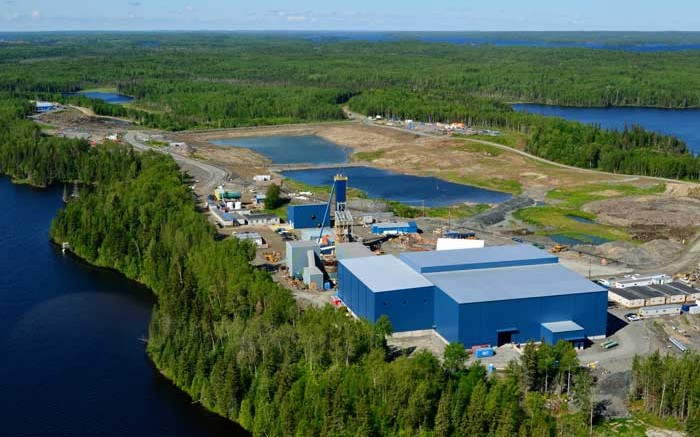

Thanks to two financing deals that came through early this year, developer Rubicon Minerals (TSX: RMX; NYSE-MKT: RBY) now says mine construction is half complete at its Phoenix gold project in Ontario’s Red Lake camp, and the project remains on track for a first gold pour in a year’s time.

“The project is tracking to schedule and budget compared to the targets we had set earlier this year,” president and CEO Michael Lalonde said in a release. “We will continue to closely monitor our activities and associated capital costs as the project progresses toward the projected operating phase in mid-2015.”

The company’s shares strengthened on the news, which prompted Joe Mazumdar, a mining analyst at Canaccord Genuity, to raise his target for Rubicon to $1.80 from $1.60. He rates the company as a “speculative buy.”

Rubicon completed two financing deals in February: a US$75-million streaming deal with Royal Gold (TSX: RGL; NASDAQ: RGLD), followed by a $115-million bought-deal financing.

Rubicon now has $180

million in cash and equivalents, and estimates it has $167.5 million in pre-production capital (including a 20% contingency) left to spend to bring its high-grade underground gold project to production. It will also need $30–40 million for corporate costs and working capital.

Rubicon is expecting to receive another US$45 million from the Royal Gold financing over the next several quarters. The streaming deal entitles Royal Gold to buy 6.3% of Phoenix production up to 135,000 oz. at 25% of the spot price, and thereafter, 3.15% of production at the same price.

In addition, Rubicon recently secured a lease covering $15-million worth of underground equipment over the next two years. The lease terms are 4.5% over a five-year term, with a 10% down payment.

Up to the end of May, the company has spent $205.2 million on capital costs at Phoenix since October 2011.

Over the next year, it plans to invest another $71.5 million into building the mill, $42 million in underground development, $31.7 million in on-site construction costs and $22.3 million in indirects and definition drilling costs at Phoenix.

Construction is more than half complete, with the company having completed a 730-metre-deep shaft in December, as well as the mill building.

After deferring some aspects of mill construction for several months to conserve cash, the company restarted construction on April 1. Civil, process and electrical engineering for the mill is now over 80% complete, and an elution plant (which extracts gold from the carbon in the leaching process) is nearly finished.

The tailings management facility is almost done, and the effluent water-treatment system has been fully commissioned.

Eleven percent of underground development above the 685-metre level — or 875 metres of a planned 8,000 metres — have been completed. A ventilation raise from the 305-metre level to surface is expected soon.

The work is being carried out by contractors, but the company is hiring staff and procuring equipment that will allow it to bring the work in house, which could lower costs.

Once in production, Phoenix is expected to produce 165,300 oz. gold a year for 13 years, based on an indicated resource of 4.1 million tonnes grading 8.52 grams gold per tonne and inferred resources of 7.5 million tonnes grading 9.26 grams gold. A preliminary economic assessment in 2013 pegged the project’s net present value at $531 million and its internal rate of return at 27%, based on a US$1,385 gold price and 5% discount rate.

Rubicon is in the midst of a 38,000-metre infill drilling program aimed at upgrading inferred resources to indicated with tighter, 25-metre spacing.

To better define resource boundaries and for stope-planning purposes, many of the infill holes will be aimed at the extremities of the deposit, or in areas believed to be outside the resource.

In May Rubicon completed 39 holes for a total of 7,050 metres, mainly from surface. The company says the results confirmed continuous mineralization in areas where it had been expected. Highlights from June include 6.8 metres grading 14.19 grams gold per tonne from 143 metres depth in hole 2014-07 and 8 metres of 10.52 grams gold starting at 106 metres in hole 2014-08.

Drilling from underground started in early May. The company has completed 13 of 18 planned drill stations along the exploration drift at the 244-metre level and has two drill rigs at work there.

After wrapping up the infill-drilling program, Rubicon will start definition drilling at 12.5-metre spacing within resource blocks so that it can better define the grade and geometry of individual stopes.

Canaccord Genuity’s Mazumdar says definition drilling could expand the resource, as the deposit’s diluted head grade, at 8.1 grams gold per tonne, is less than half the average grade of gold operations at the Red Lake district.

He noted that engineering studies are under way on reducing the area of the crown pillar that will sit above the deposit, which is located under a lake.

The company could produce another 267,000 oz. gold at a grade of 10.29 grams per tonne (undiluted) if it contours the crown pillar to the lake bottom and reduces its thickness to 45 metres, from 53 metres.

While all is well on the financial and development fronts, Rubicon is still facing opposition by the Wabauskang First Nation, a 300-member community located 100 km south of Red Lake. Wabauskang has applied for a judicial review of the mine’s production closure plan, questioning the Ontario government’s authority to approve it.

The application was heard by the Ontario Divisional Court in April, but no timeline was provided for a decision.

Rubicon says the application is without merit, and has not affected development activities at Phoenix.

On the mine-development news, Rubicon shares rose 11¢ to $1.53, on 2.7 million shares traded. It has 363.5 million shares outstanding.

This mine has the potential to be the next Gold Corp!