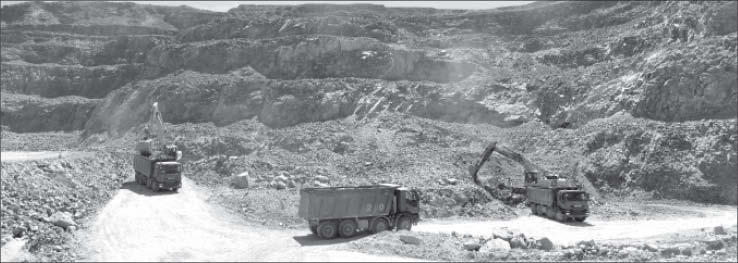

In December 2010 Perth-based Lachlan Star (LSA-T, LSA-A) went from exploring in Australia and Africa, straight into producing gold in the Americas after buying the CMD gold mine in Andacollo, Chile.

The move followed an unsuccessful foray into gold exploration in Zambia and moderate success exploring for copper in Eastern Australia. Since making the acquisition, Lachlan has been working to restructure itself around the 50,000-oz.-per-year heap-leach gold mine, with plans to increase production to 75,000 oz. per year by the end of 2012.

Part of its refocusing involved a Toronto stock listing, which Lachlan completed last October.

Following modest movement in the first few months, Lachlan took off in January after releasing a resource update and climbed from 90¢ in early 2012 to a closing high of $1.50 in late February after it released a second resource update on the CMD mine.

The first resource focused on the Toro deposit, one of several active shallow pits at the mine. The update established 17.5 million indicated tonnes grading 0.6 gram gold per tonne for 348,000 oz. gold, plus 11.6 million inferred tonnes grading 0.4 gram gold for 135,000 oz. gold, for a 314% increase in indicated resources and 28% drop in inferred resources.

The most recent update, which considers the Toro deposit and three others, established a total resource of 130.1 million indicated tonnes grading 0.4 gram gold for 1.72 million oz. gold, plus 114 million inferred tonnes carrying 0.3 gram gold for 1.26 million oz. gold, representing a 138% increase in indicated and 36% increase in inferred resources, compared with the global January resource. Both resource updates dropped the cut-off grade from 0.3 gram gold to 0.15 gram gold as the company plans to incorporate low-grade ores through run-of-mine dump leaching.

Based on 2011 resource numbers, the mine also hosts reserves of 6 million probable tonnes at 0.8 gram gold for 157,000 oz. gold.

The updated resources followed 31,000 metres of drilling in 2011.

The company has a further 33,000 metres of drilling planned for 2012. The company will target drilling in between several pits, as it looks to establish the Toro and Tres Perlas deposits as two super pits that absorb surrounding deposits, while also upgrading established resources to make mine planning easier and conduct step-out drilling.

At some point Lachlan also plans to explore the project’s copper potential. The project sits adjacent to Teck Resources’ (TCK-T, TCK-N) Carmen de Andacollo copper-gold operation, which reached commercial production in late 2010 and is anticipated to produce 80,000 tonnes of copper and 55,000 oz. gold per year. Both mines sit 350 km north of Santiago.

Lachlan’s own production came in at a little over 11,000 oz. gold in the last quarter of 2011, with 67% of production coming from outside of reserves and 57% outside the previously established resource area. The company stated that the current resources better reflect what it is mining and its potential.

On revenue of A$18.7 million in the quarter, the company managed an after-tax net profit of A$1.9 million.

The company had $14.5 million in cash at the end of December, thanks to a $15.1-million financing in late 2011. The raise, related to its Toronto listing, had the company issuing 18.4 million special warrants that can be redeemed at $1.20 until August 2013. Lachlan has $31.9 million in total liabilities, including $9.4 million in debt obligations due to banks and the vendors of the CMD mine.

Lachlan bought the mine for US$24 million, including US$9 million in cash and 1 billion shares at 1.5¢ in December 2010. The deal also required Lachlan to pay 2.5% of the gold value produced from established deposits until the end of 2014, plus 25% of the gold value produced over 119,000 oz. in the same period, which Lachlan reports adds $5 million to the price tag.

Because of the billion-share payment, combined with a financing that included issuing over a billion shares at around the same time, Lachlan had no less than 3.2 billion shares outstanding at the end of 2010. In preparation for its Toronto listing, however, the company instituted a 1-for-60 share rollback in mid-2011, bringing its outstanding shares to 53.6 million and 1.3 million options. Now the company has 75.4 million shares outstanding.

The CMD mine first started production in 1995 and has since produced over 850,000 oz. gold. The company’s filings state that mineralization at the CMD Gold Mine is hosted by the Quebrada Marquesa formation, which comprises a sequence of intermediate and felsic volcanics and volcanogenic sediments as lava flow, pyroclastic and epiclastic units. The dacite units at the mine contain generally bulk tonnage, low-grade mineralization.

The company also still controls the Bushranger copper project in New South Wales, where it finished a scoping study in early 2011. But following its refocusing on CMD the company optioned it off to Newmont Mining (NMC-T, NEM-N) in September, with the major earning in 51% by spending A$1 million within two years.

Be the first to comment on "Lachlan finds its gold star in Chile"