In 2007, Saskatchewan continued to have unprecedented growth in mineral exploration and development. The combined value of sales from Saskatchewan mineral production in 2008 was more than $4.5 billion – and that number is expected to be surpassed in 2009.

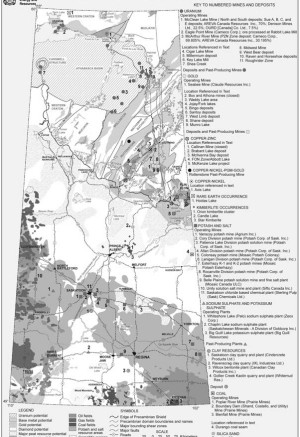

Saskatchewan continues to be the global leader in uranium and potash production, contributing 33% of the world’s supply of potash and 23% of the world’s primary production of uranium. Other minerals mined included: gold, sodium sulphate, kaolinite, coal, aggregate, bentonite, and silica sand. In addition, diamonds, base metals, and rare earth elements were the focus of substantial exploration.

Although the global market adjustment caused commodity prices to drop in 2008, exploration activity throughout the province continued to be strong. The strength of Saskatchewan’s mining industry is due to its rich and diverse mineral endowment, which reflects the geologic diversity of the province. Mineral exploration expenditures for 2008 should top $360 million, setting an all-time record and continuing a consecutive year-over-year increase that began with $22.1 million in 2001 (see Figure 1).

Mineral claims for 2008 were down slightly from 2007’s record. As of Dec. 31, 2008, there were 6,972 active mineral dispositions totalling nearly 10.58 million hectares, and 191 active potash claims covering about 4.47 million hectares.

A new coal discovery in the Hudson Bay area incited a staking rush for coal and, as of Dec. 31, 2008, there were 4,547 active coal dispositions totalling roughly 2.84 million hectares, with an additional 1,831 applications, covering around 1.38 million hectares, pending approval.

Uranium

Uranium was produced from three mines in 2007: McArthur River, Eagle Point at Rabbit Lake, and McClean Lake. Total production was 24.6 million lbs. U3O8; 18.7 million lbs. of which was produced from McArthur River. In 2008, production was forecast to be 23.8 million lbs. U3O8. The spot market price of uranium fell steadily throughout 2008 to US$53/lb. U3O8 by year-end from US$90 per lb. U3O8 in January. Long-term contract prices underwent less of a decline, falling to US$70 per lb. from US$90 per lb. U3O8 over the same period. Although the price of uranium has come down substantially, the concerns about potential supply shortages, heightened by recent production shortfalls at mining operations around the world, will likely ensure that the price of uranium will stabilize or begin to rise again.

In the Athabasca basin, the world’s premier exploration district for high-grade uranium deposits, it is estimated that about $195.4 million was spent on exploration in 2008, down slightly from actual expenditures in 2007 of nearly $200 million. Some of the largest programs included those of producers Cameco, AREVA Resources Canada, and Denison Mines, as well as junior UEX Corp. Exploration successes continue to be reported, underlining the continued potential of the basin. The most significant success, announced in early 2008, was junior Hathor Exploration’s discovery of the Roughrider Zone at its Midwest NorthEast project.

Gold

In 2008, Claude Resources’ Seabee mine remained the only gold producer in the province, with total production of 45,466 oz. gold. Expenditures for gold exploration in 2008 were forecast to be $16.9 million; on par with actual exploration expenditures of $15.3 million in 2007. Gold exploration was primarily focused on three areas of the Precambrian Shield: the Glennie Domain, the La Ronge gold belt, and the Goldfields area on the northern shore of Lake Athabasca.

In the Glennie Domain, Claude continued to focus on the Seabee area, conducting underground exploration at Seabee itself and surface drilling and resource definition of the satellite Santoy 8/8E deposit. GLR Resources continued to work towards production at the Box and Athona deposits in the Goldfields area, having undertaken further drilling for resource estimates in the past year. In the La Ronge gold belt, Golden Band Resources advanced exploration at several of its Waddy Lake projects, as well as the Bingo deposit. The work added to the company’s known resource inventory and helped it advance towards its goal of production by late 2009.

Base Metals

There was no base metals production in Saskatchewan in 2007. Despite weakening base metal prices during 2008, exploration expenditures for base metals were expected to maintain 2007’s level of around $10 million. Most of the associated exploration activity is targeting volcanogenic massive sulphide (VMS) deposits in the Flin Flon Domain (including its sub-Phanerozoic portion), sediment-hosted sulphide occurrences in the Wollaston and Kisseynew domains, and intrusion-hosted nickel-copper-platinum group element occurrences near the historic Rottenstone mine.

West of Flin Flon, Foran Mining and Copper Reef Mines are advancing the McIlvenna Bay VMS project. Exploration Syndicate made a significant copper-zinc discovery on its McKenzie Lake project in the Suggi Lake area. Murgor Resources released a NI 43-101-compliant mineral resource estimate for its Fon deposit in February 2007.

Mantis Mineral completed a geophysical survey on its Rottenstone-nickel-PGEs project, and identified several targets for winter drilling in 2008-09. Manicouagan Minerals continued its drilling and geophysical program on the polymetallic Brabant Lake deposit in the southwestern Kisseynew Domain, and filed a NI 43-101-compliant technical report, which includes an updated resource estimate. In the Wollaston Domain, Wildcat Exploration continued exploration on its Foster River lead-zinc-silver property and Golden Arch Resources completed six diamond drill holes, all intersecting sulphide mineralization, on its Wakefield Lake zinc deposit.

Great Western Minerals Group has continued evaluation and development of its Hoidas Lake rare earth element deposit with a 2007-08 winter drilling program that totalled 6,836 metres in 32 holes. The length of the mineralized JAK Zone was extended by 250 metres and 150 metres at depth, and remains open in both directions. The drilling also discovered a new mineralized zone in the JAK Zone’s footwall. Great Western strengthened its “mine to market” strategy with the acquisition of Less Common Metals, a company that produces a variety of special alloys for use in the automotive, battery, magnet, and aerospace industries.

Diamonds

Diamond exploration spending was forecast to be more than $95 million in 2008, up from $76.6 million in 2007. The bulk of the 2008 spending was at Shore Gold’s Star diamond project and the Fort la Corne Joint Venture’s (FalC JV) Orion Cluster project. Shore produced a NI 43-101-compliant mineral resource estimate for the Star kimberlite, which outlined an indicated resource of 122.7 million tonnes grading of 13.5 carats per hundred tonnes (cpht), and an inferred resource of 30.3 million tonne grading 13.1 cpht. With the bulk of the sampling completed, Shore shifted focus to desktop engineering and environmental studies as it moves the project through to the feasibility stage.

The FalC JV is a partnership between Kensington Resources, a subsidiary of Shore, with 60%, and Newmont Mining (40%). The FalC JV is undertaking an accelerated exploration and evaluation program of its Orion kimberlite cluster. The goal of the program is to recover enough diamonds to determine representative grade and diamond values for the various geologic phases. The FalC JV has started exploring its newly defined Taurus kimberlite cluster, which it believes has potential for tremendous volumes of diamond-bearing kimberlite. Vaaldiam Resources, which acquired the Saskatchewan assets of Great Western Diamonds, continued to evaluate the Candle Lake kimberlites. Some other grassroots diamond exploration was also under way in Saskatchewan.

Potash

In 2007, Saskatchewan’s potash industry set reco

rds for the amount of potash produced 16.95 million tonnes, worth $3.1 billion. The value of potash sales for 2008 is expected to exceed $7 billion.

After 25-year lull in potash exploration inactivity, Saskatchewan is now in the midst of a potash exploration boom. In 2004, only 206,306 hectares of land were under disposition for potash, but as of Dec. 31, 2008, more than 4.46 million hectares of land were under disposition for potash exploration and development.

Aside from the three current producers, there are now more than one dozen different companies involved in potash exploration in Saskatchewan. From 2007 to 2008, seismic programs totalling over 20,000 line-km had been applied for over existing potash claims, and more than 50 potash test-well licences had been granted to various exploration companies. It is estimated that more than $35 million was spent exploring for potash in Saskatchewan in 2008. All 10 of Saskatchewan’s producing potash mines have announced upgrades or expansions to increase annual capacity. Saskatchewan’s potash mining companies are planning to invest about $8.7 billion to increase production by 75% over the next 12 years.

Coal

Sherritt International reported that coal production from its three mines in the province totalled 10.3 million tonnes in 2007. In April 2008, Goldsource Mines reported intersecting over 30 metres of coal while drilling for kimberlite on its Border property claim block, north of Hudson Bay, in east-central Saskatchewan. The discovery of this unusually thick coal seam touched off a staking rush in the Hudson Bay area that quickly extended westward across the province.

In August 2008, Whitemud Resources held a grand opening for its newly built meta-kaolin plant and quarry at its Gollier Creek kaolin deposit, near Wood Mountain. The company produces meta-kaolin, a cement substitute used in concrete. The plant has the capacity to produce 175,000 tonnes of meta-kaolin annually, with room for expansion. The company has proven reserves of 52.9 million tonnes of ore, as well as measured and indicated resources of 131.1 and 28.2 million tonnes, respectively. Whitemud conservatively estimates mine life at roughly 25 years.

| Mineral exploration expenditures in Saskatchewan by | ||||||||||

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008e | |

| Uranium | 14.0 | 17.7 | 14.0 | 15.4 | 13.3 | 31.2 | 74.6 | 123.7 | 199.2 | 195.4 |

| Diamonds | 1.4 | 4.1 | 4.8 | 6.1 | 12.0 | 22.4 | 55.4 | 98.8 | 76.6 | 95.5 |

| Gold | 1.0 | 0.7 | 1.0 | 2.5 | 2.9 | 5.7 | 15.3 | 13.8 | 15.3 | 16.9 |

| Base Metals | 5.6 | 4.5 | 1.4 | 1.9 | 2.2 | 0.9 | 2.9 | 3.9 | 11.5 | 10.8 |

| PGEs | 0.9 | 1.0 | 0.1 | 0.6 | 0.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other | 0.8 | 0.1 | 0.8 | 1.3 | 0.5 | 0.5 | 1.8 | 3.4 | 22.7 | 40.9 |

| Total | 23.7 | 28.1 | 22.1 | 27.8 | 31.4 | 60.7 | 150.0 | 243.6 | 325.3 | 359.5 |

| (Other = Industrial minerals, including REE, potash, and clays). | ||||||||||

Be the first to comment on "Saskatchewan’s Potash, Uranium And Coal Garner Unprecedented Interest"