Bathurst, N.B. — The dormant Caribou and Restigouche zinc-lead mines in northern New Brunswick are once again getting a new lease on life, thanks to robust metal prices and strong investor confidence in Blue Note Mining (BN-V, BNMFF-O), which raised $75 million in a private placement financing solely on the back of the base metal project.

Blue Note, a Montreal-based junior mining and exploration company, is planning to invest close to $50 million to reopen the two mines, which have sat idle since 1998, and refurbish the mothballed mill with new state-of-the-art grinding technology, creating 270 permanent jobs. That’s good news for an area that has been hit hard by a struggling pulp and paper industry, and is facing the impending closure of the world-class Brunswick mine and the associated loss of about 1,000 well-paying jobs.

“This is big news and this is a big investment for this region,” said Bernard Lord, the outgoing premier of New Brunswick during a visit to the project in August. “They saw an opportunity, they want to seize the opportunity and this is good news for this region.”

Blue Note completed the acquisition of the Caribou mines on Aug. 1 by issuing an unsecured, non- interest bearing $15-million convertible debenture with a 5-year maturity to Breakwater Resources (BWR-T, BWLRF-O), the previous owner, and by replacing $7 million in reclamation bonds that Breakwater had posted with the New Brunswick government for the environmental rehabilitation of the mine sites.

The debenture is repayable in Blue Note shares at Breakwater’s option before maturity, or in cash or shares at Blue Note’s option upon maturity. Breakwater has the right to convert the debenture into a direct 20% ownership of Caribou within one year of the start of commercial production, during which time Blue Note is committed to spending $1.5 million on exploration at Caribou.

In addition, Breakwater retains a 1-2% sliding scale, net smelter return royalty on zinc metal production, based on a zinc price exceeding US65 per lb. As well, Breakwater holds a conditional first right of refusal on the marketing rights of the metal concentrates produced from Caribou.

Keith Ashfield, the former provincial minister of Natural Resources, said that the company is well positioned to make the reopening of the mines a success.

“Before an undertaking like this can proceed, the province must be convinced that it is a viable project and that the interests of New Brunswickers are taken into consideration,” Ashfield said. “A comprehensive review process ensured that the acquisition was feasible, the environment was protected and that mine reclamation was practical and fully attainable.”

In addition, Blue Note renegotiated a 1-year contract with BioteQ Environmental Technologies (BQE-V, BTQNF-O), which addresses the wastewater management and its treatment at both the Caribou and Restigouche mine sites.

“Another critical component to ensure the viability of the reopening of the mine is the processing of the Caribou ore,” Ashfield said. “This has been a primary concern in the past. However, the province feels confident that with Mr. Martin’s extensive knowledge of the appropriate technologies in processing ores at the Bathurst camp, the mine has an excellent opportunity to achieve the level of production necessary for success.”

Blue Note president John Martin is a 30-year veteran of the northern New Brunswick mining business and long-time resident of Bathurst. He spent much of his career with Noranda, split between the Brunswick mining operations and Heath Steele.

“It was John who convinced me of the mine’s viability, which led to our putting the deal together,” explained chairman and CEO Michael Judson.

Infrastructure

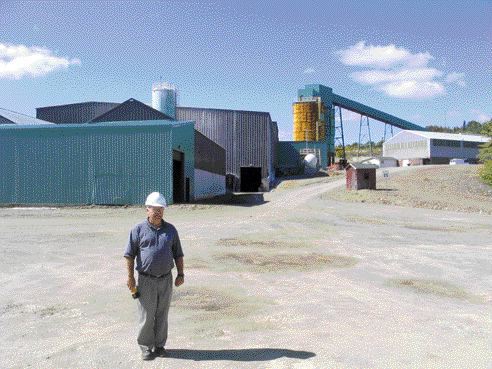

Caribou comprises an underground mine and mill, 50 km west of Bathurst, and the Restigouche open-pit mine, another 30 km west. Both mines are located a couple of kilometres off a well-maintained paved highway that cuts across the northern part of the province. The aging Caribou underground mine complex includes a 3,000-tonne-per-day concentrator. Other surface facilities include a headframe and production hoisting system, shop-warehouse, compressor building, an assay laboratory, an administration building and other service buildings.

Mine services include a 1-sq.-km tailings impoundment pond, 1.5 km southeast of the mill. The mine is hooked into the N.B. Power electrical grid. A deep-sea port at Belledune is 75 km from Caribou.

First discovered in 1955 by U.S.-based Anaconda Minerals, Caribou has a long and troubled past. Its fine-grained, massive sulphide mineralogy is metallurgically complex, which has negatively affected the mines’ performance by various operators through the years, although Martin is confident they have finally resolved the outstanding metallurgical issues.

“We will be using the most advanced state-of-the-art milling technology and flow sheet, which was developed and proven to be effective at the Lakefield Research facilities in Ontario, to process the complex, fine-grained ores that characterize the Caribou and Restigouche deposits,” he explained.

The company is aiming to process 3,000 tonnes of ore daily to produce more than 100 million lbs. of zinc-in-concentrate annually.

Martin said the company has enough ore reserves for about five years, but deep, widely spaced drilling has indicated additional resources that could add at least four years to that.

Breakwater Resources last operated Caribou from July 1997 to August 1998 but lower-than-expected metallurgical recoveries, compounded by prevailing low metal prices, led to a decision to close the mine, throwing 190 people out of work. A 2006 technical review, prepared by Micon International on behalf of Blue Note, used proven and probable reserves of 4.9 million tonnes grading 6.59% zinc, 3.45% lead and 86 grams silver in its assessment of the Caribou and Restigouche deposits. Additional inferred resources contain 3.9 million tonnes grading 7.36% zinc, 3.59% lead and 107 grams silver.

Micon suggests the project can produce over 476 million lbs. zinc, 223 million lbs. lead, 7.6 million lbs. copper and 5 million oz. silver over a 5-year life, using recovery rates of 79.9% zinc and 64.5% lead. Based on a capital outlay of $47.4 million and a predicted total cash cost of US58 per lb. zinc, net of byproduct credits, the project can generate a life-of-mine net cash flow of $44.7 million and shows a 28.7% internal rate of return. The report assumes long-term metal prices of US65 per lb. zinc, US38 per lb. lead and US$7 per oz. silver.

“Part of the fifty-million dollars that we will invest in the mine has been earmarked for exploration and we hope confirmation to the additional reserves that would extend the mine life,” said Martin.

Camp history

Beginning with the discovery of the Brunswick No. 6 deposit in 1952, a total of 45 deposits and 96 significant mineralized occurrences have been found in the Bathurst mining camp, a sub-circular area measuring 60 km in diameter. The geographic centre of the camp is about 40 km west of the city of Bathurst and 60 km northwest of Miramichi. The area hosts six past-producing volcanogenic massive sulphide (VMS) zinc-lead-silver-copper mines. Currently, the only production in the camp is from the Brunswick No. 12 deposit, discovered in 1953.

About half of the discoveries in the camp were made in the 1950s and resulted from the use of geophysics, although geochemistry and prospecting proved invaluable and were responsible for some of the finds. Later discoveries in the camp can be attributed to improved exploration technology and a better understanding of the geology.

The Brunswick mine and milling operation, now owned by Xstrata (XTA-L, XSRAF-O) through its Falconbridge subsidiary, is 30 km southwest of Bathurst. Once one of the world’s largest zinc deposits, the 41-year-old underground mine has only about four years of life remaining. The mine produces about 3.6 million tonnes of ore per ye

ar, with more than 110 million tonnes mined to date.

Brunswick’s proven and probable reserves at the end of 2005 stood at 14.7 million tonnes grading 8.77% zinc, 3.53% lead and 0.36% copper, plus 104 grams silver per tonne. Additional measured and indicated resources total 3.5 million tonnes averaging 9.36% zinc, 3.83% lead, 0.32% copper and 98 grams silver.

Of the four concentrate products produced by Brunswick, lead is the only concentrate refined in-province at Belledune, 45 km from the mine. The Belledune smelter processes a wide range of offshore lead and lead/silver concentrates. A battery recycling plant is also located on-site.

The Caribou massive sulphide deposit was discovered by Anaconda geologist Cam Cheriton in 1955.

“The discovery of the deposit was really a triumph of deductive geology backed by management ready to spend money on new geological concepts,” wrote M. D. Kierans in a letter published in The Northern Miner in 1989.

Kierans would replace Cheriton as geologist-in-charge at the Bathurst office for Anaconda (Canada) in 1959.

Cheriton, together with Walter Holyk (whose work later resulted in the discovery of the Half Mile Lake deposit in N.B., the Nanisivik mine in Baffin Island and the Kidd Creek deposit in Timmins, Ont.) developed a theory relating mineralization, stratigraphy and structure for the Bathurst camp. They informally divided the camp; Cheriton took on the northern half and Holyk worked the southern half.

Cheriton traced the favourable Orvan Brook horizon westward to a large synform fold, which he had spotted in air photos. Using an old Boliden horizontal-loop electromagnetic (HEM) unit, he laid out a radial system of picket lines to test the fold area. A strong, 4,000-ft.-long conductor coincided with the shape of the air photo fold. Detailed geological mapping, magnetic and self-potential (SP) geophysical surveys and soil sampling were done. The line with best geology, soil results and geophysical profile was selected and drilled, resulting in the discovery of a steeply dipping zone of massive sulphides.

The Caribou deposit comprises six discrete massive sulphide lenses, overlapping in part, in an echelon fashion. The stratabound lenses have been numbered 1 through 6 and occur between footwall sediments and hangingwall volcanics assigned to the Spruce Lake Formation, which forms part of the California Lake Group. The sulphide lenses are draped around the nose of a synformal structure that plunges steeply to the north.

The lenses occur over a strike length of 1,300 metres and to a depth of 1,200 metres. Historically, Caribou has been estimated to contain upwards of 60 million tonnes in sulphide resources.

The sulphide mineralization consists of mostly pyrite, with significant amounts of magnetite. The major ore-bearing minerals are sphalerite, galena and chalcopyrite. The sphalerite is reported as being marmatitic, with relatively high iron content. Minor metallic constituents include tetrahedrite, arsenopyrite and marcasite. The gangue minerals mostly consist of siderite, stilpnomelane, quartz and chlorite.

The individual lenses exhibit well-developed metal zoning, as well as an overall metal zoning from lens to lens. There are also distinct metal zones not coincident with the general zoning, including thick copper-rich zones along the keels of lenses 1 and 2. Silver varies proportionately to lead, and gold occurs mainly in electrum and in arsenian pyrite and arsenopyrite.

The Restigouche property was initially staked by Selco in 1954 on the basis of strong, base metal stream-sediment anomalies. The property was optioned in 1957 to New Jersey Zinc, which discovered the deposit by drilling a significant geochemical anomaly.

The Restigouche deposit appears to be localized between feldspar-crystal rich and feldspar-crystal poor sequences in the Mount Brittain Formation on the northern limb of a major overturned anticlinorium. The massive sulphide body extends 490 metres along strike and averages 90 metres wide and 30 metres thick. The deposit comprises at least two separate lenses of massive sulphides. The sub-cropping tabular-shaped body dips 15 to 20 to the northwest and extends to a vertical depth of 180 metres. The principal sulphide minerals are pyrite, with lesser amounts of sphalerite and galena, and minor chalcopyrite and arsenopyrite. Compared with other massive sulphide bodies in the Bathurst camp, the Restigouche deposit is relatively rich in zinc and silver but like Caribou, is fine-grained.

Previous development

Starting in 1959, Anaconda initiated an extensive underground exploration campaign at Caribou by driving a ramp and eventually conducted development work on two levels spaced 120 metres apart, including pilot plant testing. While driving a ventilation raise to surface in 1966, Anaconda discovered a supergene copper blanket and gossan cap above the primary sulphide mineralization. This near-surface zone was developed by Anaconda and Cominco into a small open-pit mine-mill operation that ran from 1970 until the depletion of the copper ore in 1974. In total, some 582,000 tonnes of supergene-enriched copper mineralization was mined.

Renewed interest in 1980 resulted in a 3-year program of deep drilling, test stoping, mine planning and marketing studies to assess the economic potential of a 2,000-tonne-per-day underground mine and milling operation. Some 60,000 tonnes of gossanous material grading 5.3 grams gold and 171 grams silver, which had been stockpiled from earlier pit operations, was treated by heap leaching in 1982-83, one of the first operations of its kind in Canada. Anaconda and Cominco recovered 8,100 oz. gold and 110,000 oz. silver.

In December 1986, East West Minerals, an Australian public company, purchased the mine from Anaconda for $1 million and assumed all environmental liability related to the wastewater treatment and reclamation of Anaconda’s prior mining operations.

A feasibility study of the project assumed a 2,000-tonne-per-day design capacity based on the production of a single bulk lead-zinc concentrate. The mine was put into production at the start of 1989 and operated for only seven months before operations were temporarily suspended pending the formulation of a new mining plan. Hampered by lower-than-expected production levels and falling well short of its production target, East West Minerals was faced with cost overruns after initially raising $45 million in project financing, in the form of a $30-million loan and a $15-million silver debenture issue.

The company said at the time it wasn’t able raise the funds it needed for further development, and didn’t have enough ore to keep the mill running.

East West Minerals relinquished control of the project to Bathurst Base Metals, a private company led by British financier Howard Miller, who helped refinance the mine in return for a controlling stake. Bathurst Base Metals initially had a 10% interest in the Caribou mine, but eventually acquired a full ownership from East West Minerals in return for a 10% net profits interest.

Breakwater Resources, which owned a 17% stake in Bathurst Base Metals and shared common directors, was hired in fall 1990 to manage the mine and complete further underground development work. Upon resuming milling operations in April 1990, Breakwater struck a deal with Bathurst Base Metals to acquire 100% of the Caribou mine by issuing 4.5 million shares and assuming the mine’s substantial debt load. But less than two months after the acquisition closed in early September that year, Breakwater suspended operations citing poor recoveries and falling metal prices.

To raise production to acceptable levels, Breakwater would need to spend $15 million upgrading the mill, said Brian Pewsey, Breakwater’s president at the time. In light of the mine’s $30-million, non-recourse bank loan and a zinc price, that was rapidly heading south, the company didn’t believe the investment prudent.

In a report to shareholders in fall 1990, Pewsey said the decision to acquire Ca

ribou was made “with the full knowledge that it was a relatively high-cost producer mainly caused by a complex concentrate, which is expensive to smelt.” But he also added that the Caribou mine, “being extremely sensitive to the price of zinc, has the potential to generate high cash flows.”

A total of 728,000 tonnes of ore was produced from 1988 to 1990. Breakwater wrote down its investment in Caribou to the tune of $64 million in 1990.

Corporate reorganization

Following a corporate reorganization in the early 1990s, Breakwater began to address the metallurgical problems at Caribou by initiating a testing program to develop a new flow sheet and reagent scheme to produce separate zinc and lead concentrates and improve metal recoveries. Lakefield Research conducted over 100 lab tests and launched a successful 220-tonne pilot plant test that suggested high-intensity conditioning, finer grinding and improvements to the reagent scheme would result in beter metal recoveries.

On the back of this test work, Kilborn completed a positive feasibility study in 1995 recommending the reopening of the Caribou mine, including development of the nearby Restigouche deposit. Ore from the two deposits would be blended together prior to milling.

Breakwater acquired the Restigouche deposit in October 1995 from Marshall Minerals for 1.5 million shares and a sliding-scale royalty payment based on the tonnage of ore mined and hauled to the Caribou mill for processing. At the time, Restigouche was estimated to contain a 1.5-million-tonne resource averaging 6.81% zinc, 5.38% lead, 1.1 grams gold per tonne and 108 grams silver.

The reopening plan was based on increasing the milling rate to 3,000 tonnes per day by expanding the grinding and flotation circuits. The total preproduction capital cost for modifying and expanding the Caribou mill, reopening the Caribou mine and developing the Restigouche deposit as an open-pit mine was estimated to be $54.4 million. The feasibility study presented two scenarios — a base-case scenario outlined a 6-year mine life, with a 27.7% rate of return based on a zinc price of US50 per lb, and a 10-year extended case scenario, which assumed additional inferred resources could be upgraded to provide an additional four years of life.

After receiving the nod and environmental approval from the New Brunswick government, Breakwater raised the required capital in a $60-million financing package comprised of equal parts debt and equity. Construction and development got under way in October 1996.

Breakwater began milling operations in July 1997 but Caribou failed to achieve commercial production and the company decided to shut it down in August 1998, with declining metal prices. Production during this time totalled 587,000 tonnes grading 6.32% zinc, 2.93% lead and 90 grams silver. The mill was plagued by mechanical and design problems, which were largely resolved by the end of 1997, but deficiencies in metal recoveries prevented the operation from reaching desired levels.

Recoveries averaged 53% zinc and 62% lead, versus targets of 83.5% zinc and 75.4% lead as predicted by the feasibility work. This, in turn, affected the concentrate grades, which averaged 46% zinc and 33.2% lead compared to feasibility estimates of 52.3% zinc and 48.5% lead.

By the end of 2001, Breakwater had written off its $107-million investment in Caribou, including preproduction losses totalling $37 million.

New research

Based on the compilation of further pilot plant test work done on a 330-tonne bulk sample in November 1998, the operating period of 1997-1998 and a 2000 study, Lakefield Research developed a “new flow sheet” that is less complex and uses fewer reagents, while ensuring a fine grind is achieved.

Breakwater’s 2000 annual review said that the concentrator’s future success depends on design and maintenance problems being addressed, the use of high-level process control equipment and practices, following Lakefield’s recommendations — including those on grinding and flotation parameters, and ensuring that all staff are well trained.

The new flow sheet provides for higher revenues with the production of a saleable copper concentrate, in addition to the zinc and lead concentrates. Anticipated recoveries on a blended ore mix over the life-of-mine are in the range of 76-79% for zinc, 57-64% for lead, 14-35% for copper and 31-36% for silver.

“I was convinced at the time that Caribou could be a smooth performing, profitable operation but low metal prices made it uneconomic for us to reopen the mine, but now it’s finally happening,” said Martin, who was general manager at the Caribou site from 1999 to 2001 under Breakwater’s care.

Blue Note is reopening the two mines with a focus on production and flow sheet improvements to the aging mill, including new state-of-the-art grinding IsaMill technology to improve on historic recoveries. A new copper recovery circuit will also be added to the mill.

“Caribou requires a very fine grind; it’s a complex, very fine-grained ore so you’ve got to grind it fine in order to liberate the minerals,” Martin said. “There have been some big developments in that area in the last few years; there are other deposits that are similar to this that are being mined in Australia and the pyrite belt in Europe.”

The IsaMill technology developed by Xstrata is a proven, large-scale, high-intensity, ultra-fine grinding technology specifically developed for rugged metalliferous applications. It has proven effective and is now essential at Mount Isa Mines and McArthur River, both notorious for fine-grained zinc-lead ores. The IsaMill is a horizontal high-speed stirred mill that operates with very high power intensities enabling the processing of fine particles at a high throughput.

The McArthur River deposit was the driving force behind the development of IsaMills. Discovered in 1955, McArthur River contained a resource of 227 million tonnes at 9.2% zinc and 4.1% lead, however no existing technology could economically treat the extremely fine-grained mineralization. The development of the IsaMill technology allowed economic regrinding to 80% passing 7 microns, fine enough to reduce silica in bulk concentrate to marketable levels.

“With respect to metallurgy, we spent an awful lot of time working on this, a significant amount of energy and resources to feel confident that we are not exposing ourselves and our shareholders to something that can’t work,” Judson said. “We believe that this new technology will help us enhance the overall economics of this project.”

“The trick now is to take what we did on a lab scale and duplicate that in a plant,” Martin said. Blue Note is purchasing three of the IsaMills from Xstrata. “They will be a key change to the mill processing,” Martin stressed.

Blue Note has begun mine dewatering and site preparation, and is in the process of completing final engineering design. It will take a couple of months to dewater the mines. Construction is expected to begin shortly with the mines and concentrator commissioned in April for startup in May.

Genivar, a Montreal-based engineering firm, was hired in August as the lead consultant to complete the engineering, procurement and construction activities on the reopening of the mine and mill.

“Caribou will be a significant player in the Bathurst mining camp and will provide a real boost to the local and provincial economy,” Martin said.

Be the first to comment on "Blue Note dusts off Caribou"