Vancouver — Great Basin Gold (GBG-T, GBN-x) is trying to get two mines into production within the next six months and in recent weeks has taken a few important steps towards that goal.

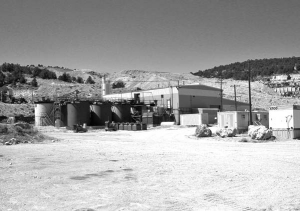

In its most recent move, the company announced an agreement to buy the Esmeralda processing plant in Nevada for US$2 million. Esmeralda comprises a mine, a mill with carbon-in-leach recovery, and a tailings facility, as well as 32.3 sq. km of prospective land that has produced almost 2 million oz. gold during its mining history.

For Great Basin, the exploration potential is an upside. The company is buying the operation as a processing facility for ore from its Hollister project, roughly 460 km northeast. Hollister is in north-central Nevada, while Esmeralda is just west of the centre of the state. Great Basin says interstate roads cover 80% of the distance between the sites, with transportation costs estimated at US$55 per ton of ore.

Metallic Ventures Gold (MGV-T, MTLVF-o) purchased Esmeralda from the receiver of the previous bankrupt owner in 2000. Metallic explored the land package with an eye to reopening the mill to process small amounts of high-grade ore. The company tried to do just that in 2004 but could not make the operation economic; the mill was put back on care and maintenance.

Metallic still holds the permits necessary for mining, milling and crushing activities at Esmeralda and Great Basin’s deal with the company includes the transfer of those rights. The permits are contingent on the operator putting into place a US$2-million bond covering reclamation liability.

The mill can process up to 350 tons per day. The company expects that recommissioning and recon-figuring at the mill will take at least four months. During that phase, Great Basin will evaluate and, if needed, implement further upgrades to improve gold recovery and expand the capacity of the mill. Costs to get the mill up and running again are expected to total US$8 million; operating costs from there are estimated at US$40 per ton.

Milling costs are therefore expected to come to US$95 per ton, which Great Basin says is significantly lower than the 20% revenue royalty it currently pays for toll milling.

Investors seemed to like the move, pushing Great Basin’s share price up 13¢ to $1.10. The company has a 52-week trading range of 91¢- $3.83 and 215 million shares issued.

The Esmeralda acquisition also comes with mineral resources, though tonnage and grade estimates are historical in nature. Great Basin has begun an initial assessment of previous mining activities and plans to review historical resources with the aim of developing a National Instrument 43-101-compliant report. Preliminary observations and data from underground workings indicate the property is home to a high-grade epithermal vein-type target.

To pay for all of this, Great Basin has closed a US$51.5 million senior secured note debt financing with warrant coverage. The financing will conclude the Esmeralda purchase, as well as contributing towards development costs at the company’s Burnstone gold project in South Africa.

Hollister’s geology is characterized by epithermal veins. Great Basin is developing underground access to three gold-bearing vein systems called Clementine, Gwenivere, and South Gwenivere. According to a June estimate, the project hosts 1.47 million measured and indicated tonnes grading 29.71 grams gold per tonne plus 1.14 million inferred tonnes grading 17.4 grams gold.

Trial stoping at Hollister has given the company confidence that the strike length of the vein system will be extended. The company is hoping that extension will replace veins to be excluded in the next reserve estimate because trial mining has shown the veins cannot be mined economically. Great Basin is exploring the possibility of using a thermal fragmentation process to access some of these narrow veins.

Development work at Hollister is already paying returns, in fact, as Newmont Mining (NEM-T, NMC-n) signed on to buy and process a 15,000-ton bulk sample from Hollister. Newmont is responsible for transportation and processing costs and will pay Great Basin US$470 per oz. of gold recovered. The Hollister ore is expected to carry an average grade of 1.3 oz. gold per ton as well as 9 to 12 oz. silver per ton.

Exploration drilling is also paying off for Great Basin. Drilling in the newly discovered Hatter Graben vein system shows the veins occur in a robust, wide structural zone with several sub-parallel bonanza-grade veins similar to the Gwenivere and Clementine vein systems currently being prepared for underground mining. Gwenivere and Clementine are 1.5 km west of the new discovery.

Great Basin’s other big step forward was at Burnstone, in Mpumalanga, South Africa. In late October, the company’s subsidiary, Southgold, was granted a new order mining right there allowing it to mine for gold, silver and aggregate. In conjunction with applying for this right, Great Basin found a black economic empowerment partner in Tranter Gold, which acquired the necessary 26% of Burnstone. At Tranter’s request, the 26% interest in Burnstone was converted to shares in Great Basin, giving Tranter 9.3% of Great Basin and making it the company’s biggest shareholder.

Surface and underground infrastructure development is well under way at Burnstone. By the middle of November, a decline had been advanced over 2 km, with less than 200 metres remaining. A vertical shaft had reached a depth of 165 metres; it needs to reach 500 metres. Mining at Burnstone is expected to begin in a few months time.

Be the first to comment on "Great Basin Buys Mill For Hollister"