Late March saw the Canadian government table its budget, the theme of which proved to be “steady as she goes” — both in the broad sense, and for the mining industry specifically.

One of the juiciest tax breaks mineral explorers active on Canadian soil get, the 15% Mineral Exploration Tax Credit (METC) — a.k.a. “flow-through” shares — was continued for yet another year, to the pleasure of groups such as the Prospectors & Developers Association of Canada (PDAC) and the Association for Mineral Exploration British Columbia (AME BC).

The federal government first introduced the latest version of the tax credit in 2000 for five years and extended it in 2006 for another two years. It has been extended by only one year at a time ever since.

The two groups also applauded the federal government’s continued support of skills training and Aboriginal communities — two critical areas of need, if mines are going to be built in increasingly remote areas of Canada, where Aboriginal communities predominate, and skill sets may be lacking relative to urban areas.

In its role as an industry lobbyist, the PDAC says it’s eager to engage in dialogue with the federal government concerning the fate of the Geo-mapping for Energy and Minerals program, which the PDAC says “provides critical geoscience knowledge necessary for exploration to guide investment decisions, as well as for governments to inform land-use decisions, such as the creation of parks and other protected areas.”

AME BC’s president Gavin Dirom argues that the METC should become permanent, because it would “send a powerful signal to investors that the federal government encourages continued investment in Canada’s mineral-exploration sector, as part of its responsible resource-development strategy. Especially important, the tax credit will enable grassroots exploration programs to continue in the quest of discovering new mineral deposits while contributing to steady, high-paying and skilled jobs in communities throughout the country.”

It’s further downstream, however, that the federal budget starts to bite, with two big surprises: Firstly, the Accelerated Capital Cost Allowance is being eliminated for new mines and mine expansions; and secondly, as of 2018, mine development expenses such as overburden removal and shaft-sinking will no longer be 100% deductible as “Canadian exploration expenses,” but will be treated as “Canadian development expenses,” and be deductible at a rate of only 30%.

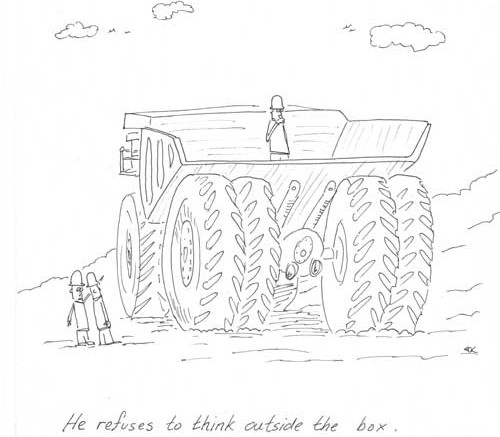

In other words, you may have to forget about trying to issue flow-through shares to fund early stage mine-building activities in Canada, and brace yourself for paying taxes as your mine is being built and before development expenses are recouped.

While lamenting the above changes, the Mining Association of Canada in Ottawa did give its thumbs-up to the government’s moves to address skill shortages. These include establishing a Canada Job Grant; supporting paid internships; reducing barriers in apprenticeship accreditation; reallocating funds to promote education in high-demand fields; funding for Yukon College’s Centre for Northern Innovation in Mining; enhanced Aboriginal training-to-employment programs; a boost in scholarships and bursaries; and a proposal to provide $37 million over two years to support research partnerships with the industry through granting councils.

The Quebec wing of the mining industry didn’t comment on the federal budget, being too busy attending a key government tax forum in Montreal and trying to put out the fire of imminent provincial tax hikes on the mining industry. The Quebec Mineral Exploration Association said it left the meeting “disappointed with the experience” but still “hopeful” it could convince the government to listen to its pleas, while the Quebec Mining Association said that “the hikes are positioned as just penalizing the mining industry, whereas in reality, they put into peril the livelihoods of thousands of families in the province who rely on the industry for employment.”

The Parti Québécois-led minority government’s proposed new tax regime apparently will try to impose a 5% tax on the gross value of annual production and a 30% royalty on “super profits,” reminiscent of the one imposed last year in Australia.

The province is one of the highest-taxed jurisdictions in North America, and the previous Liberal government already raised taxes on profits to 16% from 12% in 2010.

Be the first to comment on "Editorial: Seeing to the flow-through"