Selwyn basin, Yukon — The Selwyn project being explored by Pacifica Resources (PAX-V, PCFRF-O) hosts a large resource that could become one of the major new suppliers of zinc and lead concentrates in the world. But the challenges associated with developing a district-scale project in a remote wilderness suggest that the company will likely have to find a senior partner with deep pockets to fully realize this “world-class” potential.

President Harlan Meade has no illusions otherwise, particularly since several new discoveries expanded the potential of the project to host sedimentary exhalative (SEDEX) mineralization over 37.5 km of favourable stratigraphy from the previously known extent of 30 km.

“The scope of this project means we will need a strategic partner,” Meade told The Northern Miner during a recent visit. “Big deposits such as this never end up in the hands of junior companies.”

Notwithstanding, Meade has so far resisted overtures from major mining companies seeking to gain a toehold in the project now that rising zinc demand and a persistent supply gap have sent prices skyrocketing.

“In my experience, senior companies are not strategic partners,” Meade added.

Instead, Pacifica has approached Asian metal-producing and smelting companies, introducing the project to them “as a strategic investment opportunity for long-term security of supply for zinc and lead.” The Yukon government is playing a lead role in facilitating such visits, and has joined trade missions to Asia to promote the Selwyn basin as a “secure source” of zinc at a time when mine supply is in deficit and few new mines are under development.

“We are interested in selling a minority interest in the project, not the company,” Meade said, adding that such an investment will also serve as a poison pill to keep “the other guys” at bay for a while.

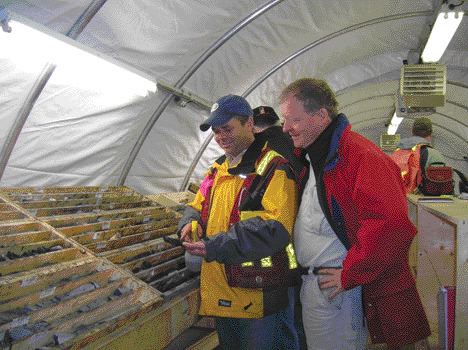

Toward that end, Pacifica invited a delegation of smelter and mining groups from China, Korea and Japan to visit the scenic project, where a newly expanded $10-million exploration program is in full bore to better define the full potential of the property.

Days earlier, The Miner joined analysts on a 2-day tour of the project, which covers more than 300 sq. km stretching westward from the border with the Northwest Territories. At least eight drill rigs were turning on-site, with four testing stratigraphic targets with potential for new discoveries. The others were conducting infill drilling to convert “mineral potential” into the inferred resource category and inferred resources into the indicated category, and to define an additional 100 million tonnes of mineralization amenable to open-pit mining with-in new discovery areas (to supplement existing resources).

Howard’s Pass

Pacifica acquired the core Howard’s Pass project in the Selwyn basin in April 2005, attracted by known resources defined by predecessor companies of Placer Dome and U.S. Steel, which spent at least $20 million on exploration and underground bulk sampling from the 1970s through to 1982. The historic work focused mostly on the advanced XY and Anniv zones, which along with other zones, are hosted in a favourable stratigraphic unit known as the “Active Member.”

The core, 96-sq.-km project cost Pacifica $10 million, payable over seven years, plus work commitments of $3.5 million in the first two years. The vendors retain a 1% net smelter royalty on production, and a 20% net profits royalty capped at $10 million.

The land package was subsequently expanded by staking to cover 304 sq. km, including 66 km of the known strike length of favourable strata.

Pacifica’s initial $3.5-million summer exploration program focused on expanding resources amenable to open-pit mining in the advanced XY and Anniv deposits, and also identified the Brodel and Don Valley zones and other areas prospective for near-surface deposits. The 2005 program also included a first-pass assessment to determine the project’s potential to become an economic mine, including initial metallurgical studies, an essential component for most zinc projects.

While the Selwyn project has a “potential mineral inventory” estimated at 1.5 billion tonnes, much drilling remains to be done to upgrade this into reserves and resources. Based on drilling to date, the indicated resource stands at 33.5 million tonnes grading 5.52% zinc and 2.1% lead, containing 4.08 billion lbs. zinc and 1.55 billion lbs. lead. Inferred resources add another 112.9 million tonnes grading 5.4% zinc and 2.14% lead containing 13.44 billion lbs. zinc and 5.31 billion lbs. lead, immediately adjacent to the indicated resources.

Jason Dunning, vice-president of exploration, and exploration manager John O’Donnell are overseeing this year’s expanded $10-million program, one of the largest being conducted in the northern territory. A second 40-person camp was established near the XY deposit to supplement the Anniv 40-person base camp established in 2005.

An important goal of this year’s ongoing program is to define about 400 million tonnes of near-surface mineralization to provide initial production for roughly 25 years. This target seems achievable, given that three new discoveries have already been made, dubbed HC, Pelly North and OP West. This year’s drilling has extended the mineralized Active Member by 7.5 km to 37.5 km, while also filling in large gaps between the historical Anniv and XY drill areas.

“Everything about this project is big,” Dunning said. “We still don’t know where this thing is going to stop.”

The exploration team relies primarily on geology and stratigraphic markers to trace and define the system, as well as geochemistry, as gravity surveys and geophysical methods are of limited use.

The discovery hole at the HC zone intersected an estimated true thickness of 36.15 metres of zinc-lead sulphide mineralization. A follow-up hole also intersected zinc-lead mineralized Active Member with an estimated true thickness of 29.6 metres.

The HC zone is in the Don Valley between the Brodel zone and Anniv deposits. It is believed to be the faulted extension of the Brodel zone situated on the northeast limb of the XY synclinal structure, and as such, has spurred drilling to define the new zone and test the stratigraphy to the southwest, toward the anticlinal hinge.

The Pelly North and OP West discoveries occur on the northwest end of the mineralized trend. Drilling at OP West returned 7.6 metres of Active Member, while the initial drill hole at Pelly North intersected 16.8 metres of mineralized Active Member.

While no assays are yet available, the generally continuous nature of the sulphide mineralization combined with the volume of comparable core from past campaigns makes grade assessment a fairly accurate exercise.

Pacifica has completed more than 33 holes totalling 6,082 metres to date this year, and expects to expand the initially proposed 25,000-metre program to as much as 40,000 metres.

New model

Along the way, the geological team is challenging some previous concepts about the nature of the system. One such change is the view that the mineralized Active Member is part of a large continuous sheet of mineralization that occurs over a distance of 50 km, rather than the known zones being related to three restricted sub-basins. Regional mapping also indicates that the strata near the core Howard’s Pass deposits are repeated as panels between moderate to low-angle, west-dipping thrust faults. The fault panels are in turn cut by latter steep normal faults that further juxtapose the strata.

The next phase of stratigraphic drilling will step across the basin, which will involve deeper drilling, to better test the synclinal model. Drilling will also explore for higher-grade mineralization similar to that found in portions of the XY zone, which could potentially be mined by underground methods to accelerate payback of the proposed mine.

“These targets had returned grades of up to 20% combined lead-zinc in the past,” O’Donnell said. “That’s what attr

acted Placer, which never closed off those high-grade zones. We’re seeing some sections of high grade that (one would) expect to see in feeder zones, though I don’t think we’ve seen the actual feeders yet.”

As exploration continues, Pacifica intends to continue metallurgical testing. The 2005 program confirmed and updated testing carried out in the 1970s and 1980s that included flotation, gravity and pressure-leach oxidation processes.

A key element was testing to determine the effectiveness of using dense media separation (DMS) as a preconcentration step prior to milling. Initial results suggest potential to upgrade mineralization to 20% combined zinc and lead by separating heavier mineralization from the less dense waste shale material.

“DMS turns Howard’s Pass into a potential high-grade operation,” Meade said, noting the “upgraded” grades obtained in test work are similar to those at Alaska’s producing Red Dog zinc-lead-silver mine, hosted in the same rocks as Howard’s Pass.

The Selwyn project is atypical of SEDEX deposits in that, unlike Red Dog and other deposits, it has no appreciable silver. It has minimal pyrite and pyrrhotite too, as evidenced by the waste-rock piles from past underground bulk-sampling (1970s) that still show no evidence of iron-staining or acid generation.

“One reason why DMS should work here is that we don’t have pyrite,” Meade said. “DMS doesn’t work on all zinc deposits, because most have pyrite, and when you upgrade pyrite, where does that get you?”

The absence of pyrite not only reduces potential for acid generation in waste rock and tailings, but is beneficial to metallurgical separation of the fine-grained zinc and lead sulphide minerals. Previous metallurgical test work showed that zinc and lead concentrates are low in arsenic, antimony and other deleterious elements. Even so, the fine-grained nature of the sulphide mineralization within black carbonaceous shales poses challenges in producing quality concentrates. Test work is ongoing to address these issues and confirm overall recoveries.

Improved fundamentals

While other challenges that prevented Howard’s Pass from being developed in the past remain, they appear less formidable in light of dramatically improved zinc prices and market fundamentals.

“Power costs and infrastructure are still the big ones,” Meade said. “The mine and metallurgy can take care of themselves.”

Among the scenarios being considered is a 160-km-long rail line to the Robert Campbell Highway in the western Yukon and securing power supply from independent producers, including potential hydroelectric sources.

“We don’t feel we need to get into the power business,” Meade said. “Our feeling is that if we give them an off-take agreement, they will build it.”

Pacifica could connect with existing road networks in neighbouring Northwest Territories, but seems determined to avoid this given the problems that other resource companies have encountered dealing with N.W.T. review boards and permitting agencies. Fortunately, a permit application for use of an access road from the nearby Cantung tungsten mine in N.W.T. was recently grandfathered by the Mackenzie Valley Land and Water Board. While this road won’t be used to haul out concentrates, which will go west to Pacific ports, it will be used to provide logistical support of the project. A winter trail also connects the site to the Robert Campbell Highway in the Yukon.

Pacifica expects to encounter environmental opposition in light of recent lobbying efforts to expand the Nahanni Park in N.W.T. The project doesn’t lie within or near the proposed expanded park boundaries, but this isn’t likely to deter efforts of hard-liners opposed to resource development anywhere in the surrounding region. Pacifica has hired a manager of environment and community affairs to deal with such issues as the project moves forward.

“One of the key things is to get government, First Nations and community support for the project,” Meade said, “because we fully expect they (environmental groups) will come out of the woodwork to take us on.”

What Pacifica does have in its corner is good support from the Yukon government, and pre-existing strong ties with local native groups. The considerable clout of Asian metal producers and smelters seeking a long-lived secure supply of zinc could provide another important boost for the final push to production in the years ahead.

Be the first to comment on "Pacifica’s discoveries enhance district-scale potential at Selwyn"