Callinan Mines (CAA-V, CCNMF-O) wants a look at HudBay Minerals’ (HBM-T, HBMFF-O) books on suspicions that the company isn’t complying with a net profits interest and royalty agreement signed in 1988 regarding a copper-zinc property in Flin Flon, Man.

Callinan has filed an action with the Manitoba Queen’s Bench against Hudson Bay Mining & Smelting, a subsidiary of HudBay, for the right to conduct an audit of the books and records for the Callinan mine and the 777 mine — HudBay’s flagship project.

HudBay Minerals reported earnings of $565 million in 2006, but the company does not break down earnings for each mine in its public reports.

In a statement, HudBay said the company believes it has made all appropriate payments to Callinan.

Under the net profits interest (NPI) agreement, Callinan was granted a 6.66% profits interest in the Callinan mine and any other projects developed on the property, which now also hosts the 777 mine. Callinan also has a 25-per-tonne royalty for ore milled from the site, which HudBay has paid.

Callinan has wanted to inspect HBM&S’s books since 1996, but the company has refused on the basis that its records are confidential.

But according to Callinan’s statement of claim, the NPI says HudBay must allow Callinan to inspect or audit the accounts related to the Callinan property or, where confidential to HudBay, allow an independent auditor to review HudBay’s records.

HudBay is also supposed to send Callinan NPI statements, but Callinan says it did not receive any in 1990, 1991, 1998, 2000 or 2005.

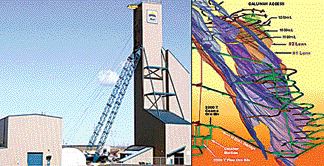

The 777 mine has a proven reserve of 5 million tonnes grading 2.3 grams gold per tonne, 27.5 grams silver, 2.8% copper and 4.5% zinc. Probable reserves are 11.8 million tonnes grading 2.1 grams gold, 26.9 grams silver, 2.3% copper and 4.5% zinc.

Production at 777 increased to 1.35 million tonnes of ore in 2006 from 1.1 million tonnes in 2005 and 1 million in 2004, when production began.

Analyst Mike Collison of Dundee Securities says Callinan’s problem is not unusual for companies holding NPI agreements.

“These type of agreements benefit those who define what profit is,” Collison says. “At this point, there is nothing that would remotely indicate that HudBay has acted in bad faith.”

Collison says it depends on how the agreement defines profit, which, when left up to the operator, can be completely valid — although not in the best interest of the company holding the NPI agreement.

HudBay’s 2005 financial report states that Callinan would receive the NPI of net proceeds of production if aggregate cash flow for the year and cumulative cash flow are positive. HudBay reported that cumulative cash flow was negative in 2005.

Collison points out that 777 cost more than $400 million and says it’s possible the project is not at a break-even point yet.

He says there could be some cash for Callinan by the end of 2007 if 777 continues its success.

“But it wouldn’t surprise me if there isn’t,” Collison says.

Jim Dartnell, senior mining strategist at Wolverton Securities, however, says he would be surprised if Callinan doesn’t see any money soon.

“Callinan is obviously enjoying good times with high copper and zinc prices,” Dartnell says.

Dartnell wrote a report on HudBay in September 2006, highlighting the fact that since buying Hudson Bay Mining & Smelting from Anglo American (aauk-q, aal-l) in December 2004, HudBay enjoyed a net income of $483.3 million and a cash flow of $490.1 million to Sept. 30, 2006.

“Without making this complex subject too complicated, it would appear the 777 mine has a cumulative positive cash flow,” writes Dartnell in a January 2007 report on Callinan.

As outlined in its suit, Callinan is also looking for:

* a declaration that HudBay must maintain separate records for the 777 and Callinan mines;

* a declaration that the cumulative cash flow defined in the NPI agreement and accumulated for the Callinan mine should not be used in calculating the net profits interest generated from 777;

* an order forcing HudBay to make financial records for both mines available to Callinan;

* an order for an accounting of all sums improperly included or excluded in calculating the net profits interest;

* general damages for breach of contract and breach of fiduciary duty and aggravated and punitive damages, interest and costs.

Be the first to comment on "Callinan sues HudBay"