Building a nearly 1,200-km-long pipeline is inevitably challenging, but putting one through two provinces and the territory of dozens of First Nations, only to emerge in a contentious port location, makes for a daunting task indeed.

But Enbridge (ENB-T, ENB-N) thinks it’s up to the task with its Northern Gateway pipeline, which could link the Alberta oilsands to the Pacific and the ravenous Asian markets beyond.

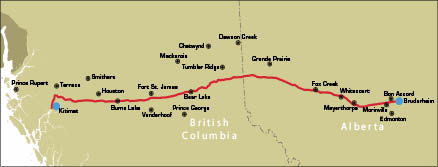

The $5.5-billion project, the biggest in Enbridge’s history, would allow the export of 525,000 barrels of crude a day from Bruderheim, Alta., to the port of Kitimat, B.C., while a smaller parallel pipeline would bring 193,000 barrels of condensate, used to thin the unrefined heavy oil, from the port to Alberta.

The company maintains that there is clear demand for such an export option. Currently the only choice is to export the crude oil to the U.S. Recently Enbridge announced it had already secured commercial agreements with Canadian producers and Asian refiners for the full capacity of the pipeline, long before any federalgovernment project approval.

“This support demonstrates the need for Northern Gateway and is a major step forward for the project,” Janet Holder, Enbridge’s executive vice-president of western access, states of the agreements.

Enbridge has declined to name or say how many companies it made agreements with, as the deals require no financial deposit and no penalties to withdraw.

Alberta producers and Asian refiners have, outside of these arrangements, put up $100 million of the $250 million Enbridge is spending on the project’s initial development costs.

But before shipping any oil westward, Enbridge must secure regulatory approval for the project, which is currently the subject of a federal joint review panel, the most rigorous environmental review possible under the Canadian Environmental Assessment Act.

The process, involving primarily the National Energy Board and the Canadian Environmental Assessment Agency, but also Transport Canada, Fisheries and Oceans, Indian and Northern Affairs and Natural Resources, takes roughly two years and is expected to wrap-up in late 2012.

Public consultations for the process start in January 2012, and already numerous groups, including dozens of First Nations and environmental organizations, have voiced their opposition.

Concerns centre on possible pipeline and tanker leakages, especially within the Great Bear Rainforest area and the rugged and narrow B.C. coastline.

Those opposing the pipeline point to several recent high-profile pipeline leakages in North America, as well as the Queen of the North ferry wreck in 2006 along the proposed shipping route, as examples of the danger the project poses.

Enbridge is working hard to convince the dissenting groups that its pipeline and the shipping channels will be environmentally safe. The company will: ensure only double-walled ships are used to export the oil; install a radar system in the tight channels to ease navigation; have escort tugs to guide the super-tankers; and provide first-response capabilities for emergencies.

Enbridge is also working to convince First Nations of the project’s economic benefits.

The company is promising upwards of a billion dollars in benefits, including a possible 10% equity stake in the project, hiring guarantees and hundreds of millions of dollars in spending on aboriginal businesses.

It’s not yet clear how many native groups favour the project, but some are adamantly opposed to it and even refuse to meet with Enbridge representatives.

With the project running through so many unresolved land claims, disagreements on the project could end up in the Supreme Court, or at least significantly delay the pipeline.

When the Mackenzie Valley pipeline was proposed in the 1970s, a panel ruled that the project should be put on hold for a decade so that land claims there could be resolved.

But for now Enbridge will advance the project as the review process continues, highlighting the hundreds of jobs it will create, the billions in taxes it will pay and the many spin-off benefits a project of this scale brings.

If the company settles the outstanding issues and secures approval through the joint review in late 2012, it could start pumping oil through the pipeline by late 2016.

Enbridge’s share price recently closed at $32.27, just off its 52-week high of $32.74. There are 776.4 million shares outstanding.

Be the first to comment on "Enbridge touts pipeline demand as review continues"