Alamos Gold (TSX: AGI; NYSE: AGI) has scored a major victory at its Mulatos gold mine operation in Mexico with the acquisition of surface rights for two satellite gold deposits that could add low-cost production growth as early as 2016.

Cerro Pelon and La Yaqui are 3 km and 7 km from the Mulatos mining operation, and the near-surface, highly oxidized deposits are amenable to open-pit heap leaching that should lower the overall cost profile at Mulatos and generate “significant” free cash flow, the company says.

Alamos estimates it will cost US$21 million to build both small mines, each of which will operate with independent crushing circuits and heap-leach pads. Initial production at La Yaqui is expected in 2016, followed by Cerro Pelon in 2017.

The company says its focus over the next 18 to 24 months will be on permitting and development. Environmental impact assessments are required for both deposits, and Alamos believes it can get approvals within 15 months. Once the permits are received, construction could take eight months at La Yaqui and 10 months at Cerro Pelon.

Ore from Cerro Pelon would be mined and stacked at a throughput rate of 2,200 tonnes per day over a four-year mine life, based on current reserves. La Yaqui would be mined and stacked at a rate of 1,500 tonnes per day over a three-year mine life based on current reserves.

Initial metallurgical work shows recoveries that are above 80%, but the company says it is budgeting for a 75% rate over the combined mine life.

The company will use contract mining and describes the two deposits as “technically simple” and “economically robust.”

Management forecasts that average production from both deposits combined will be 33,000 oz. gold a year over a five-year mine life, with peak annual production of nearly 50,000 oz. gold. Both reserve pits are based on a US$800 per oz. gold price.

Mulatos could produce 150,000 to 170,000 oz. gold this year, and Alamos estimates that Cerro Pelon and La Yaqui will drive production at Mulatos back to 200,000 oz. a year and “sharply” lower operating costs.

With their combined reserve grade of 1.6 grams gold per tonne — nearly double the 2014 budget of 0.85 gram gold per tonne — Cerro Pelon and La Yaqui could lower the cost profile at Mulatos. Indeed, Alamos says the average life-of-mine cash costs, including royalties at Cerro Pelon and La Yaqui, could be below US$500 per oz.

The company says there is “significant exploration potential” at Cerro Pelon, which has seen little exploration so far, and its is planning an initial 12,000-metre drill program there this year and next.

Alamos has identified four breccia zones: North, South, West and Cliff. The North and South zones have strong silica alteration and contain most of the mineralization that has been defined to date, but mineralization appears to be open to the southeast and southwest, and drilling this year will target a possible 200-metre strike extension to the south, the company says.

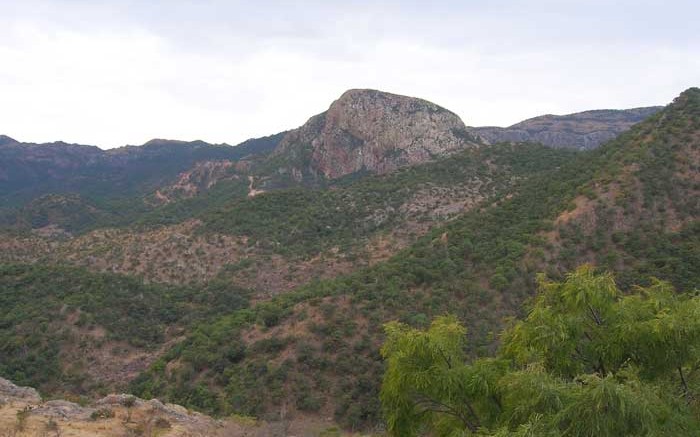

Alamos acquired the Mulatos project for $10 million in February 2003. The first gold pour followed in 2005 with commercial production in April 2006. The mine lies in the Sierra Madre Occidental mountain range in Sonora state, 300 km south of Mexico’s border with the U.S.

Elsewhere in Mexico, Alamos is permitting its open-pit, heap-leachable Esperanza project in the state of Morelos, 110 km south of Mexico City and 70 km north of the country’s Guerrero gold belt. Alamos acquired 100% of the project as part of its August 2013 acquisition of Esperanza Resources.

Outside of Mexico, Alamos has exploration and development activities in Turkey and the U.S.

Alamos has a strong balance sheet, with no debt and US$400 million in cash and equivalents.

Over the last year the company has traded in a range of $8.82 to $17.86 per share. At press time Alamos was trading at $9.18 per share.

Brian Quast of BMO Capital Markets has a $13.75 target price on the stock and Josh Wolfson and Jon French of Dundee Capital Markets have a $12.50 target price.

Be the first to comment on "Alamos adding Cerro Pelon and La Yaqui to the mix"