The S&P-TSX Venture Composite Index posted a gain in the first week of April, climbing 57.46 points over the April 1-7 trading session to close at 2,551.32.

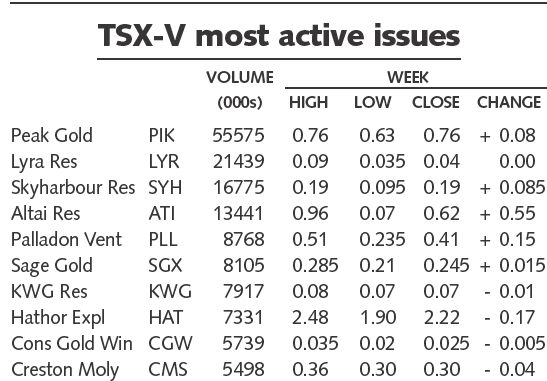

Peak Gold was the top trader for the third week running, still basking in the news of its proposed three-way merger with Metallica Resources and New Gold. Peak Gold traded 55.5 million shares over the session, closing up 8 at 76 per share. If the alliance goes ahead, it will create an intermediate gold producer with a market capitalization of about US$1.6 billion.

Investors were also drawn to Skyharbour Resources. On April 3, the company announced it had made “what appears to be” a significant discovery of volcanogenic massive sulphide mineralization, about 500 metres southwest of the former South Bay mine, 80 km east of Red Lake, Ont. Skyharbour moved 16.7 million shares and soared 80.9%, or 8.5 per share, to close at 19.

Drill intercepts of high-grade gold at its HNK gold project in southern China had New Pacific Metals gaining the most value on the week. It rose 75 per share to close at $2.80 on news of a high-grade gold vein assaying well into the double digits. Hole ZK3001 intersected the new R1 vein, returning a 32.13-metre intersection grading 14.33 grams gold per tonne, including 8.13 metres grading 55.05 grams gold.

Altai Resources clocked the greatest percentage change on the week, soaring 785.7% — or 55 a share — to close at 62. The junior explorer with interests in gold, nickel, industrial minerals and natural gas, reported on April 2 that it had completed a private placement of $2.8 million with Sprott Asset Management and MMCAP International. The placement consisted of 7 million share units at 40 apiece. (Each unit is made up of one Altai share and half a share purchase warrant.)

Investors flocked to Palladon Ventures after it announced a five-year deal to sell run-of-mine ore to one of China’s biggest iron ore importers. Under the contract, Palladon will sell at least 2 million metric tonnes of ore a year to China at pricing fixed through March 2009. Shipments are expected to begin in the third quarter. News of the deal sent Palladon shares up 57.6%, or 15, to close at 41 apiece.

Pacific Booker Minerals dropped $1.28 per share on no news, closing at $8.60. The company, a base and precious metal exploration company, has a single advanced-stage copper, gold, and silver project in central British Columbia.

Seabridge Gold also lost value over the trading session — a hangover perhaps from the March 31 release of its 2007 financial results. The company posted a net loss for the year ended Dec. 31 of $5.5 million, or 15 per share, compared with a net loss of $3.3 million, or 10 per share, for 2006. Its shares fell $1.01 over the session to close at $23.30.

Be the first to comment on "TSX VENTURE EXCHANGE APRIL 1-7"