Now that Virginia Mines’ (VGQ-T, VGMNF-O) famed lonore discovery is on its way to making James Bay Canada’s next big gold camp, the explorer’s new strategy is to boost resources at its smaller deposits in the area.

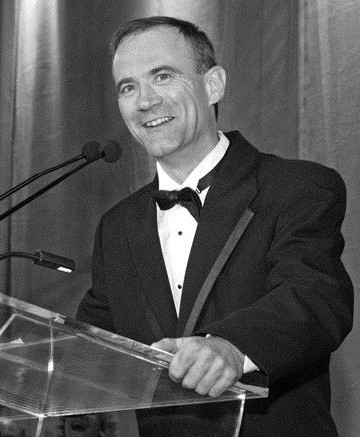

“Since we are going to have mining infrastructure in James Bay, developing the resources could be strategic in the future for satellite deposits,” says Virginia president Andr Gaumond.

Last year, Virginia sold the 3-million-oz. lonore property to Goldcorp (G-T, GG-N).

Virginia spent about $5 million on exploration in 2006, but Gaumond says the lonore sale kept the company busy for the first half of 2006. The deal was valued at more than $500 million plus a 2% net smelter return royalty for Virginia.

This year, the company is spending more than ever on exploration, about $16 million. However, Virginia’s actual 2007 financial outlay is only about $3 million after deductions of tax credits and joint-venture contributions.

Gaumond says Virginia’s exploration team of 40 to 50 geologists will be the largest in Quebec this year. But just because the company’s spending more, it doesn’t mean Virginia’s approach to exploration has changed.

“We have always spent the money that a project deserves — that’s the only rule,” Gaumond says. “This year, we have more projects than before and we’re going back to some of the small deposits we discovered in the past.”

Virginia is focused strictly on exploration, selling projects before the development stage. The company currently has 24 projects on the go, 19 of which are grassroots.

About $4.5 million will be spent on the Poste Lemoyne Extension, Corvet Est and the Coulon projects, which will include 22,000 metres of diamond drilling.

The Post Lemoyne gold project has a resource of 203,483 tonnes grading 14.5 grams gold per tonne, or 95,000 oz. gold. It’s located along the La Grande volcanic belt in James Bay. Lemoyne is 100%-owned by Virginia with a 1% net smelter return royalty held by GlobeStar Mining (GMI-V).

The 100%-owned Corvet Est gold project is also located along the La Grande belt. Goldcorp has the option to acquire 50% by spending $4 million over five years. Of note is the Marco zone, which has been traced over 1,400 metres to a depth of 350 metres and remains open laterally and at depth. Past drilling has returned gold grades of 10.1 grams per tonne over 5.2 metres, 3.96 grams over 7.75 metres, 4.78 grams over 5 metres and 14.73 grams over 1.9 metres.

Gaumond says he is excited about the 100%-owned Coulon base metal project, also in James Bay. The property is optioned to Breakwater Resources (BWR-T, BWLRF-O), which can earn a 50% interest for $6.5 million in exploration spending and $180,000 cash over eight years. The property is host to five volcanogenic massive sulphide lenses, two of which were just discovered last fall.

“However, it’s a base metal deposit, so that means you have to transport a concentrate — which means higher cost compared to gold, which means you need a bigger deposit,” Gaumond says. “We know it needs to be quite significant.”

Drilling on Lens 43 yielded grades of up to 0.58% zinc, 1.37% lead, 57.14 grams silver per tonne and 0.6% copper over 3.5 metres to a vertical depth of 120 metres. Lens 44 returned up to 3.05% zinc, 1.54% copper, 21.55 grams silver and 0.21 gram gold over 11 metres to a vertical depth of 170 metres. Most of the lenses are open in all directions.

The company has also planned 6,000 metres of reverse-circulation drilling and 2,000 metres of diamond drilling at the Sagar project in its wholly owned Labrador Trough in northern Quebec. Uranium Star (URST-O) can acquire up to a 75% interest in the 200 claims on the property. The exploration team hopes to trace the source of Mistamisk boulders containing over 70 erratic blocks with an average value of 1.3% U3O8 and 64.9 grams gold per tonne.

But Gaumond knows it’s the development of the James Bay region that other mining companies have their eye on.

“We’ve been telling the market for thirteen years that the area has the potential to develop into a mining camp and now this is exactly what is happening,” Gaumond says. “A lot of companies are monitoring what Virginia’s doing in James Bay.”

Be the first to comment on "Virginia plans ahead for James Bay gold camp (March 05, 2007)"