VANCOUVER — In its forty-sixth annual mining industry survey, PwC’s Digging Deep: The Mining Industry in British Columbia 2013 reflects a difficult year for the sector across all commodities.

“These are challenging times for B.C.’s mineral exploration, development and mining industry,” the report begins. “Volatile commodity markets, challenging financing conditions and rising energy and labour costs pose a number of hurdles for companies across the province. As a result, the net income and revenues generated by B.C. companies fell for the second straight year in 2013. Mining companies were forced to cut costs and some held back on development to try to maintain healthy balance sheets and sustain cash for long-term growth.”

The annual report attempts to capture the financial results and major trends in the province’s mineral exploration, development, and mining industry. In 2013 a total of 37 projects participated in the survey — 21 operating metal and coal mines, 14 projects in the development stage and two exploration-stage assets — which is a comparable sample set to that surveyed in 2012.

Participants reported gross mining revenues of $8.5 billion, down from $9.2 billion in 2012 and $9.9 billion in 2011, when commodity prices were at or near record highs. The decline, attributed to lower commodity prices, higher costs and some cutbacks in activity, drove net income down to $1.4 billion for the year, compared to $1.8 billion in 2012.

The key commodities in B.C. are coal, copper and gold, and prices for all three declined in 2013. The metallurgical coal price dropped to an average US$160 per tonne in 2013, from US$193 per tonne in 2012. Copper dropped to US$3.32 per lb. in 2013, versus US$3.61 per lb. in 2012, and the gold price declined dramatically to average US$1,411 per oz. in 2013 after averaging US$1,668 per oz. in 2012.

Lower commodity prices meant lower earnings. More generally, the report notes that “investment in the sector remains depressed,” which has made it hard for mining companies to raise money. The financing freeze has been hardest on the sector’s smaller players.

“This funding crisis is particularly pronounced for prospectors and junior mineral-exploration companies,” the report states. “Nearly 60% of the mineral exploration and mining companies listed on the TSX and TSX Venture exchanges, or 945 out of 1,616, are headquartered in B.C.” It adds that “these B.C.-based companies raised about $2.6 billion in 2103, down from about $5.3 billion a year earlier.”

The money that was raised did less for those providing it: return on shareholder investment fell to 13% in 2013, down from 22.8% in 2012 and 46% in 2011.

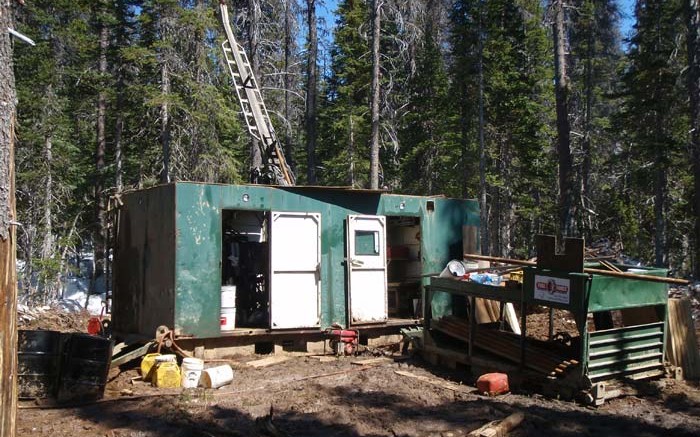

With less money available, it is no surprise that mining and exploration companies also spent less in 2013. Capital expenditures at operating assets fell to $1.8 billion, down from $2.7 billion in 2012 and $2.9 billion in 2011. Exploration fared no better: survey participants spent $185 million on exploration and development in 2013, compared to $294 million in 2012 and $431 million in 2011.

On a positive note for B.C., the province is attracting a greater share of the exploration and development dollars that are being spent. In 2013 B.C. received almost 20% of the exploration spending in Canada, up from just 6% in 2001. However, most of these dollars will go to advanced copper–gold and coal projects, not early stage properties.

Gavin Dirom, president and CEO of the Association for Mineral Exploration British Columbia, summed up the problem this could create.

“This is an important issue because mineral exploration, especially work undertaken by junior companies, is the lifeblood of the mining industry,” Dirom said. “Sustained investment in grassroots or early stage exploration is required to discover deposits that eventually lead to advanced projects, construction and ultimately new mines.”

Two B.C. projects got underway in 2013: the new Mount Milligan copper–gold mine in northwest B.C., and the reopened New Afton copper–gold mine in the south of the province. A third mine, Red Chris, is nearing completion. There are more than 20 major mines and mine expansions seeing environmental assessment and permitting.

PwC also assessed what B.C. could address to increase its mineral-exploration and development appeal. The province has rich resource potential, a highly skilled workforce, offers political stability and a competitive tax regime, and has good access to Asian markets. However, the requirement for projects to pass through overlapping provincial and federal environmental assessments, a persistent backlog in notice of work permit applications, a lack of clarity on land access and rights with respect to First Nations, and rising electricity costs are deterring potential investment in the province.

“Mining has always been a cyclical business,” the report concludes. “The past five years have proven that point. The industry bounced back from one of its worst recessions in history — the 2008–2009 global financial crisis — thanks to soaring commodity prices in 2011. Since then, however, the metals and minerals markets have once again been under pressure.

“While prices are still strong compared to the commodities crash five years ago, they have been depressed,” it continues. “No metals have been spared the drop . . . the result has been a drop in mining company valuations around the world. Investors have since lost confidence in the sector, at least in the short-term, until prices and valuations recover.”

Be the first to comment on "Fewer mining dollars spent and earned in BC"