VANCOUVER — The South Carolina Department of Health and Environment Control (SCDHEC) has received a request for review of the mine operating permit for Romarco Minerals’ (TSX: R) proposed Haile gold mine. The review filed by the Sierra Club targets the reclamation plans for the mine in Lancaster County, South Carolina.

Romarco is a Toronto-based gold mine developer with projects across the U.S. The Haile gold mine project is wholly owned, and the company’s focus. In November Romarco announced it would invest US$353 million to move Haile into construction and development.

The Sierra Club, a non-profit environmental organization, submitted the request for review citing inadequate reclamation bonds. The mine-operating permit is the last one needed by Romarco to start work at Haile early next year.

The request was filed on Nov. 19 — one day before the state mining permit took effect. As a result Romarco could face months of delays at Haile if all avenues of appeal are pursued by the Sierra Club. In the review and appeal process, the SCDHEC board has 60 days to hold a review or decline the request.

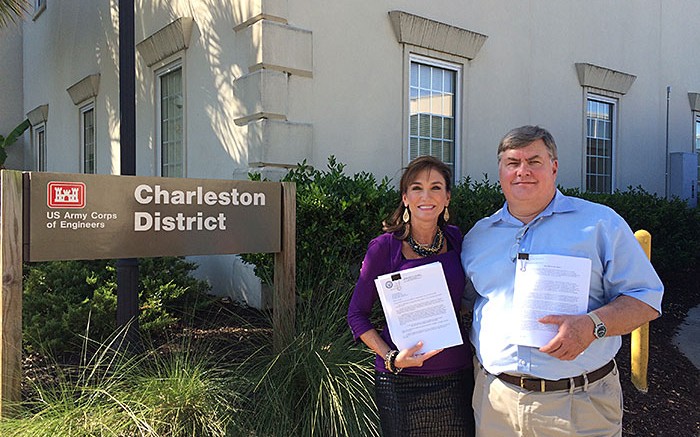

In a conference call Romarco president and CEO Diane Garrett called the request for review “disheartening and disappointing.” Romarco says there is no technical merit for the review, and will defend its position.

The reclamation bond for the site has been set at US$60 million. On the conference call Garrett made it clear that the financing and the plan for cleanup had been laid out and finalized in the environmental impact statement (EIS).

The EIS was signed and approved by regulatory agencies, including three of the state’s major environmental groups and the South Carolina Department of Natural Resources.

Romarco says the size of the reclamation bond is adequate. Garrett adds that “there is no foundation to say that $60 million is not sufficient for a project of this size.” The Sierra Club is concerned that the amount posted cannot cover all cleanup costs, and says it wants to guarantee the protection of the environment after the mine is closed.

The Haile deposit is part of the Carolina slate belt that trends from Georgia to Virginia and hosts gold deposits across the five states. Haile has a measured and indicated resource of 71.2 million tonnes at 1.77 grams gold per tonne for 4 million oz. gold, with an inferred resource of 20.1 million tonnes at 1.24 grams gold for 800,000 oz. gold.

Haile has proven and probable gold reserve of 30.5 million tonnes at 2.06 grams gold per tonne for 2 million oz. gold.

Romarco has plans for open-pit mining at Haile. In the pre-production phase, Romarco aims to process 7,000 tonnes per day and ramp up to 60,500 tonnes per day after the first year.

While the request for review could delay the construction timeline at Haile, BMO Nesbitt Burns analyst Andrew Kaip sees it as an opportunity for Romarco to wait for better market conditions before securing project financing.

In the meantime, Romarco will conserve cash. The company’s balance sits at US$18 million.

After announcing the review Romarco shares fell 6.7% to 62.5¢. Shares have traded within a 52-week window of 35¢ to 99¢. Romarco has 660.5 million shares outstanding for a $410-million market capitalization.

Be the first to comment on "Permit review hinders Romarco at Haile"