Mining is an unpredictable business, but it’s still cyclical in nature. In good and bad times, the industry faces new, unique challenges, and nowhere is this more evident than in executive compensation.

The industry is in a period of flux, striving to find the right balance between performance and compensation across countries and subsectors. How should the mining industry reward its top talent? How does it retain the talent? How does it determine success?

These are the questions our management consulting firm, Hay Group, has concentrated its global mining practice on.

Looking back, 2011 was a unique year for mining. According to the HSBC Global Mining Index, from December 2010 to July 2011 the mining industry was performing at levels close to 2007, before the 2008 fall in commodity prices.

The concern for mining companies in the first half of 2011 was how to attract and retain critical executive and non-executive talent using appropriate pay packages.

The scramble for non-executive talent was complicated by a tight pipeline for mining personnel, starting from new graduates to experienced hires.

A year later, the story is more complex, especially for executives.

Hay Group followed up on our investigation into the relationship between CEO pay and company performance among a select group of 27 leading mining organizations.

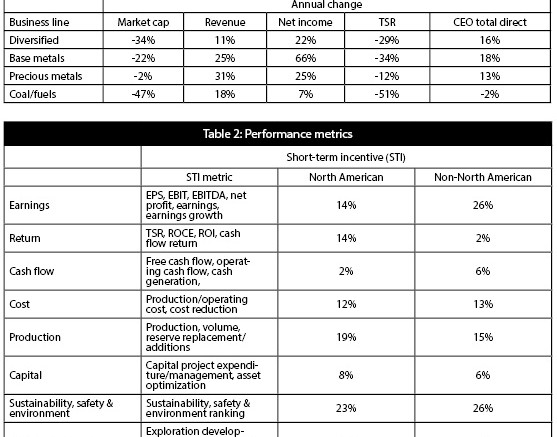

In fiscal 2011, both median market capitalization and total shareholder return (TSR) showed an across-the-board decrease, compared to the previous year (see table 1). This happened despite rising median revenues and overall net income.

There was a clear disconnect between the financial performance within the mining sector and the broader markets’ view of what the sector was worth. Recognizing the increases in revenue and net income, the 2011 median CEO pay package generally grew, albeit at a lower rate.

So what happened to executive pay in 2012? Did the pay packages reflect the change in TSR and market capitalization? Or did pay packages align with sector performance?

Since 2001, Hay Group has conducted an annual global study of executive compensation for the largest producing miners in countries including Australia, Canada, Chile and the U.S.

Our 2012 study consisted of more than 2,000 executives representing more than 400 business units.

Here’s what we learned from the 2012 compensation market:

1. Base salaries saw modest gains. Australian senior management and executive base salary increases (6.4%) continue to lead those in Canada (3.5%) and the U.S. (3.3%). Chile awarded salary increases of 3% (plus inflationary increases).

2. Salary forecasts for 2013 for senior management and executive positions tell a similarly modest story. The forecasts are highest in Australia at 5.75%, compared to Canada and the U.S., which are tied at 3.3%, and Chile at 3%.

3. Within the total pay package for senior management in Canada, mid- and long-term incentive arrangements (i.e., stock options, etc.) represent the largest proportion at 43%, followed by base salary at 41%. By country, this differs for senior management in: Chile, where the total pay package consists of mostly base salary and other guaranteed cash, with annual incentive and mid- to long-term incentives representing a smaller portion; Australia, where pay packages consist of base salary and other guaranteed cash with base salary at 55%, annual incentives at 15% and mid- to long-term incentives at 30%; the U.S., where packages consist of base salary at 48%, annual incentives at 23% and mid to long-term incentives at 29%.

As we examined last year (see “Mining execs’ pay jumps as industry rebounds,” TNM, Feb. 27–March 2/12), mining companies have had to re-evaluate their compensation structures to maintain a fine balance in managing their risk, performance and compensation outcomes.

This year’s research found mining companies making these changes to their incentive programs to ensure that they adhere to pay-for-performance principles by changing short- or long-term incentive metrics. When examining the composition of executive pay packages in the mining sector, we see several trends.

In North America especially, sole reliance on earnings as a short-term performance metric is being replaced by a more balanced approach. For example, sustainability, safety and environment are becoming more prevalent as part of the overall short-term incentives metrics, followed by production and various financial measures.

That said, the weighting of sustainability, safety and environment varies versus production and financial measures from organization to organization.

Generally, North American and non-North American mining companies are tracking similar metrics. Table 2 outlines the current prevalence of performance metrics in the Hay Group survey.

For mid- and long-term performance metrics, total shareholder returns (TSR) remains the most commonly used mid- and long-term metric in North America and outside North America, with 41% of North American and 38% of Non-North American mining companies using this metric.

TSR fell within the mining sector throughout 2012, and corporate performance does not appear to have been as strong. At the same time, turnover at the CEO level has been higher than in previous years. With new CEOs comes a change in the prioritization of the business objectives of most organizations. Hay Group believes the ripple effect of filling executive roles, both externally and internally, will result in movement in executive compensation amounts and structure.

There are no easy answers when it comes to creating executive pay packages. The volatility of the mining sector makes it increasingly difficult to create the perfect pay structure.

For now, we suggest asking the following questions of the organization: Does higher incentive compensation go hand-in-hand with better performance? Should TSR be the sole measure of company performance and the basis for rewarding management performance? Have you achieved a balance between guaranteed and variable pay that you are satisfied with? Is following market trends the appropriate strategy for the organization? Is the company attracting new investors and retaining current shareholders with the compensation philosophy and pay packages that the organization has in place?

Examining the pay structure by considering the questions outlined above will help to increase confidence in a company’s compensation process.

— Based in Toronto, Christopher Chen is national director for executive compensation at Hay Group and a member of the firm’s Executive Reward Global Leadership team. He is a former lawyer and compensation director, and has worked with private and public sector clients across Canada in the areas of corporate governance, compensation strategy, competitive benchmarking and incentive design. He can be reached at christopher.chen@haygroup.com.

Anand Parsan is senior principal in Hay Group’s Executive Compensation practice, based in Toronto. He has practiced as an HR professional for over 15 years locally and internationally, and offers strategic and technical skills based on his many years of consulting and industry experience. Anand is a trusted advisor to board members and management, and is an expert in the design and implementation of corporate governance and compensation programs that support organizational strategy and objectives, as well as shareholders’ interests.

Hay Group is a global management consulting firm with over 2,600 employees working in 84 offices in 48 countries, with clients in every major industry. Visit www.haygroup.com for more information.

Be the first to comment on "Commentary: The cyclicality of global mining executive pay"