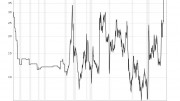

One of the more sobering aspects of the New Year for miners was the rather swift tumble in copper prices, which blew through the long-standing US$3 per lb. support level to hit 6-year lows below US$2.50 per lb., with the spot price having barely recovered to US$2.53 per lb. at presstime.

Looking through the coverage of the copper markets in 2014, there were plenty of warnings about the copper market heading into oversupply in late 2014 and 2015, and yet copper’s fall still seemed to catch mining people off guard.

Perhaps this is due to the deep-seated feeling that the global copper mining industry has truly hit its historic peak output levels, especially as world-leading Chile sees its enormous, aging open pit mines reach their maximum depths amid falling grades and water scarcity.

The broad consensus is that the current downturn in copper prices is due to a double whammy of a soaring U.S. dollar and a slowing Chinese economy, particularly in copper-hungry construction. China’s slowdown immediately translated into projections of slower growth worldwide, with the World bank lowering its 2015 forecast for global gross domestic product to 3.0% from 3.4%.

However, for copper miners, there are the two large mitigating factors of the falling currencies of resource exporting economies plus the halving in oil prices, which should cushion the fall in copper prices for those mining copper outside the U.S. and, especially those with open pit operations.

Most copper analysts see continued softness in copper prices for the rest of the year and maybe into 2016. Beyond that, most are bullish that copper has some of the best supply and demand fundamentals in the longer term, as we get through this rough patch and the “peak copper” scenario looms large again.

• If you take a look at the front page of this week’s issue, you’ll see the “odometer” turning over to “Vol. 101, Issue 1”. Yes, this is our 100th anniversary issue!

While we will be publishing a large 100th anniversary commemorative issue later in the year, we would like to thank our many readers, contributors and advertisers from across Canada and around the world for their unwavering support, in good times and bad in what we all know is a sometimes merciless, oftentimes bounteous, cyclical industry.

This weekly newspaper was born in the rough Cobalt silver camps of northern Ontario during the first eight months of the Great War — back when people thought it would be a quick victory and troops would be home before long.

Right from the beginning, the paper was built on the notion that a good trade journal should also report the bad news, and not just be an industry cheerleader, as was the style of the times.

The two original founders, Ben Hughes and Ernest Hand, soon passed the ownership to various members of two generations of Pearce family members, who ran it as a family business and gradually built up the printing assets right up until 1989, when Southam took over. Ownership later passed to Hollinger International, and in more recent times to Vancouver’s Glacier Media.

Over those many decades, the newspaper reflected the changing face of Canadian mining, moving from Cobalt to downtown Toronto in 1929, and gradually increasing the scope of its coverage from Ontario to across Canada and, now, the world.

We were there as the Sudbury basin was built into today’s nickel colossus, as Western Canada was opened up to resource extraction, as the diamond rush gripped the Northwest Territories, and as Canadian miners fanned out across the globe at the end of the Cold War.

With your continued support, here’s to many more fruitful years ahead for the ‘Miner as we stand by our 100-yeaer-old promise to be “On the Level” and report on the endlessly fascinating stories of the world’s miners and mineral explorers.

Be the first to comment on "Editorial: Where to next for copper?"