Jaguar Mining (TSX: JAG; US-OTC: JAGGF) says gold production at the company’s underground Pilar gold mine in Minas Gerais, 50 km east of Belo Horizonte, Brazil, will nearly double over the next three years to 60,000 oz. gold per year. Total gold production guidance from all its mines for 2018 has not changed, however, and still sit sat 105,000 oz. gold.

“If you turn back the clock a little over two years, the mine itself had no less than 50,000 oz. in reserves and little to no mineral resource runway,” Jaguar CEO Rodney Lamond says of Pilar in a telephone interview with The Northern Miner.

Jaguar then began exploring the downward-plunging extension of the orebody at Pilar. Its work led to a 227% increase in its measured resource and a 104% increase in its inferred resource. As of December 2017, Pilar contains 974,000 proven and probable tonnes grading 3.99 grams gold per tonne for 125,000 oz. gold. It also has 3.7 million measured and indicated tonnes grading 4.37 grams gold for 532,000 oz. gold, with another 2.3 million inferred tonnes grading 5.69 grams gold for 433,000 oz. gold.

The increase in production is offset by the company’s decision to put its Roca Grande underground gold mine on care and maintenance.

Roca Grande is a 500 oz. per month gold mine that, along with Pilar and processing facilities, comprises Jaguar’s Caete complex. Over the past two years, Lamond says Jaguar has limited its exploration on the property, instead focusing on Turmalina and Pilar.

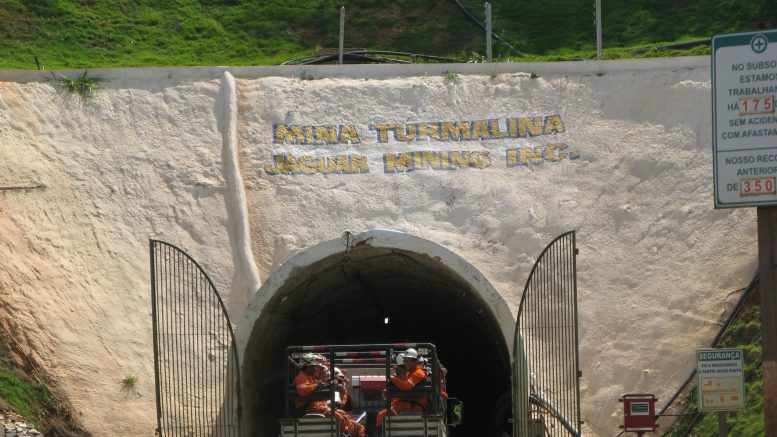

Workers underground at Jaguar’s Caete complex in Brazil:. Credit: Jaguar Mining.

“Now that our exploration team has been successful with that runway extension at Turmalina and Pilar, we’re turning our focus onto Roca Grande,” Lamond says.

The limiting factor at Roca Grande that Jaguar has to resolve involves a 4- to 8-metre oxide cap that sits on the orebody and is saturated with water. The company first found what Lamond calls the “water table” when it went underground at Roca Grande in 2009. The water is connected to an aquifer and constantly recharges, and as a result in 2011, one year after building the processing facility at Caete, Jaguar abandoned that orebody, planning development at a later time.

“We’ve since found some technical expertise out of South Africa that deals with perched water tables and how to basically isolate aquifers,” Rodney says. “And so we’re embarking on that program in addition to the growth exploration program. We believe that in the region of Roca Grande there are 500,000 to 800,000 oz. that are unmineable at the moment, but we’re hopeful that will come back on.”

Lamond insists, however, that Roca Grande is not a “key driver” in getting Jaguar to its 200,000 oz. gold per year production goal, which the company hopes to achieve in the next five years. That will instead hinge on production from Pilar and Turmalina. At Turmalina — located 130 km northwest of Belo Horizonte — he hopes to announce an increase in production shortly.

Lamond joined Jaguar in late 2015 and became CEO the following year. He calls 2016 a “banner year” for Turmalina, when Jaguar produced 63,000 oz. gold at the facility.

“It was the economic engine that supported all the investments we’ve made over the last two years at Pilar,” he says.

However, in early 2017, Jaguar ran into “temporary ground control conditions” at Level 9 of Turmalina’s underground mine that forced production back to Level 10. After this interruption the company relied on lower-grade orebodies from Orebody C, as opposed to Level 9’s Orebody A.

Staff at Jaguar’s Paciencia in Brazil. Credit: Trish Saywell.

Staff at Jaguar’s Paciencia in Brazil. Credit: Trish Saywell.

The Brazilian real was up 19% against to the U.S. dollar compared to the start of 2016. The company was still developing Pilar, and all three circumstances drove up operating costs.

Cash-operating costs increased 25% to US$924 per oz. gold sold compared to the first quarter of 2016. Similarly, all-in sustaining costs increased 22% to US$1,323 per oz. gold sold over the first quarter of 2016.

Rodney says that Turmalina is back on track, but that Jaguar still needs to increase output volume from Orebody A to get it back to producing 15,000 oz. gold a month. He says the company’s focus this year is exploring Turmalina and Pilar. The company recently announced updates from the two projects, with 14 underground holes at Turmalina and three infill holes at Pilar.

At Turmalina, highlights included 4.69 grams gold over 7 metres estimated true width from Orebody A and 7.89 grams gold over 6 metres true width. Highlights at Pilar included 17 grams gold over 5 metres true width and 6.28 grams gold over 10 metres true width.

The company also wants to restart its 85 sq. km Paciencia gold mine, 50 km southwest of Belo Horizonte, Brazil.

Jaguar picked up Paciencia from Anglo American (LON: AAL) in 2005. The property came with a 4.5% gross revenue royalty and what Lamond calls “complications in the terms of agreements” that he is renegotiating. He wants to resolve this issue before investing more in the project, and start exploration to define a resource and refurbish the processing plant and tailings facility.

Jaguar shares are valued at 34¢ with a 52-week range of 22¢ to 68¢. The company has a $107-million market capitalization.

Be the first to comment on "Jaguar doubles production at one gold mine while losing another"