IQALUIT —There don’t seem to be many places at Peregrine Diamonds’ (PGD-T) 49%-owned Chidliak project, on Baffin Island, 120 km northeast of Iqaluit, that are sheltered from the arctic wind, even in early August.

As we tour the Discovery camp, moving from the heated office tent to the heated medic’s tent, then again as we make our way to one of the three A-Star helicopters that ferry people, equipment and supplies around the 9,800-sq.-km project, the overcast sky, damp conditions and strong winds have the visitors — if not the hardier management types — donning toques and borrowed gloves.

But not long after our flight begins, the helicopter touches down in a slight depression of the exposed, rocky terrain about

56 km north of the camp, and we find a protected spot that also demonstrates just how quickly things move at Chidliak.

Located in that depression is the CH-28 kimberlite, and it’s about as fresh a find a visitor to this fast-developing project could hope to see. A few days ago, the kimberlite was just one of hundreds of geophysical anomalies on the project — until a prospecting team following up on a magnetic high discovered kimberlite boulders up to several metres in size, as well as smaller cobbles scattered around one section of a 160-metre-diameter crater. Both were brimming with limestone xenoliths and coarse-grained indicator minerals.

The discovery rate at the Childliak project, a joint venture with 51%-owner and diversified miner BHP Billiton (BHP-N, BLT-L), has been nothing short of phenomenal.

Peregrine, the operator of the project, started the field season in March with 16 kimberlite discoveries under its belt. By the end of the program in September, the company had racked up 34 new finds for a grand total of 50.

“We knew we were going to make a lot of discoveries,” said Brooke Clements, the company’s president, in late September. “But (this year’s program) definitely exceeded our expectations.”

Part of the discovery rate, which averaged a new kimberlite every two and a half days during the summer, can be attributed to the near-surface, land-based location of many of the kimberlites at Chidliak.

“We’ve had as many discoveries prospecting as by drilling,” said Peter Holmes, Peregrine’s vice-president exploration, during the tour of Chidliak. “In general, these things are outcropping (or under very shallow soil cover).”

At the time, with a total of 32 kimberlite discoveries at the project, Holmes, a De Beers alumnus who spent 17 years with the diamond company, said he was confident that number would reach 40 by the end of the season.

A month later, the final tally seemed to both please and stun him.

“Going from 40 to 50 is a quantum leap,” Holmes told Diamonds in Canada at a conference in September.

He added: “I’m not familiar with too many projects where you’re finding 34 kimberlites on a single project in one field season.”

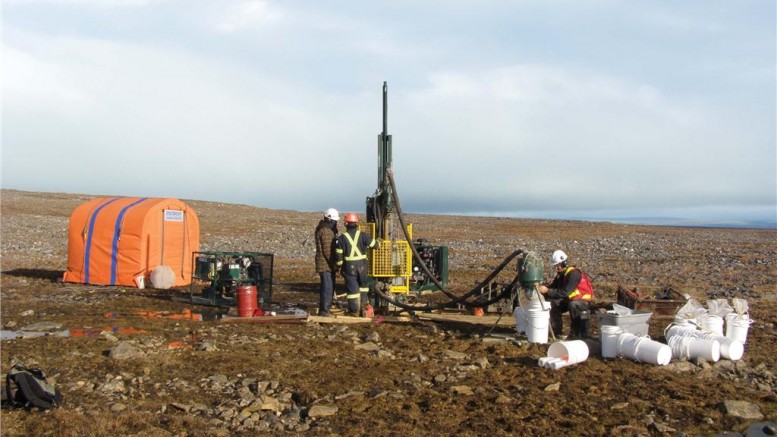

Another element of this year’s successful $15.3-million exploration program was the addition of a reverse-circulation drill to the two diamond-drill rigs on the island. The more nimble and mobile RC drill — which tested up to four anomalies in one day and can be moved in about an hour by helicopter in eight loads — was introduced in August. Holmes says the efficiency of the drill really kicked in near the end of the program, when it made four quick discoveries in 10 days.

Not only are there plenty of kimberlites to be found within the growing Chidliak diamond district, which now spans about 70 km north-south and 40 km east-west — but they are also showing other promising attributes.

About a quarter of the kimberlites at the project look “interesting,” Holmes says — which means that they’re bursting with coarse-grained indicator minerals and mantle xenoliths. And while a handful of the kimberlites are likely dykes (up to seven), the vast majority so far look like pipes.

“The important thing is we’re also finding the diamonds and now we’re starting to find kimberlites that have decent size,” Clements says. “Hopefully, all that stuff will come together and we come out with the right combination of everything.”

CH-17/CH-28 cluster

CH-28 isn’t just an example of the many prospecting finds at Chidliak. The two-hectare kimberlite is also the fourth of 17 so far tested at the project to demonstrate economic potential, joining CH-6, CH-7 and CH-1 as promising targets that warrant follow-up testing with larger samples.

As presstime, results were pending for 33 of this year’s discoveries.

Results from a 239-kg microdiamond sample from CH-28 were released in September. The sample, processed by caustic fusion, shows a coarse diamond size distribution and returned 174 diamonds larger than the 0.106-mm sieve size. Five stones are larger than the 0.85-mm mesh, weighing a total of 0.196 carat. Three of the five are off-white, one grey and one yellow, and the largest is a 0.11-carat, off-white, transparent tetrahexahedroid.

CH-28, along with the nearby CH-17 (the first find of the season) has also opened up a new area of the project. The two represent a new kimberlite cluster at the north end of the vast project, about 35 km north of CH-6. Next year, Peregrine plans to open up a third camp nearby to better investigate the potential of the area. (A second camp, Sunrise, was built 12 km west of the Discovery camp in 2009.)

A discovery by drilling, the CH-17 find was made in early May. However, drilling conditions at the kimberlite, which is located under a lake, proved problematic, and only 3 metres of core were recovered.

Holmes says that heavy snow and slush on the ice forced Peregrine to terminate drilling early for safety reasons, but the small sample the company was able to recover still holds promise.

“Based on what we’ve seen in the prospecting grains, we’ve got very good mineral chemistry for that area, so we’re very encouraged,” Holmes says. “And even though we only had a 3-metre interval (at CH-17), it’s still a very interesting kimberlite.”

The sample is described as macrocrystic olivine-rich kimberlite containing country rock and mantle xenoliths, and abundant indicator minerals — including pyrope garnet grains of up to 30 mm and chrome diopside grains of up to 15 mm.

CH-6 and CH-7 mini-bulk samples

Outside of the new area opening up at the north end of Chidliak, Peregrine is especially encouraged by CH-31, the largest kimberlite found so far, about 4 km southeast of CH-7. Based on geophysics, drilling and the distribution of kimberlite float, CH-31 is estimated at five hectares at surface. The company says the kimberlite is associated with a strong electromagnetic anomaly with an associated subtle magnetic low anomaly, and plans to use the geophysical model generated from CH-31 to select other large kimberlite targets for surveying and drilling next year. Core drilling at CH-31 returned a 410-metre intersection of kimberlite (true width 290 metres); microdiamond testing is under way. CH-31 has at least two phases and is described as volcaniclastic kimberlite with carbonate xenoliths.

While the September microdiamond results from CH-28 were positive, they didn’t budge Peregrine’s stock from the $2.40-range. What the market is really waiting for are results of two mini-bulk samples the company took this summer: A 50-tonne sample from CH-7 by surface excavation and a 14-tonne sample from CH-6 by core drilling. The samples, which are being processed by dense media separation, followed by X-ray sorting, should yield initial parcels of commercial-size diamonds and give a rough idea of the grade in the phases of kimberlite tested. At presstime, those results were expected in November, with the CH-7 material to be processed and released first.

The sample from CH-6, which is covered by about 15 metres of overburden, recovered kimberlite from at least two phases. Eight core holes were drilled into the kimberlite, and intersected a volcaniclastic phase that extends to a vertical depth of 140 metres with a coarse-grained macrocrystic unit (probably magmatic), underlying it. The kimberlite is open to the south. Peregrine says that both phases of CH-6 contain abundant coarse-grained indicator minerals and mantle xenoliths, including eclogite, harzburgite and garnet lherzolites, of up to 23 cm. The core holes, which were mostly drilled vertically, returned kimberlite intervals of up to 303 metres.

Hopes are especially high for CH-6, which returned microdiamond results last fall that wowed the market. A 569-kg sample from CH-6 returned a total of 4,737 diamonds larger than the 0.075-mm sieve size. The sample was taken from three phases of the kimberlite and returned a total of 109 commercial-size diamonds (larger than the 0.85-mm sieve size) weighing 4.58 carats.

As for CH-7, last October, the company reported a coarse diamond size distribution in a 221-kg sample of the kimberlite. The sample yielded 664 diamonds larger than the 0.075-mm sieve size and 11 larger than 0.6 mm, with one stone weighing 0.64 carat.

In addition to the 50-tonne mini-bulk sample taken from CH-7 this summer, the company attempted to assess its size potential, drilling six core holes and two RC holes. Holes drilled across the body returned horizontal true widths of 88 and 95 metres; the company says the pipe contains both magmatic and volcaniclastic phases.

Other work

While mini-bulk sample results released from one phase of

CH-1 earlier this year were disappointing, Peregrine still believes in the potential of the complex kimberlite. The 49.6-tonne sample taken from the outcropping CH-1A phase returned 214 commercial-sized diamonds weighing 20.26 carats, indicating a grade of 0.41 carat per tonne. However, that may not be representative of the kimberlite as a whole, which has at least four phases. In an effort to get a better handle on CH-1, this year Peregrine took vertical RC drill samples from three separate magnetic high anomalies at CH-1, interpreted to represent three distinct lobes. Kimberlite was intersected in all three holes under less than 2 metres of overburden.

The exploration season at Chidliak wrapped up in September after about six months of field work, starting in mid-March (last year’s field season was about four months). In addition to the mini-bulk samples, Peregrine completed 7,672 metres of core drilling in 48 holes, and 1,442 metres of RC drilling in 50 holes. The RC drilling was conducted in the last 35 days of the program. The company also conducted 20,587 line-km of airborne geophysics, 1,800 line-km of ground geophysical surveys over about 100 geophysical anomalies, prospected 112 anomalies, and took 404 kimberlite indicator mineral (KIM) samples. It also continued with the second year of work on an environmental baseline study.

2011 and beyond

With next year’s program already in mind, in October, Peregrine announced it was raising up to $10 million in a private placement. Priced at $2.50 per unit, with each unit consisting of one common share and half a warrant, the financing was expected to close at the end of October. Peregrine said the money would go toward exploration at its projects and general working capital purposes. Pre-financing in mid-October, the company had 87.8 million shares outstanding and traded at $2.26 apiece.

The 2011 exploration program won’t be finalized until the beginning of the year, Clements says, but it will have the same dual focus as this year: discovering more kimberlites and advancing known kimberlites with promise.

“It’s going to be a similar formula — a lot of drilling, a lot of prospecting, a lot of geophysics, and take it from there,” he says.

If the CH-6 and CH-7 results are positive enough, Clements says the company would start to think about a full-fledged bulk sample — something that would require much expense (likely tens of millions of dollars for an onsite dense media separation test plant and a larger camp), as well as reams of logistical planning.

“We probably wouldn’t start it next year, but we could be in a position to commit to doing it next year,” he says. “Before you embark on a program like that, you want to make sure you understand the critical mass of your project and that you start on the best kimberlites and things like that.”

Tied to the results from CH-6 are exploration plans for the “String of Pearls” area, which consists of four magnetic anomalies aligned along a 600-metre trend in a north-northwest direction from CH-6 (CH-6, CH-10 and CH-20 are three of the anomalies). Peregrine sees potential in the String of Pearls to add tonnage to bulk up CH-6, so further exploration will depend on the mini-bulk-sample results. CH-10 did not see any exploration this year, while CH-20 was discovered this year.

While Chidliak is still a relatively early stage project, Clements and his colleagues are clearly thinking beyond 2011. On the roughly half-hour flight up to the project from the bustling Iqaluit airport on a Twin Otter plane, he points to the mostly dry, relatively even ground conditions below. A 120-km overland road from Iqaluit to the project would not be difficult to build here, he says, a huge advantage compared with the 300-km-plus, short-lived ice road that supplies the diamond mines in the Northwest Territories.

November will prove a pivotal month for Peregrine and Chidliak. Not only are the crucial mini-bulk-sample results from CH-6 and CH-7 expected to hit the market, but BHP Billiton will also have to decide whether it wants to take a bigger chunk of Chidliak. The major has the option to fund the project to a bankable feasibility study in return for another 7% interest, and a total of 58%.

So far, BHP has displayed its faith both in the project and in Peregine. Although BHP is now the majority owner of the project, after spending a required $22.3 million over the past two years on exploration, it is leaving Peregrine in the driver’s seat as operator of the project again next year — a vote of confidence from the 80%-owner of Canada’s first diamond mine (Ekati) to be sure.

Of course, the company has already put its stamp on Chidliak by providing valuable advice based on its own experience exploring for and developing Ekati.

“They are the ideal partner because they have been down this exact path before,” Clements says.

Since BHP has spent more than the total required to earn its 51% stake (it fully funded this year’s $15.3-million program and last year’s $9.2-million program), if it chooses to forgo the extra 7% stake it could earn, Peregrine will be on the hook for a 49% share of about $3 million in spending for 2010, and the same proportion going forward.

Under the November 2008 earn-in agreement between the two companies, if the major instead decides to opt in, it will also acquire all marketing rights to any diamonds produced at Chidliak for the first three years of production.

“Both options have their advantage,” Clements says. “If they exercise their second option and carry us to feasibility, it’s kind of nice to not have to spend money.”

However, the downside is the loss of that 7% interest and marketing rights for the first three years that could otherwise give Peregrine some flexibility in terms of a downstream business or alliance, he adds.

New diamond district

Peregrine acquired its first prospecting permits at Chidliak in 2007 based on high concentrations of KIMs found in reconnaissance till sampling in the area in 2005 and 2006. BHP acquired its earn-in rights at Chidliak by co-funding the 2005 program.

Clements says there were a couple reasons Peregrine opted to explore on Baffin Island — first and foremost, the geology of the area.

“The rocks on Baffin Island are ancient Precambrian rocks — greater than two billion years old,” he explains. “The geologic setting is ideal for diamonds.”

The second reason, Clements says, was simply that it was virgin territory.

“In 2005, as far as we knew, no one else had explored southern Baffin Island for diamonds.”

While there have been some diamond discoveries on the northern half of Baffin Island, the geology of the southern half of the island wasn’t thought to be Archean until more recently.

Outside of Chidliak, Peregrine is well exposed to the new diamond district it’s discovered. In addition to Chidliak, the junior has about 23,500 sq. km on Baffin Island, all of which is 100%-owned by the company. The 8,500-sq.-km Qilaq project is adjacent to Chidliak, and the 15,000-sq.-km Cumberland project is 200 km north of Chidliak.

In August, Peregrine found its first two kimberlites at Qilaq by prospecting. Microdiamond results released in October showed both kimberlites to be diamondiferous. A 62.7-kg sample from Q1 returned 38 diamonds over the 0.106-mm sieve size and a 241.5-kg sample from Q2, 4 km south of Q1, returned 253 stones, including one larger than 1.18-mm, a white/colourless, transparent distorted rystal weighing 0.05 carat.

Further work is planned at both Qilaq and Cumberland next year.

The company also has projects outside of Baffin Island in Nunavut, as well as in other prospective areas of Canada.

It all has Clements optimistic about Peregrine’s future as a potential miner.

“We are open to everything,” he says, including alliances with quality partners. “But we certainly have the mindset that we could and would develop a mine.”

The next Ekati?

A diamond geologist his entire career — since 1981 — Clements also led the team at Ashton Mining of Canada that discovered the Renard diamond deposits, in Quebec. Joint-venture partners Stornoway Diamond (SWY-T) and Soquem are now conducting a feasibility study for the Renard project.

Clements says there are similarities between the two discoveries.

“They are both classic grassroots or greenfields exploration stories,” he says. “Really, even the initial discovery at Ekati was the same thing — they were sediment-sampling for ten years on the track to find Ekati, so a lot of the great discoveries are similar.”

At Ekati, he adds, initial exploration started out about 1,000 km away from the ultimate prize — the pipes that eventually made it into the mine plan.

The outstanding results from CH-6 in September 2009 prompted comparisons of the project with early results from Ekati and Rio Tinto (RTP-N) and Harry Winston Diamond’s (HW-T, HWD-N) Diavik mine, in the Northwest Territories — both by the company’s management and by newsletter writer John Kaiser of Kaiser Bottom Fish Online.

Most recently, at an investment conference in September in Toronto, Kaiser, who visited the project this summer, told an audience that the data suggest Chidliak could be even bigger than the famed Ekati.

Clements, however, is unfazed by the high expectations created by such comparisons with the holy grail of Canadian diamond mines — Diavik and Ekati.

“Everyone’s looking for something like that to happen again,” he says. “So it’s more up to Mother Nature now. If it’s there, we’ll deliver it.”

Be the first to comment on "Peregrine’s quantum leap at Chidliak"