Eskay Creek in British Columbia’s Golden Triangle was at one time the world’s highest-grade gold mine before Barrick Gold (TSX: ABX; NYSE: GOLD) finally shut it down in 2008 due to low gold prices. The underground mine produced 3.3 million oz. gold and 160 million oz. silver at average grades of 45 grams gold per tonne and 2,224 grams silver over its 14-year mine life.

Now Skeena Resources (TSXV: SKE; US-OTC: SKREF) wants to put Eskay Creek back into production as an open pit, with grades of 4.5 grams gold per tonne, which would make it one of the highest-grade open-pit operations in the world. Grades at most open-pit mines typically run 0.5 to 1 gram gold per tonne.

“Eskay Creek is one of the best open-pit deposits held by a junior company in the world,” Walter Coles Jr., the company’s president and CEO, tells The Northern Miner, noting that it could potentially be fast-tracked into production as early as 2025. Skeena is on track to complete a preliminary economic assessment (PEA) before the end of the third quarter of this year.

Since optioning the project from Barrick in December 2017, Skeena has completed a resource estimate based on 7,583 historic surface and underground diamond drill holes, and another 46 surface holes of its own drilled last year.

The most recent resource estimate, updated in February, consists of a pit-constrained 12.7 million indicated tonnes grading 4.5 grams gold per tonne and 117 grams silver per tonne (6 equivalent grams gold per tonne) for 1.82 million contained oz. gold and 47.79 million oz. silver (2.46 million equivalent oz. gold).

Inferred resources weigh in at 13.6 million tonnes grading 2.2 grams gold and 42 grams silver (2.8 equivalent grams gold) for 984,000 oz. gold and 18.46 million oz. silver (1.23 million equivalent oz. gold).

“With a 4.5-gram-per-tonne pit, the internal rate of return on this is amazing,” says Paul Geddes, Skeena’s vice-president of exploration and resource development.

Geddes notes that the bottom of the resource averages a 186-metre depth (230 metres at its deepest point), and Skeena has also found a small underground portion of 300,000 oz. gold that goes down to 400 metres, making it all “very shallow.”

The underground resource stands at 819,000 indicated tonnes grading 6.4 grams gold and 139 grams silver (8.2 equivalent grams gold) for 169,000 oz. gold and 3.66 million oz. silver (218,000 equivalent oz. gold). Underground inferred runs to 295,000 tonnes grading 7.1 grams gold and 82 grams silver (8.2 equivalent grams gold) for 68,000 oz. gold and 778,000 oz. silver (78,000 equivalent oz. gold).

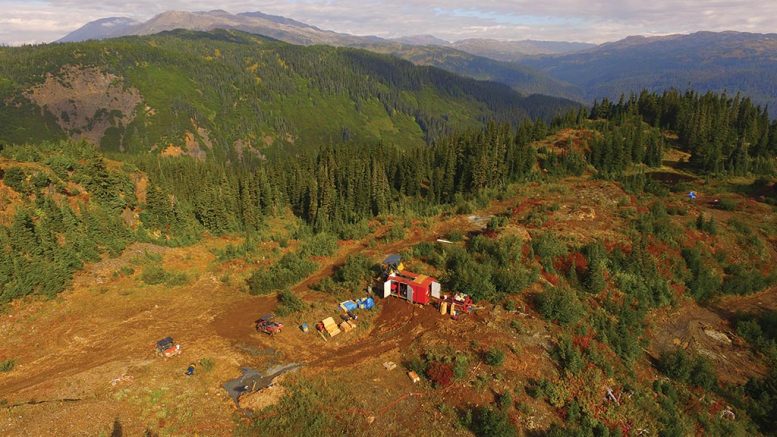

Skeena geologists at the Eskay Creek core shack. Credit: Skeena Resources.

“Eskay is an epithermal, volcanogenic-massive-sulphide deposit, and the exhalative horizon, the contact mudstone, is typically what had the bonanza gold grades, and that’s what was selectively mined,” Geddes says. “But the 5- to 10-gram material in the feeder zone underneath the mudstone was never touched. We have numerous examples where they intersected 10 grams over 3 metres and leave it wide open at depth, so our exploration potential dominantly exists along strike, and there are other areas of contact along the mudstone and the other feeder zones that sit underneath the contact mudstone.”

In addition to the high-grade resource and exploration prospects, the project also benefits from improvements in the gold price and to regional infrastructure since the mine last operated as a remote operation run on diesel fuel. B.C. Hydro built the 287-kilovolt Northwest Transmission Line that runs from Terrace to Bob Quinn Lake and north to Imperial Metals’ (TSX: III) Red Chris mine, and the paving of the Stewart-Cassiar highway north from Smithers.

The company also points to a friendlier permitting regime. Coles Jr. notes that in the last three and a half years, British Columbia has permitted more mines in Canada than any other province, and “has become much more hospitable for mining companies” than it was when the mine entered production in 1994.

“Whereas the ability to permit an open pit in the 1990s was viewed as questionable,” he says, “the evidence speaks for itself now. There have been a significant amount of mines permitted over the last five years.

“Historical operators were in a different political environment and came at this project in a way that was reflective of the situation they were in,” he continues. “What is different today is we have a very supportive government and very supportive permitting regime in the Golden Triangle, and that allows us to look at this project differently than previous operators.”

The mining executive points to Seabridge Gold’s (TSX: SEA; NYSE: SA) KSM development project and Ascot Resources’ (TSXV: AOT; US-OTC: AOTVF) Red Mountain project, both of which have received their permits, while Pretium Resources’ (TSX: PVG; NYSE: PVG) Brucejack mine was permitted in less than three years, he says.

Indeed, the Golden Triangle has become one of the most important metal regions in Canada. The Brucejack mine is 25 km southeast of Eskay Creek, and Imperial Metal’s Red Chris mine is 126 km northeast. Seabridge Gold’s KSM project is 19 km southeast, and Galore Creek, a joint venture between Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) and Newmont Goldcorp (TSX: NGT; NYSE: NEM), is 83 km northwest.

A helicopter carries a drill to the 22 zone at Skeena Resources’ Eskay Creek gold property in northwestern B.C.’s Golden Triangle region. Credit: Skeena Resources.

Under Skeena’s option agreement on Eskay Creek, Barrick has a 1% net smelter return royalty on the property, and has a back-in right to acquire a 51% interest by paying Skeena up to three times its cumulative expenses on the project, and reimbursing the $10-million purchase price.

Geddes notes that there were always two myths surrounding Eskay Creek: the first, that there is little gold left, which Skeena has proven wrong, and, the second, that it has difficult metallurgy, given its arsenic and mercury content.

“Everyone would tell us it is metallurgically impossible, and I would question that because the data had been buried since 2008,” he says.

Demonstrated metallurgy from the Eskay Creek mine involved a 350-tonne-per-day flotation plant with 80% and 92% average gold and silver recoveries. Gravity separation of gold accounted for 10–30% of preliminary separation. Sulphide concentrates were moved by truck to either the Port of Stewart for smelting in Japan, or to Kitwanga, for loading onto rail cars headed to a smelter in Quebec.

Now Skeena is investigating the amenability of the Eskay Creek blended mineralization to leaching and other optimization possibilities, and results are expected before the end of June.

Skeena also plans to drill Eskay Creek — as well as its Snip development project, 30 km west — in June.

The junior optioned Snip from Barrick in March 2016, and acquired 100% of the project in July 2017. The property contains the historic Snip mine, which produced 1 million oz. gold between 1991 and 1999 at an average gold grade of 27.5 grams gold.

“Snip was a fabulous mine back in the day,” Geddes says, noting that the mine’s previous owners only went after the highest-grade mineralization due to low gold prices at the time, leaving a lot of gold behind.

“Anything less than 20 grams per tonne wasn’t worth mining to them, so they high-graded it and extracted the guts out of it, and left us the ‘lower-grade material’ of around 10 grams per tonne,” he says. “What we want to do is expansion drilling, some regional step-outs, test them, and see if we can come up with another Snip mine on our land package.”

Skeena’s Eskay Creek property as seen from a helicopter. Credit: Skeena Resources.

“The footprint of the mine itself was small. The Twin zone hosted the majority of it, and it only has a strike length of 400 vertical metres, so if we drilled 100-metre centres, we could probably latch onto something pretty quickly.”

The deposit remains partly open along strike and in some production areas.

Skeena has reviewed and modelled over 280,000 metres of historic drill data and drilled a total of 27,000 metres. Highlights include 13.80 grams gold over 18 metres in drill hole 18-110, starting from 141 metres downhole; 36.65 grams gold over 2 metres, from 105 metres downhole, in 18-80; and 31.80 grams gold over 2 metres, within a broader 5-metre intercept grading 11.74 grams gold, from 70 metres downhole in 18-64.

Elsewhere in the Golden Triangle, Skeena is advancing its GJ copper-gold property, 30 km west of the Red Chris mine. The property has two deposits located 14 km apart: the porphyry copper-gold Donnelly deposit, and the porphyry gold-copper Spectrum Central Zone.

A PEA of GJ, completed in April 2017, envisions a 25-year mine life with an initial $216 million capital expense. The study estimates an after-tax net present value at an 8% discount rate of $314.09 million, and an internal rate of return (IRR) of 20.6% at US$2.75 per lb. copper, US$1,250 per oz. gold and US$17.75 per oz. silver. Skeena is looking for a partner to develop GJ to the pre-feasibility stage.

The GJ Donnelly deposit contains 215.2 million indicated tonnes grading 0.31 gram gold, 1.9 grams silver and 0.26% copper for 2.14 million contained oz. gold, 13.03 million oz. silver and 1.24 billion lb. copper. The inferred resource measures 28.3 million tonnes averaging 0.31 gram gold, 1.8 grams silver and 0.14% copper for 280,000 oz. gold, 1.64 million oz. silver and 85 million lb. copper.

The Spectrum Central Zone stands at 31.2 million tonnes in the indicated category grading 0.94 gram gold, 2.6 grams silver and 0.10% copper for 940,000 oz. gold, 2.64 million oz. silver and 68 million lb. copper, and 29.8 million tonnes in the inferred category, measuring 0.47 gram gold, 1.4 grams silver, 0.12% copper for 450,000 oz. gold, 1.34 million oz. and 76.4 million lb. copper.

“It’s very close to the Red Chris mine — where Newcrest recently came in as majority owner — and it’s a large land package with [430 sq. km] in an area that is attracting more and more attention,” Coles Jr. says. “We’re pretty excited about its copper-gold potential. It has just been overshadowed by our focus on Eskay Creek and Snip, but there will be a time and a place for this project — especially if copper prices gain a little bit more momentum.”

Skeena shares are trading at 47¢ in a 52-week range of 25¢ to 70¢. The company has a $48-million market capitalization.

Be the first to comment on "Skeena envisions high-grade open pit at Eskay Creek"