The mineral industry in Newfoundland and Labrador continued to enjoy a relatively strong level of activity in 2009 as measured by historical standards. Projected expenditures on exploration and deposit appraisal are about $58 million. Although down from the record levels of previous years, due to the downturn in the global economy, the 2009 figure is still the fourth highest for the province in the past decade. Furthermore, by year end, there were indications of a significant recovery in all industry sectors.

Claim staking in the province dropped to 18,932 in 2009 from 33,158 in 2008. Claims in good standing have also declined substantially, to 120,615 at year end 2009 from a recent high of 189,283, as companies consolidated their land positions. However, new claim staking rebounded strongly in the fourth quarter.

Through its Mineral Incentive Program, the province supported exploration with a 2009 budget of $3 million for cost-shared funding of approved projects, an increase of $500,000 from 2008. Funding is allocated to three main components: junior exploration assistance, $2.2 million; prospectors’ assistance, $400,000; and natural stone assessment, $250,000. The program also delivers an annual two-week prospector training course.

A new, online mineral exploration approval management system (MEAMS) is expected to be operational this summer. The system will allow timely processing of all permits and approvals for mineral exploration. As well, MEAMS will be the single online application portal for the majority of permits required for exploration.

Mining and development

Vale Inco formally notified the province that it will build a hydromet nickel processing plant at Long Harbour, Nfld. Construction is forecast to be completed in February 2013 at a total estimated cost of US$2.8 billion. The plant will produce 50,000 tonnes of finished nickel per year.

Hunan Nonferrous Metals, now controlled by China Minmetals Corp., has acquired A 100% interest in the Beaver Brook antimony mine for $29.5 million. Beaver Brook is the only operating antimony mine in North America.

Rambler Metals and Mining has purchased the Nugget Pond gold processing facility from Crew Gold for $3.5 million. The facility is located 40 km from Rambler’s Ming mine, currently in development. The gold concentrator will be adapted to process base metal sulphides, as well as gold from Ming.

Rambler has reported a total measured and indicated resource for the Ming mine of 3.6 million tonnes grading 2.21% copper, 1.31 grams gold per tonne, 7.86 grams silver and 0.39% zinc.

Anaconda Mining is upgrading and expanding the milling facility at its Pine Cove gold mine. An agreement to process ore from Pine Cove at the Nugget Pond mill has been terminated.

Labrador highlights

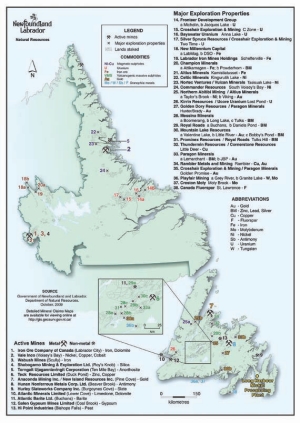

Recent exploration in Labrador has focused on three main commodities: iron, uranium and nickel. The economic downturn has reduced exploration for the latter metals in 2009. However, two advanced iron projects in western Labrador operated by Labrador Iron Mines Holdings and New Millennium Capital are approaching production. These are focused on high-grade direct shipping ore deposits (DSO) previously documented by the Iron Ore Co. of Canada. Other companies, including Altius Minerals and Champion Minerals, have iron projects at earlier stages of exploration.

Labrador Iron Mines completed a resource estimate on its James and Redmond DSO deposits which are targeted for first-phase production. The deposits have a combined total indicated resource of 11 million tonnes grading 57.4% iron. The company plans for initial production in 2010.

New Millennium Capital and its project partner Tata Steel are also working toward production of DSO. New Millennium reported measured and indicated resources for its DSO project of 67 million tonnes averaging 58.9% iron, plus inferred resources of 7.1 million tonnes at 55.9% iron. Production is expected to begin in 2011.

Fronteer Development Group announced a positive scoping study for the proposed Michelin uranium project located in the Central Mineral Belt (CMB) of Labrador. The study is based on open-pit and underground mining of the Michelin and Jacques Lake deposits, with a milling facility at the Michelin site capable of processing 10,000 tonnes of ore per day, producing up to 7.3 million lbs. U3O8 per year. Direct cash costs are stated at US$28.57 per lb. of U3O8 over the 17-year mine life.

Bayswater Uranium published a resource estimate for its Anna Lake uranium deposit, also in the CMB. The deposit is estimated to contain 5.06 million tonnes at a grade of 0.044% U3O8, for a total of 4.9 million lbs. of contained uranium oxide. The deposit also hosts an estimated 1.5 million lbs. molybdenum and 1,000 kg of rhenium.

Of general interest, recent claim staking has focused on historic showings of rare metals and/or rare earth elements in central Labrador. Areas of interest include western Labrador, the western Central Mineral Belt, and nearby areas with perceived geological potential for these metals. About 2,300 claims were acquired in 2009.

Newfoundland highlights

Exploration on the Island of Newfoundland in 2009 was also down from last year, due primarily to unfavourable market conditions. The emphasis was primarily on base metals and gold in central and western Newfoundland. New showings have been reported, and several have seen early stage drilling.

Canada Fluorspar updated the resource at its St. Lawrence fluorspar property. It now contains indicated resources of roughly 9.1 million tonnes grading 42% CaF2 and 950,000 tonnes of inferred resources grading 31% CaF2. Initial production is planned for 2011.

Thundermin Resources and Cornerstone Capital Resources continued drilling on the Little Deer copper deposit. The deposit hosts an indicated resource of 1.08 million tonnes averaging 2.9% copper and an inferred resource of 1.95 million tonnes grading 2.3% copper.

Highlights of drilling in 2009 include 3.8 metres grading 6% copper, within a wider mineralized 12-metre interval grading 2.5% copper. High-grade gold mineralization in float and outcrop has also been reported from the property, with up to 22.7 grams gold per tonne in grab samples.

Creston Moly (formerly Tenajon Resources) reported an indicated resource estimate at its Moly Brook zone of 86.8 million tonnes grading 0.065% molybdenum plus inferred resources of 31.3 million tonnes at 0.056% molybdenum.

Kermode Resources announced an inferred resource for its Jackson’s Arm gold project. The Road, Apsy and Beaver Dam zones together host 18.3 million tonnes averaging 0.84 gram gold per tonne.

Mountain Lake Resources and Marathon PGM Corp. have entered into an option and joint-venture agreement, granting Marathon a sub-option to earn a 50% interest in the Valentine Lake property. At Valentine Lake, the Leprechaun Pond deposit contains an inferred resource of 1.3 million tonnes grading 10.5 grams gold per tonne.

New discoveries

Northern Abitibi Mining continued to expand the mineralized zones at its Viking gold property through trenching and diamond drilling. The company has reported two new areas of high-grade gold mineralization near the Thor vein, with assays of up to 120.1 grams and 148.1 grams gold per tonne, respectively, from grab samples. Among the better drill results in 2009 was a 27-metre interval grading 7.9 grams gold.

Royal Roads and Benton Resources have discovered magmatic nickel-copper sulphide zones on their Long Range property. The Portage nickel prospect returned up to 2.7% nickel, 0.58% copper and 0.24% cobalt from grab samples. Other bedrock grab samples assayed up to 5.3% copper, 1.13% nickel, 0.04% cobalt and 0.06 gram gold per tonne.

JNR Resources and Altius Resources reported a new copper-molybdenum-gold-silver prospect on their Topsa

ils project. Grab samples from sulphide-bearing boulders yielded assays of up to 3.5% copper, 0.12% molybdenum, 35.1 grams silver per tonne and 0.18 grams gold. JNR and Altius also reported the discovery of rare earth metals and uranium-thorium mineralization at Topsails. Grab samples returned up to 3.11% total rare earth oxides (TREO), 0.5% yttrium, 2.38% zirconium, 0.18% niobium, 0.019% uranium and 0.144% thorium.

Mountain Lake Resources has reported values of up to 32.7 grams gold per tonne and 5.5% antimony from trenches on its recently optioned Little River gold property. An initial 14-hole drill program returned 3 metres of 4.8 grams gold per tonne.

Spruce Ridge Resources has reported a new zone of gold mineralization on its Kramer property with grab samples grading up to 49.8 grams gold per tonne and 111.2 grams silver.

Rare Earth Metals conducted reconnaissance sampling of its little-explored Red Wine property in Labrador. Results include values of up to 4.99% TREO, 0.97% beryllium and 2.35% niobium from the Mann No. 1 zone.

Metals Creek Resources has reported assay results from its recently discovered Betts Cove platinum group elements showing. Channel sampling returned three continuous 1-metre samples averaging 1.6 grams platinum per tonne, 7.46 grams palladium, 0.26 gram gold, 0.94% copper, and 0.66% nickel.

Outlook

There are encouraging signs of a recovery in the province’s mineral industry. Several projects are nearing production, and a new nickel processing facility is under construction. New showings have been reported and new option/joint-venture agreements — often harbingers of increased activity –have been signed. For further information on mining and mineral exploration in Newfoundland and Labrador, please visit our website at www.nr.gov.nl.ca/mines&en/statistics/exp_overview.stm

.

Be the first to comment on "Light At The End Of The Tunnel"