Vancouver — Just six months after NovaGold Resources (NG-T, NG-X) brought on Teck Cominco (TCK.B-T, TCK-N) as a partner to build a mine at its Galore Creek copper-gold deposit in northwestern B.C., the pair dropped a bombshell by suspending development activities citing escalating capital costs and a lagging construction schedule.

The companies also forecast shrinking operating margins — attributed to the strengthening Canadian dollar — making the project uneconomic under its current permitting and development plan along with current long-term metal price projections (thought to be in the range of US$1.50 per lb. copper, US$600 per oz. gold and US$12 per oz. silver).

Although the partners plan to examine alternative development strategies for Galore Creek, NovaGold and Teck will wind down activities at the site and place it under care and maintenance.

Earlier this year, NovaGold engaged engineering firm AMEC Americas to review the 2006 Galore Creek feasibility study (led by Hatch engineers) and begin project engineering. By mid-October, AMEC’s evaluation indicated capital costs for the mine would be substantially higher than projected in the feasibility study (estimated at about US$1.8 billion) and could run as high $5 billion.

While some proposed changes from the original feasibility study are acknowledged, the latest review attributes a major portion of the capital cost increase to difficult sequencing involved in building the tailings dam and water management structures. The process could protract the construction schedule by up to two years.

“We reached this decision after extensive review and the realization that capital costs have increased significantly,” said NovaGold president and CEO Rick Van Nieuwenhuyse in a conference call. “In addition, reduced operating margins as a result of the strong Canadian dollar have further reduced project economics — to the point where the project is no longer viable while using current consensus long-term metal prices. Clearly, if we could evaluate this project using today’s copper and gold prices, it would be economically viable. But industry standards evaluate projects using long-term historical averages.”

With labour and materials exerting inflationary pressure on the industry, Van Nieuwenhuyse said that miners are continuing to assess what long-term metal prices are appropriate to use.

“Unfortunately, we have to make decisions now on what we know now,” he said.

The fallout also sees Teck Cominco’s earn-in obligations amended. Under the new plan, the major will invest a further $72 million in the partnership — earmarked to analyze Galore Creek development options over the next five years.

Teck Cominco’s sole funding of other project costs incurred after Aug. 1, 2007, will now total $263 million — down from the roughly $500 million it was initially obligated to spend under the original agreement. The next $100 million in costs (primarily project shutdown and care and maintenance) will be shared, with NovaGold kicking in 33% and Teck Cominco 67%, with costs shared on a proportional basis thereafter.

“It is indeed a very disappointing moment and I know there are many stakeholders who would have preferred that we push on in the hopes that commodity prices would stay high and bring things onside,” said Teck Cominco president and CEO Don Lindsay. “But in the end, we feel compelled to make the prudent decision and cut back spending to a minimum while we determine a new, more economic way forward.”

When questioned on the decision’s effect on Teck’s bottom line, Lindsay confirmed it was an important part of the company’s growth profile, although it wouldn’t have begun production until 2012.

Both companies plan to write down the Galore Creek project in the fourth quarter, but have not established a long-term carrying value. NovaGold has spent more than $400 million on the project, while Teck Cominco will have invested $263 million by year-end.

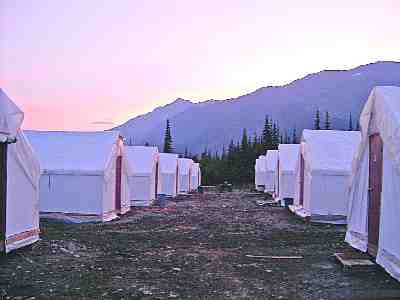

The wind down is expected to affect most of the more than 400 people currently working at Galore Creek.

The decision also has the potential to affect the timeline of the recently announced B.C. government power line initiative along Highway 37 to Bob Quinn. A portion of the estimated $400-million transmission line project was to be paid by the Galore Creek partners.

Shares of NovaGold plummeted to a 25-month low on the news — down 54% — closing $10.71 lower at $9.25 apiece on strong volume. Teck Cominco shed 5%, giving up $1.82 to close at $35.67 per share — touching a more than 1-year low.

The aftermath saw several junior explorers with projects in the region also decimated. Copper Canyon Resources (CPY-V, CAYRF-O), with an adjoining resource to Galore Creek, lost 70% of its share value to close down 84 at 37 per share. Shares of Copper Fox Metals (CUU-V, CPFXF-O) shed 45%, down 38 to 46 apiece, and Romios Gold Resources (RG-V, RMIOF-O) was down 32% for a 19 loss at 40 per share.

NovaGold is advancing its Nome operations (Rock Creek, Big Hurrah and Nome Gold) in western Alaska towards production by year-end, with expected output of about 100,000 oz. gold annually at full operation. The company also recently inked an agreement with Barrick Gold (ABX-T, ABX-N) to jointly advance the Donlin Creek gold deposit in southwestern Alaska on a 50-50 basis.

Be the first to comment on "Sun sets on Galore…for now"