Denver, Colo. — Sean Roosen, president and chief executive of Osisko Mining (OSK-T, OSKFF-o), wasn’t the only executive at the recent Denver Gold Forum to praise Quebec as one of the best places, if not the best, for mining companies to operate. But he was certainly one of the most vocal.

Roosen kicked off his presentation on the Canadian junior developer’s Malartic gold project near Val d’Or, Que., citing the province’s first-place finish on the Fraser Institute’s 2007-08 ranking of mining jurisdictions. The province scored 97 points out of a total of 100 on the think tank’s annual Policy Potential Index, which measures the overall policy attractiveness of the 68 jurisdictions in the survey.

Among Quebec’s attributes are a highly skilled workforce, no government royalties and one of the lowest mining taxation rates in Canada (about 34%). The mining incentives the province offers are also unique. The provincial government gives a 42% refund on all non-flow-through exploration expenditures on everything from drilling, trenching, and assaying, to surveys, prospecting, and geochem. So if a company spends $100 on exploration, the government reimburses it $42. So far, Osisko has received about $20 million through the government’s mining incentive scheme.

Power costs are also extremely attractive and among the lowest in the industry. At 4.3-4.7 per kilowatt- hour, rates in Quebec are 50% of those in Ontario and 40% of those in Nevada. “Quebec is one of the best mining jurisdictions on the planet,” Roosen said.

Even relocating a community to make way for its Malartic mine doesn’t appear to be causing the company any problems. Osisko must relocate a total of 170 houses to make way for the proposed mine and since starting the process in July has relocated 32 of them. “The community is behind the company’s plans — it’s a pro-mining community,” Roosen explained.

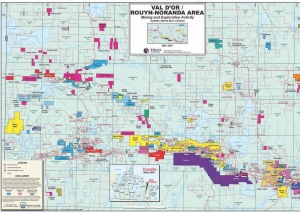

On Sept. 8, Osisko released a new National Instrument 43-101 compliant resource on its 100%-owned Malartic project, south of the town of Malartic about 20 km west of Val d’Or. It hopes to move the mine into production at the end of 2010.

At a cutoff grade of 0.36 gram gold per tonne, the total Malartic resource stands at 8.41 million oz. gold. Of that, 7.69 million oz. gold is in the measured and indicated category and 720,000 oz. is inferred.

At the same cutoff grade, Malartic has 232.3 million tonnes grading 1.03 grams gold in the measured and indicated category and 37.44 million inferred tonnes grading 0.6 gram gold.

Roosen told analysts and investors at the Denver gold conference that the company is headed for an updated feasibility study in the fourth quarter of the year. The study will evaluate the deposit and the 100%-owned adjacent areas for a large-scale, open-pit, bulk-tonnage operation.

So far, Osisko has identified five main target zones and 40 exploration targets for possible expansion. The 56.6-sq.-km property includes the former underground Canadian Malartic mine, which poured more than 1 million oz. gold from 1935-1963. Osisko purchased the property in November 2004.

A preliminary assessment study released in March demonstrated that the proposed mine, which will cost about $760 million to build, will have a discounted net present value of $1.5 billion. Payback has been forecast in 39 months.

The study estimated average annual gold production of 457,800 oz. over the mine’s 14-year lifespan at a cash cost, after royalties, of US$381 per oz., yielding an internal rate of return of 22.2%.

Osisko has drilled 1,100 holes to date and purchased mining and milling equipment for delivery in 2009. Roosen noted that with a lead time in some cases of between 150 and 170 weeks for certain items, Osisko got a head start, ordering its semi-autogenous grinding and ball mills in 2006.

Now, with a strong balance sheet of $150 million in its treasury and $35 million in equity and relocation, the company believes it is well funded for future growth.

But like many companies in the industry, Osisko believes it is significantly undervalued.

In Toronto, the junior recently traded at about $2.25 per share, down from about $4.35 per share in mid-April and more than $6 per share in mid-March. Osisko has a 52-week trading range of $1.86-7.24 per share.

“Our share price graph looks like many mining companies these days,” Roosen said. But looking ahead, he cited a number of recent analyst forecasts that range from: $5.50 per share (TD Waterhouse); $6.50 per share (Canaccord Adams; RBC Capital Markets); $7.50 per share (National Bank); $7.80 per share (Paradigm Capital); $8 (T. Weisel); and $8.40 (Pacific International).

Be the first to comment on "Osisko touts the ‘Quebec advantage’"