Molycorp (MCP-N) has bought one of only two rare-earth processing facilities in Europe.

The US$89-million investment for a 90% stake in AS Silmet will double Molycorp’s current rare-earth production capacity to 6,000 tonnes from 3,000 tonnes and in one fell swoop, gives it a European base of operations, a larger customer base, and an expanded product line.

Silmet will soon start sourcing rare-earth feed stocks from Molycorp’s Mountain Pass mine in California, and will become the first rare-earth oxide and metal producer in Europe that is not dependent on rare-earth materials from China.

Last year China exported about 30,258 tonnes of rare earths, compared to demand outside of China of about 55,000 tonnes, according to Mark Smith, Molycorp’s president and CEO.

“This gap in supply and demand is expected to worsen in 2011 as independent forecasts predict that full-year 2011 export quotas will total less than 30,000 tonnes, compared to total demand outside of China of about 60,000 tonnes,” Smith said in a press release announcing the company’s 2010 financial results on March 9.

Silmet, which will change its name to Molycorp Silmet, has a manufacturing operation in Estonia. It will focus on producing rare-earth oxides and metals including didymium metal, which is a critical ingredient in neodymium-iron-boron permanent rare-earth magnets.

The acquisition will expand Molycorp’s manufacturing capabilities as Silmet is also one of the world’s biggest producers of pure niobium and tantalum metal. Niobium and tantalum metals are used in electronics, materials manufacture, optics, health care, chemical process equipment, power-generation systems, aerospace and superconductive materials.

The Estonia plant has three factories that conduct rare-earth metals separation, rare metals production, and metallurgical operations and the company produces up to 3,000 tonnes of rare-earth products and 700 tonnes of rare metal products a year for customers in Europe, North and South America, Asia and Russia.

Newsletter writer John Kaiser, who follows the rare-earth sector very closely, describes the deal as a “win-win” in a note. “It enables Molycorp to process its own stockpiles at double the current rate at Mountain Pass to 6,000 tonnes per year and sell the output at the equivalent of US$90/kg total rare earth oxides, it brings the plant to full capacity and keeps the employee brain trust intact, and it gives Molycorp metals refining capacity, a missing link in its ‘mine to magnet’ supply chain.

“While this deal is clearly a plus for Molycorp… it also has positive implications for the overall rare-earth sector by signaling Molycorp’s willingness to use its paper as currency for strategic acquisitions,” he notes. The US$89-million acquisition consists of US$9 million in cash and 1.59 million Molycorp shares priced at $50.21 apiece.

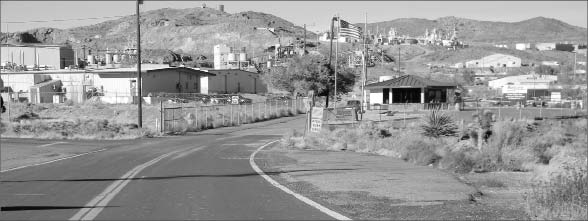

Currently, Molycorp produces about 3,000 tonnes of commercial rare-earth materials each year. When the Colorado-based company completes Phase I of its expansion and modernization project at its Mountain Pass processing facility, it expects to produce at a rate of about 19,050 tonnes of rare earth oxide (REO) equivalent a year.

By late 2013, the company says it anticipates reaching a production capacity of about 40,000 tonnes of REO equivalent a year and plans to provide rare-earth products ranging from high-purity oxides and metals to alloys and permanent magnets.

Anthony Young, a director at Dahlman Rose & Co. in New York, says the acquisition will enable Molycorp to further capture the current elevated rare-earth price environment.

“While sales from Mountain Pass have some price caps in place, we believe that sales from the AS Silmet assets will be completely uncapped,” he writes in a research note to clients. “Rare-earth prices increased by more than 500% in 2010 and several metals prices are up more than 100% year to date.”

Based upon the additional capacity at Silmet, Young increased his 2011 and 2012 earnings per share estimates for Molycorp to US$2.15 and US$6.20 respectively, up from US$1.20 and US$5. He has a 12-month target price on the stock of US$85 per share. At presstime in New York, Molycorp was trading at US$65.24 per share.

In addition to its acquisition of Silmet, Molycorp announced in March that it had signed a cooperative research and development agreement with the U.S. Department of Energy’s Ames Laboratory. Under the agreement, the partners will focus on developing new methods to create commercial-grade rare-earth permanent magnets. One of the goals of the collaboration is to make breakthroughs in rare-earth material manufacture that will advance rare-earth magnet design and make permanent rare-earth magnets with properties comparable to today’s neodymium-iron-boron magnets.

“The material combinations studied will correspond with the relative concentrations of rare-earth elements in Molycorp’s Mountain Pass mine, using techniques that are cost-effective and leave a smaller environmental footprint than current methods,” Molycorp outlined in a release announcing the partnership.

Other recent agreements include a memorandum of understanding Molycorp signed with Sumitomo of Japan in December 2010, under which Molycorp will supply Sumitomo with 1,500 to 1,750 tonnes of cerium and lanthanum-based products and 250 tonnes of didymium oxide a year over five years. The agreement also outlines the purchase by Sumitomo of US$100 million of Molycorp’s stock and a US$30-million long-term loan.

In a separate deal in the same month, Molycorp signed a letter of intent with Japan’s Hitachi (HIT-N) to form joint ventures that will produce neodymium-iron-boron rare-earth alloys and magnets in the United States. The arrangement would give Molycorp access to the technology, people and facilities to convert its rare-earth materials into alloys and high-performance magnets in the U.S. by late 2012.

Molycorp’s sales in 2010 rose 396% to US$35.2 million, compared to US$7.1 million in 2009. Actual and adjusted net losses in 2010 were US$49.1 million and US$17.3 million, or US79¢ and US28¢ per share, respectively.

Be the first to comment on "Molycorp acquires REE processor in Estonia"