VANCOUVER — Fission Uranium (TSX: FCU; US-OTC: FCUUF) is back in the discovery business at the Patterson Lake South (PLS) uranium project just south of Saskatchewan’s Athabasca basin, after a year filled with uncertainty.

Tough market conditions raised questions about how long the company could hold onto the asset on its own, which led to a failed merger attempt with Lukas Lundin’s Denison Mines (TSX: DML; NYSE-MKT: DNN) and a half-hearted attempt at a proxy fight by a small group of retail shareholders.

This uncertainty subsided early in 2016, however, when Fission scored a white-knight investment from China’s CGN Mining.

The deal was announced and closed within two weeks, and involved a strategic investment by CGN, wherein it subscribed for nearly 97 million Fission shares at a healthy premium of 85¢ per share. Chairman and CEO Dev Randhawa says the financing closed quickly because the Chinese company had done due diligence on PLS for “around two years.” CGN now holds a 19.9% equity stake in the company.

The influx of cash — to the tune of $82 million — helps Fission get back to what it does best: exploration. The company is in the midst of a 12,000-metre drill program at PLS this year, with 60% of this total dedicated to expanding its Triple R resource. The rest is earmarked for property-wide exploration.

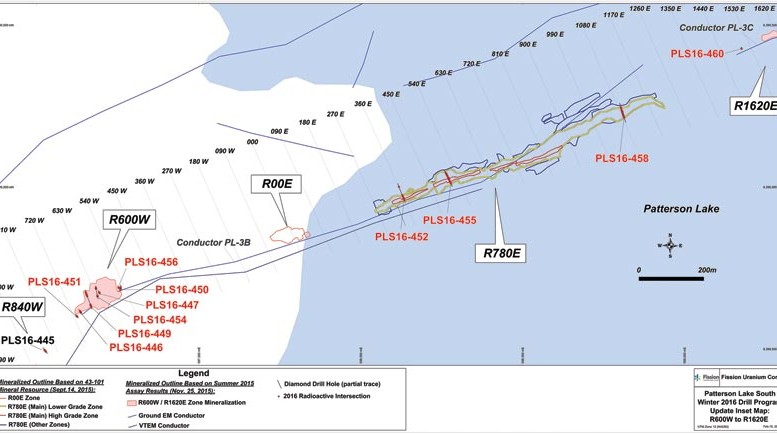

President and chief geologist Ross McElroy describes the drill initiative as “largely a book-end” program for hitting targets east and west of the main Triple R deposit, which comprises Fission’s R780E and R00E zones. To the west, the company will test the promising R600W zone, while to the east drilling will focus on the emerging R1620E zone.

“CGN has a lot of geological and engineering strengths. They have developed projects, and obviously have a goal in mind in terms of PLS,” McElroy said during an interview.

“They definitely see the path the project will take, and how it will eventually be a producing mine. Our emphasis this year will be on building what we know in terms of the Triple R deposit and moving towards higher-level engineering studies. But CGN is aware of the exploration potential on the wider property package, and so we’ve also gained a partner interested in seeing us test new targets,” he added.

Triple R’s indicated resource is 2.3 million tonnes grading 1.6% uranium oxide (U3O8) for 80 million contained lb., including a high-grade zone of 44.3 million lb., based on 110,000 tonnes at 18.2% U3O8.

Fission released a preliminary economic assessment on the project in late 2015 that models a $1.1-billion mine that would average 7.2 million lb. U3O8 production over a 14-year mine life.

Uranium mineralization at PLS is hosted mostly within metasedimentary basement lithologies and, to a much lesser extent, within overlying sandstone thought to be Devonian in age.

The company’s goal this year is to include the R600W zone and maybe the R1620E zone in an updated resource calculation.

The results from Fission’s 2016 drilling have started on a positive note. On Feb. 1 the company reported its first “wildcat” hole had intersected a 42-metre wide mineralized zone, 135 metres west of R600W.

A week later Fission said its is adding 1,200 metres of drilling to the discovery, which it calls the “R840W” zone.

“We really want to test R600W in terms of strike and width. We’ve put 20 holes into it since making the discovery this past winter, and the grade and width are on par with Triple R,” McElroy said. “We still haven’t established the full size, so this year we hope to expand. Funny enough it’s come full circle to a degree, because the area around the conductor at R840W is where the exploration at PLS started back in 2012.”

Fission said on Feb. 16 it has another high-grade discovery at R1620E, where hole 16-460 cut 55.5 metres of total composite mineralization over 82.5 metres. The preliminary results indicate the strongest mineralization yet encountered east of the main Triple R area.

“Again we’re looking at something that’s shallow, and that’s really characteristic of the emerging PLS trend,” McElroy continued. “It’s a reminder we’re dealing with a unique project that doesn’t compare to anything else discovered in the Athabasca. We’re really excited about the prospect of some high-grade growth in our resource numbers.”

Fission has traded within a 52-week range of 53¢ to $1.38, and last traded at 65¢ per share. The company has 484 million shares outstanding for a $319.4-million market capitalization.

Be the first to comment on "Fission heats up PLS with twin ‘book-end’ discoveries"