Henan Province, China — The Ying silver-lead-zinc mine in central China is already generating enough cash flow to pay for exploration to upgrade known resources, outline more resources at depth and find new veins on the 59-sq.-km property.

The program is in line with Silvercorp Metals’ (SVM-T, SVMFF-O) strategy to produce first and explore later — the reverse of most mining plans.

“Conventional wisdom would suggest we do more drilling and wait to produce,” Silvercorp chairman and CEO Rui Feng told investors on a recent tour of the mine. “But we say let’s produce to get cash flow for exploration.”

The Vancouver-based company’s goal is to increase resources, already estimated at 97 million oz. silver plus lead and zinc byproducts, by 50% by next May. Silvercorp, which has a 77.5% stake in Henan Found Mining — the mine’s Chinese owner — has already completed 47 km of tunnels and about 40,000 metres of drilling within the 10-sq.-km area covered by a mining permit.

Of the $25 million that has been spent on the property to date, Feng says only $5 million came from Silvercorp’s treasury. The rest is derived from mining high-grade silver veins on the property, starting from the moment the company received its mining permit at the end of March.

The Chinese have little patience for North American mining companies that spend years drilling off a deposit before they consider production, according to Feng. He says Silvercorp’s understanding of this and other aspects of the country’s business and social culture helped the company secure a majority interest in Ying, and the subsequent mining permit, in timely fashion.

He adds that because the Ying veins are extremely narrow (less than 1 metre in most cases), it makes sense to crosscut into the host rock and tunnel directly along individual veins, rather than to try to find and outline veins by drilling only. As the veins are developed, they also provide payable ore.

But the rush to production has its downside.

The Ying mine has never been subject to a feasibility study, so numbers related to annual production and operating and development costs are difficult to predict and may vary considerably over the life of the mine.

Safety conditions

Safety has also been compromised. Contract miners, truckers and barge operators are paid by the load so there is a strong incentive to get the ore out of the mine, onto 3-wheel trucks, down a narrow switchback, across a reservoir and to the custom mill as quickly as possible.

When The Northern Miner visited the property recently, children were darting out to the ore tracks from a row of barracks built around the mine portal, underground blasting was taking place so close to the visiting group that one could smell the cordite, and there was an open hole in the tunnel floor big enough for a person to fall through. The mine has had two fatalities in seven months of production.

The conditions at Ying are only primitive when compared to North American operations, says Cathy Fong, vice-president of corporate development.

“If you were to visit a typical Chinese operation, you would see that Silvercorp is doing well,” Fong says.

From a financial perspective, it is. Silvercorp more than doubled its earnings to 11 per share in the second quarter ended Sept. 30 from 5 in the first quarter. For the first year of operation ending March 31, 2007, the company is projecting a net profit of 70-80 per share. Silvercorp has about 48 million shares outstanding for a projected annual profit of as much as $38.4 million.

Though the transport route from mine to mill is inefficient, labour is cheap, keeping total production costs at a relatively low US$42.53 per tonne (compared to a value of US$800 per tonne for the highest-grade veins).

After mining and transport by small trucks down the switchback, the ore is loaded onto privately owned barges, then reloaded onto larger trucks and sent to nearby custom mills for processing at a combined rate of about 400 tonnes per day. About 5-10% of the ore is high-grade enough to be hand-sorted on-site and shipped directly to a smelter.

Because the veins are so narrow, dilution is high, more than 150% using the shrinkage stope method. The company is now combining shrinkage with re-suing mining methods to reduce dilution.

Transport and processing will also improve when Silvercorp completes a new mill connected to the mine by a 30-km road that will wind around the reservoir, though some ore will still be shipped across the water and to the custom mills to keep the locals happy.

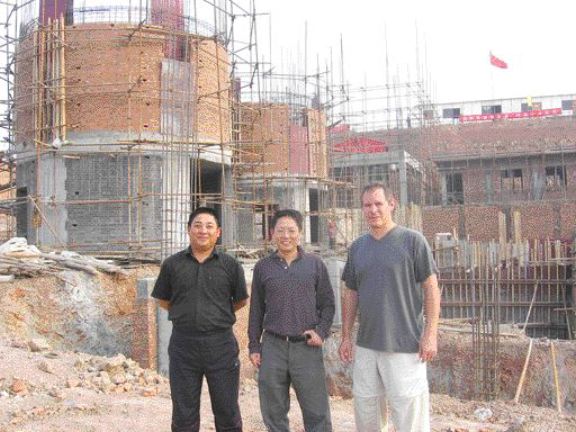

During The Northern Miner’s visit, Silvercorp’s mill was under construction in preparation for completion in early 2007 at a cost of US$3-US$4 million. It is permitted for a rate of 600 tonnes per day to produce a lead-silver concentrate and a zinc concentrate.

In the fiscal year ended March 31, 2007, Silvercorp expects to produce 3.53 million oz. silver, 43.7 million lbs. lead and 8.15 million lbs. zinc.

Tax incentives

From a tax perspective, it makes sense for the company to keep the ratio of lead-zinc to silver revenue at Ying slightly greater than 1:1 because there are incentives for lead-zinc mines under China’s mining legislation that don’t apply to precious metals mines.

Silvercorp is enjoying an income tax holiday for its first two years of operation (though the company does pay a resource tax of 2%). Income taxes, shared between the provincial and municipal governments, will be 15% for the following three years and 30% after that.

The company is sinking three vertical shafts to prepare for future production and is building a new 300-tonne capacity barge. There were 10 underground drill rigs and two surface rigs upgrading resources and finding new ore at the time of the site visit.

The Ying mine has a National Instrument 43-101-compliant measured and indicated resource of 811,620 tonnes grading 1,535 grams silver per tonne, 26.5% lead and 8.6% zinc. Inferred resources stand at 1.25 million tonnes grading 1,426 grams silver, 25.5% lead and 9.4% zinc. The resource estimate is based on 14 known veins, but Silvercorp plans to incorporate 25 veins into its 2007 resource update.

Within the wider property area outside the mining permit, Silvercorp has identified about 45 mineralized veins with an average width of about 1 metre by mapping and surface and underground channel sampling. Mineralization in the form of massive galena sheets is hosted in a set of quartz-carbonate veins cross-cutting Archean-aged felsic gneisses.

And as part of its strategy to consolidate the silver district, Silvercorp is in the process of acquiring a 60% interest in the nearby HPG silver-gold-lead mine for $6 million. Feng sees potential for further ore below 700 metres at HPG and plans to sink a shaft to exploit the deeper resources.

The company has also agreed to purchase the mining permit for the NZ gold-silver project located 135 km southeast of the Ying, by paying the private owner around US$1.1 million. NZ has been subject to limited underground mining to produce a reported total of 39,000 tonnes of ore grading about 6 grams gold per tonne.

Silvercorp is well financed for acquisitions, with about $60 million in the treasury left over from two financings in the past year. The most recent equity issue raised $47.8 million through an offering of 2.5 million units priced at $19.10 per unit. If the Ying mine continues to be not only self-financing but cash flow positive, there will be little need for Silvercorp to go back to the market with hat in hand in future.

— The author is a freelance writer specializing in mining issues, and principal of Toronto-based GeoPen Communications.

Be the first to comment on "Silvercorp flouts convention at Ying"