TIMMINS, ONT. — Greg Gibson is all about the big score, even if he has to take small steps to get there.

His most recent lucrative deal was guiding Trelawney Mining and Exploration as it outlined 6.9 million oz. gold at the Côté Lake deposit halfway between Timmins and Sudbury. The project drew interest from a variety of suitors and was eventually sold to Iamgold (IMG-T, IAG-N) a year ago for over $600 million.

And now his latest role has him thinking on an even bigger scale.

Gibson took the reins at Northern Gold Mining (NGM-V) in mid-2012, and his arrival marked what could be a new era for both the company and the eastern flank of the Timmins gold camp.

“Everything in this area is too small for a major, hence the consolidation work we’ve got underway. We’re starting to build mass,” he says. “It’s highly unlikely that a number of projects will get off the ground on their own. Consolidated together, however, with satellite deposits feeding into a central mill, you’d get the capital-expenditure reduction you need to make it work.”

While the scale of consolidation Gibson envisions will take a good deal more work on the mergers-and-acquisitions front, Northern Gold has been doing its part by consolidating as much ground as it can while at the same time driving an exploration program that is worthy of the fertile ground.

Running parallel to its consolidation ambition is the evolving name of its flagship project. Before Gibson arrived, Northern Gold was synonymous with the Garrison project and the big-tonnage, low-grade Garrcon deposit that sits within it.

But now the project has grown in scale, and been redubbed the Golden Bear project to reflect its larger size. Golden Bear encompasses not only Garrison, but also the recent acquisitions of Golden Pike, Buffonta and Harker-Holloway, amongst others.

The project lies in the Abitibi, 100 km east of Timmins and 65 km north of Kirkland Lake — an area whose mineral wealth is well established. Indeed, its rich history has resulted in a number of other companies having staked claims, which has in turn left Northern Gold to assemble a patchwork of properties — taking what it can as they become available.

“We’re tying up ground that is strategic to our overall consolidation plan,” Gibson says. “Each acquisition helps us to get there. We try to get properties that are contiguous with each other when we can, and that allows us to unlock some synergies.”

As Golden Bear is currently configured, the project holds the aforementioned Garrison project and Buffonta, 4 km south, on the other side of ground held by Barrick Gold (ABX-T, ABX-N). Contiguous to Buffonta and to the east is, Harker Holloway, and 25 km west lies Golden Pike, which is surrounded by claims held by Brigus Gold (BRD-T, BRD-X), St Andrew Goldfields (SAS-T) and Lake Shore Gold (LSG-T). All told Northern Gold now has claims that cover more than 216 sq. km.

Gibson was appointed to the board last June, and named president and CEO two months later. His arrival coincided with three equity raises: the first was for $5 million and closed in late July; the second was for $13 million and closed in late August; and the third was a flow-through financing for $10 million that closed last October.

With the balance sheet strengthened, Gibson turned his sights to the surrounding scenery.

“Part of the reason for this consolidation is because it’s the best place in the world to do it,” Gibson says. “We’re extremely positive that more consolidation will happen, but at the end of the day it all comes down to valuations. I can go and make a deal with an individual property owner to pick up ground, but when you’re looking at consolidating, it becomes a matter of valuation and everyone agreeing on a price that allows us to move forward.”

When it comes to doing higher-level negotiations with other mining companies, cash is king. And with that in mind, Gibson’s arrival at Northern Gold also brought a shift in focus to near-term gold production.

Before he took the reins, the large-tonnage, low-grade Garrcon deposit soaked up most of the company’s capital. But developing a deposit of Garrcon’s heft into a cash flow-positive mine would take years and significant outlays of capital. There are also development and operational risks that go with any large-scale, open-pit operation — as seen with the experiences of Detour Gold (DGC-T) with its Detour Lake mine, and Osisko Mining’s (OSK-T) Canadian Malartic mine.

Gibson says that serious advancement of Garrcon will be on hold until companies like Osisko and Detour get their mines humming along, and market sentiment comes back around.

“Big capex projects are scaring the investment community right now,” he says. “That will change at some point, but we won’t do Garr-con until that happens.”

So Garrcon, despite having measured-and-indicated resources totalling 1.27 million oz. gold, with an average grade of roughly 1.03 grams gold per tonne, slides to the back burner. In its place comes the high-grade Jonpol deposit.

Fortunately for the company, it didn’t have to look far, as Jonpol, a historic underground operation, sits a few hundred metres north of Garrcon.

“Jonpol was forgotten,” Gibson explains. “They hit low grade at Garrcon in the heat of the low-grade frenzy and ran with it. But now the market has changed, and I’m more of an underground guy anyway, so we’ll focus on Jonpol.”

(With over 30 years of experience in the mining industry, Gibson has been a mine manager at mines from Australia to B.C., to right here in Timmins.)

Jonpol sits on the Munro fault, which is a west-striking splay off the north side of the Destor-Porcupine fault zone. Mineralization occurs in a shear zone that is tens of metres across in places and is composed of altered mafic volcanic rocks. Gold mineralization is hosted in quartz-carbonate narrow veins in mafic and ultramafic host rocks.

The deposit is made up of four zones that run from west to east: the JD zone, the JP zone, the RP zone and the East zone. The zones line-up along a strike length of 1.7 km.

Back in 1997, Hillsboro Mining took a 50,000-tonne bulk sample of high sulphide ore from the center of the JP zone. The average grade of the sample was 6.7 grams gold and it yielded 9,476 oz. gold. The rock was processed at the Horne, a smelter and mill owned by Xstrata (XTA-L) that is just over an hour’s drive from the property. The Horne remains a possibility for milling ore from a future operation at Jonpol.

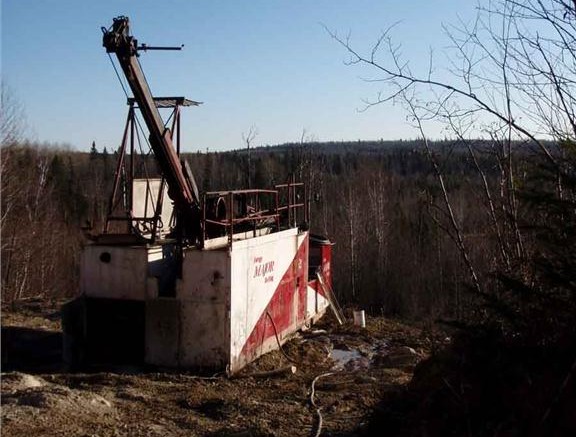

Between 1985 and 2007, over 117,000 metres of diamond drilling in 419 surface holes was drilled by Jonpol Exploration, Cominco, Lac Minerals and Val Gold Resources. Amidst the drilling development work targeted the JP zone, where a 184-metre shaft was sunk and a ramp to the 150-metre level was built with mining on six sub-levels.

Northern Gold used some of the historical drilling to put together a national Instrument 43-101 compliant resource estimate for the deposit that outlines indicated resources of 253,100 tonnes grading 7.77 grams gold for 63,000 oz. gold and inferred resources of 1.56 million tonnes at 4.93 grams gold for 247,000 oz. gold.

While the total ounces pale in comparison to Garrcon, an aggressive drill program and redevelopment plan could change things. Northern Gold expects to have the underground workings at Jonpol dewatered by May and drill-ready for the end of August.

Once underground, the plan is to go down to the 145-metre level of the RP zone and drive eastward towards the East zone, drifting along a vein that has an average width of 1.8 metres. Drilling will also test for continu

ity of mineralization along the western flank of Jonpol, in the area between the JP and JD zones.

Of course, dealing with high-grade, narrow vein zones presents challenges that weren’t as prevalent with Garrcon.

“We think we can develop a nice mine plan, but if you miss it by an inch, you miss it by a mile,” Gibson says of the exploration work ahead. “But if we can join-up these zones, we will turn it into a much more interesting deposit.”

While the area between the RP and East zone is just a few hundred metres, it has never been drilled because of swampy conditions at surface and because the two zones had been controlled by different companies, with Cominco holding the East zone and Hillsboro holding the RP zone.

Gibson says Hillsboro was known to have been more interested in following the vein and taking the easy ounces, so little was done on RP in terms of serious exploration work.

Northern Gold plans to make up for the neglect of the past with 45 holes in the East zone for 12,000 metres, and 10,000 metres for the zone between the East and RP.

The company expects to spend $5 million to dewater and rehab the old mine — an expenditure that has been kept relatively low, thanks in part to a deal struck with Trelawney, now a subsidiary of Iamgold.

Leveraging Gibson’s strong ties with Trelawney, Northern Gold was able to get equipment — including surface and underground electrical distribution systems, ventilation and mine air-heat systems, compressors, generators, long-hole drills, a Jumbo drill, water-treatment equipment, various pieces of mobile equipment, including scoop trams and excavators, and even a Gekko Mill — all for just 6 million shares. The company has 247 million shares issued.

Any development at Jonpol will benefit from the site still having its underground permits from the late 1990s — a contributing factor to Gibson’s belief that Jonpol could be the source of a high-grade operation producing 30,000 to 40,000 oz. gold per year in a relatively quick time-frame, and at a reasonable cost.

Down the road

Due to the junior’s recent spate of acquisitions, the Northern Gold story isn’t just about Jonpol.

One interesting deal, at least in terms of near-term production, was the all-share acquisition of Victory Gold. The transaction netted Northern Gold the Gold Pike property, which is adjacent to Brigus Gold’s Black Fox mine and St Andrew Goldfields’ Hislop mine.

Gold Pike is situated along the Destor-Porcupine fault zone, and recent drilling at the site by Victory returned highlights of 2.02 grams gold over 71.5 metres and 3.35 grams gold over 31.5 metres, while an exploration hole from 2011 returned a dazzling intercept of 65.4 metres grading 7.13 grams gold.

Much of the early exploration work at Golden Pike was carried out by Noranda in the 1980s, and that work was followed up on by Royal Oak Mines taking a bulk sample in the early 1990s that amounted to 100,000 tonnes at 3.4 grams gold.

“It gives us an area of confirmed mineralization with some production from a bulk sample, and that gets us closer to our plan of producing,” Gibson says.

While Gold Pike represents a new venue for growth for Northern Gold, the project still ranks third in priority after Jonpol and another recent acquisition: Buffonta.

Buffonta was one of the first acquisitions overseen by Gibson, as the 15.6 sq. km of ground was acquired in September of last year.

Sitting roughly 4 km southwest of Garrison on the southwest side of a large granodiorite intrusion known as the Garrison Stock. Buffonta hosts three known gold zones: Kerr Pit, Number 5 and Number 6.

At Kerr Pit, mineralization occurs in amphibolite-grade meta-volcanic rocks that form part of the contact-metamorphic aureole around the Garrison stock. Gold occurs in quartz veins and vein breccias around, which are prominent grey-to-brown-coloured pyritic alteration halos.

Visible gold is known to occur within quartz breccia veins and within carbonate veins, while microscopic gold occurs with pyrite within and marginal to the quartz veins.

While a winter diamond-drill program is underway at Buffonta, there has also been historical work, with production of 9,000 oz. gold from 64,000 tonnes milled at the Kerr-Addison mill.

The site comes with a historical resource of 544,000 tonnes averaging 4.8 grams gold per tonnes for roughly 105,000 oz. gold.

Zones 5 and 6 lie southeast of Kerr, and Zone 6 also has an open pit. The pits at Kerr and Zone 6 are only 30 metres deep, but mineralization has been encountered down to 215 metres. Initial drilling will focus on an area beneath the Kerr pit and to the east of the pit towards Zones 5 and 6.

“Both pits were like glory holes,” Gibson says. “They got the best ore and then got out.”

There are also similarities with Côté Lake in terms of the zone’s closeness to the large granodiorite intrusion.

“No one paid attention to granodiorites in the break before. They are good targets,” he says. “Côté Lake was one big granodiorite, and the Garrison Stock is quite prominent.”

Beyond Buffonta’s boundary, to the east, lies another recent acquisition: the Harker-Holloway property. The claims there cover 130 sq. km and contain the prospective Iris gold-tungsten zone. Iris has a historic, non-compliant resource of 1.08 million tonnes grading 2.05 grams gold. The zone also has a 150-metre decline that could reduce costs and speed-up any development.

“It’s a deposit with a small resource because it was explored hand-to-mouth,” Gibson says. “It never had the $10- to 15-million exploration budget, but it is some of the most prospective and least explored ground on the fault.”

The geology at Iris is comprised of variably magnetic tholeiitic basalt. Intercalated with the basalt are locally important siliceous horizons that could be rhyolite. In the deposit area there is an intrusive outcrop that is divided into an early pyroxenitic fraction, and a later, more extensive syenitic phase. All the rocks are cross-cut by north to northeasterly striking shears.

It is no secret that junior miners are finding it harder than ever to raise capital. The fear is that the situation could mean that even projects with abundant potential in low-risk jurisdictions won’t turn into mines due to scarce funds. And if companies continue along in self-contained, isolated spheres, that fear may become a reality.

But collectively, with one central mill, the mineral wealth of not Garrcon, Gold Pike, Jonpol, Buffonta and Iris could be tapped along with Lake Shore Gold’s Fenn-Gib project, and possibly Moneta Porcupine Mines’ (ME-T) Windjammer, 55 zone and Southwest zone.

“You’ve got another Sudbury on your hands if you did it,” Gibson enthuses. “One central mill with trolley lines bringing the ore in. The guys at the other companies want it to happen too. They realize it has to be done.”

Be the first to comment on "Northern Gold’s great expectations"