VANCOUVER — After almost three months of promising scintillometer results, Hathor Exploration (HAT-V, HTHXF-O) released the first set of assay results from its summer drilling program at the Midwest Northeast uranium property in Saskatchewan and the market liked what it saw.

Hole 30 returned 69 metres grading 2.33% U3O8. From 332 metres down-hole, the core graded 2.81% U3O8 for 49 metres; the next 6 metres averaged 0.018% U3O8 and the following 14 metres assayed at 1.68% U3O8. Within the 49-metre interval, a 9-metre segment came in at 10.54% U3O8.

Hole 31 returned a short hit: 2.5 metres grading 1.35% U3O8, from 289 metres depth.

And hole 32 cut two intercepts: 20.41% U3O8 over 6.5 metres from 318 metres down-hole, followed closely by 16 metres grading 0.74% U3O8.

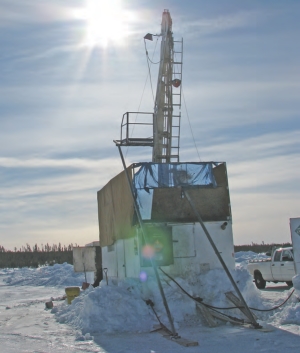

Hathor’s summer program is targeting the intersection of the basement-hosted uranium-bearing structures of the Roughrider zone and the Athabasca unconformity. Vertical depth to the unconformity is roughly 215 metres.

The results lifted Hathor’s share price 51 in mid-day trading; the junior closed the day with a 43 or 12% gain, at $4.04. The midday high of $4.12 is a new share-price high for Hathor. The company has 80 million shares issued.

Hathor discovered the Roughrider zone at Midwest Northeast in February, while exploring for more of the nickel-cobalt-molybdenum- copper mineralization the company found on other parts of the property.

The February scintillometer results from that first hole — hole 12 — were promising enough to lift Hathor’s share price to $1.30 from 50. In March, rush assays for hole 12 returned 12 metres of 5.3% U3O8, raising the junior’s share price another 60.

Hathor hit the zone with another 11 holes before the end of the winter drilling program. Results continued to show promise for the new uranium zone: hole 20 returned 10% U3O8 over 15 metres, hole 19 cut 2.1 metres of 4.11% U3O8, hole 21 cored 5 metres grading 3.58% U3O8, and hole 28 returned 2.6% U3O8 over 9.5 metres.

With those results in hand, Hathor was able to close a $15-million underwritten bought-deal private placement, selling 5 million shares at $3 apiece.

In mid-June, Hathor was able to start drilling again, after receiving surface exploration permits.

Since then, four news releases announcing high scintillometer readings from Roughrider core had slowly lifted Hathor’s share price to above $3.50 but the recent release is the first containing actual grades.

Hathor owns 90% of the Midwest Northeast project; the rest is held by Terra Ventures (TAS-V, TASFF-O).

Be the first to comment on "Hathor hits a homer"