VANCOUVER — Shares of Volta Resources (TSE: VTR) doubled on Oct. 28, after the tabling of a friendly, all-share bid from diversified producer B2Gold (TSX: BTO; NYSE-MKT: BTG) values the junior gold explorer at US$63 million.

The companies signed a binding letter of agreement that would see Volta shareholders receive 0.15 B2Gold shares for each share held, which represents a purchase price of 42¢ per Volta share. B2Gold is offering a 106% premium based on Oct. 25 share prices, and an 81% premium based on volume-weighted average share prices over the past 20 trading days.

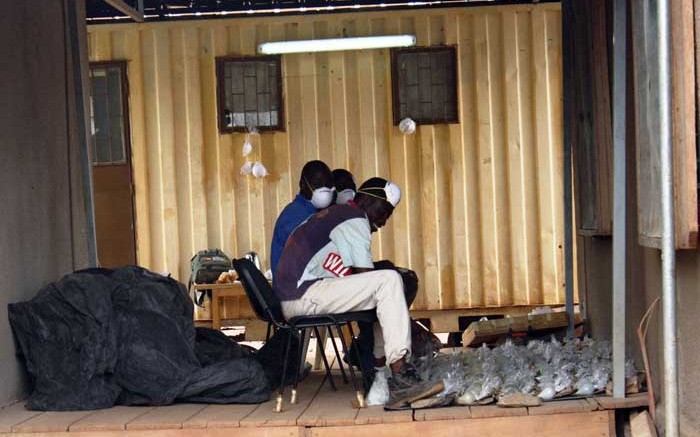

Volta’s portfolio includes nine projects across Burkina Faso and Ghana, with a focus on prospective West African greenstone belts.

The company’s flagship asset is its 81% stake in the Kiaka gold project, which is located 120 km southeast of Ouagadougou, Burkina Faso, and nearing the feasibility stage.

“From our perspective we’ve been interested in the project for a while. Volta has put a lot of work into Kiaka, and we’re attracted because it is a large and credible resource that has a potential to be a significant gold producer,” B2Gold president and CEO Clive Johnson said during a conference call, citing Volta’s exploration success and prefeasibility study (PFS) as attractive attributes.

“This project has a lot of potential, not just in terms of its size, but also in the sense of alternatives in the feasibility study that could improve economics depending on the gold environment,” he added.

Kiaka’s measured and indicated resources total 153 million tonnes grading 0.99 gram gold per tonne for 4.9 million contained oz.

In mid-2012 Volta released its PFS at Kiaka that modelled a US$610-million open-pit mine, which focused on in-pit reserves of 126 million proven and probable tonnes grading 0.96 gram gold for 3.9 million contained oz.

Kiaka would crank out 340,000 oz. gold annually over a 10-year mine life via a carbon-in-pulp leach circuit, and generate a US$548-million pre-tax net present value at an 8% discount rate, along with a 23.3% internal rate of return and a 4.3-year payback. Volta’s PFS assumed a US$1,372 per oz. gold price.

Despite reporting “multiple expressions of interest from a range of banks and project-finance advisory groups” after its PFS, Volta indicated that financial challenges for development-stage gold companies were one of the main catalysts behind its acceptance of deal. Volta’s stock was down 60% year-on-year to 20¢ per share just prior to B2Gold’s offer.

“We did not want to do a cash deal because we fully believe in the project,” said Volta president and CEO Kevin Bullock. “What we are able to provide our shareholders with this deal, in a difficult market, is a premium at the high-end of recent precedents, with an opportunity to play in the upside going forward, while limiting downside of the scenario we would have had with a one-asset development project. We now have several assets globally that are profitable, and it has provided liquidity to our shareholders.”

Volta’s second resource-stage asset in Burkina Faso is its Gaoua copper-gold porphyry project, which covers 558 sq. km near the southern limit of the Boromo greenstone belt. The project’s Gongondy and Dienemera deposits host 282 million inferred tonnes grading 0.32% copper and 0.35 gram gold, which equates to 3.3 billion contained lb. copper equivalent.

B2Gold was searching for an asset to strengthen its development pipeline, as the company closes in on a 2014 production target at its Otjikoto gold project in Namibia. After the transaction B2Gold will have 675 million shares outstanding, with former Volta shareholders holding 3.4% of the combined company.

Volta shot up 20¢ following the news, as 24 million shares of the company traded hands en route to a 40.5¢-per-share close at press time. Volta has 155 million shares outstanding for a $63-million press-time market capitalization, and reported US$6.7 million in cash at the time of the B2Gold offer. Volta traded within a 52-week window of 11¢ to 65¢.

B2Gold jumped 3¢ on 9.2 million shares traded after news of the deal. The company had 651 million shares outstanding at press time for a $1.9-billion market capitalization. Shares have a 52-week trading range of $1.87 to $4.24.

“There’s definitely a lot happening in West Africa. We’ll be continuing to look at various acquisition opportunities. We’ve got Otjikoto in development, and that’s now combined with Kiaka,” Johnson continued. “We want to be cognizant of the fact we aren’t taking on too much, too quickly. Having said that, we’ll be getting to know West Africa better, and looking at other opportunities.

“We’re always looking, but right now I’d say there isn’t anything on the front burner, because we’re going to be focused on this deal and what we have,” he concluded.

B2Gold’s acquisition requires 67% acceptance by Volta shareholders, who have until Jan. 15, 2014, to tender their shares.

Be the first to comment on "B2Gold makes all-share offer for Volta Resources"