchange in March, mostly resulting from the company’s investor relations program not complying with National Instrument 43-101 with respect to the use of the words “ore” and “deposit.”

Stock trading was never halted and PGM says it is now fully compliant with the exchange’s disclosure policies. The company has taken down its website, has no intention of putting up a new one, and is now referring investors to view its filings on the System for Electronic Document and Retrieval website at www.sedar.com.

T.N.M. Nugget

PGM VENTURES’ AGUAS TENIDAS PROJECT

ASSET:

Dormant underground zinc-copper mine near Seville, Spain

OWNERSHIP:

100% PGM Ventures (PPG-V) with no royalties

RESERVES:

Zinc-rich portion of 10.9 Mt @ 1.0% Cu, 7.1% Zn, 2.1% Pb, 67 g/t Ag and 0.8 g/t Au plus copper-rich portion of 9.6 Mt @ 2.4% Cu, 0.9% Zn, 0.2% Pb, 28 grams silver and 0.5 gram gold

DEVELOPMENT PLAN:

US$168 million needed to build 1.6 Mt/yr mine and concentrator

PRODUCTION:

Minimum 13-yr mine life, producing annually 50,000 t Zn, 24,000 tonnes Cu, plus by-products, in concentrates; Start-up late next year

OFFTAKE AGREEMENT:

10-yr agreement with Switzerland’s Trafigura Beheer to sell all output to European smelters

Be the first to comment on "PGM Ventures to reopen Spanish zinc-copper mine (May 15, 2006)"