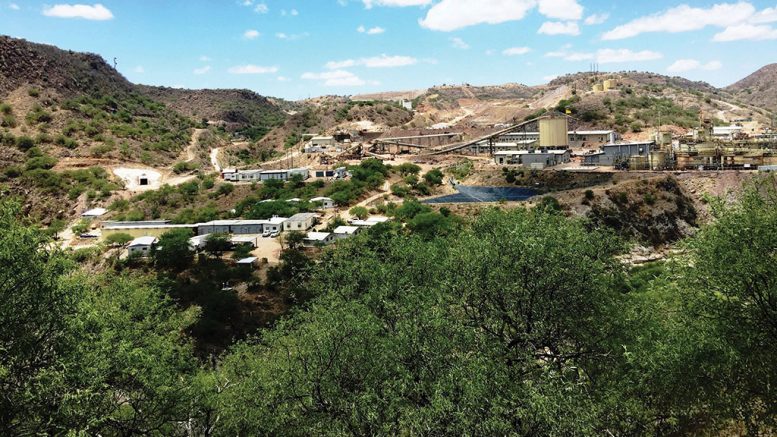

Premier Gold Mines (TSX: PG) is convinced it can add years to the mine life at its 2,000-tonne-per-day Mercedes gold-silver mine in Mexico’s Sonora state.

“We’ve got about a four- to five-year mine life based on current reserves, and that was the life when we bought it in 2016, so we’ve been successful in replacing reserves every year,” the company’s president and CEO, Ewan Downie, tells The Northern Miner.

The underground mine, 250 km northeast of Hermosillo and 300 km south of Tucson, Ariz., contains reserves and resources from numerous deposits on the property.

Premier Gold Mines CEO Ewan Downie.

Proven and probable reserves at the end of 2018 totalled 3.38 million tonnes grading 3.63 grams gold per tonne and 25.05 grams silver per tonne, for 395,000 contained oz. gold and 2.73 million contained oz. silver.

This year, Premier plans to drill 45,000 metres from surface and underground.

One of the exploration targets at Mercedes is the Marianas zone, because it makes up the down-plunge extension of the main Mercedes mine trend. The deposit remains open in multiple directions, and more than 10,000 metres of drilling is planned there this year to convert inferred resources to reserves.

Marianas has never been mined, and, until recently, had only been drilled from surface, but many of the surface intercepts suggest potential grade in excess of the current reserve grade, the company says.

“One of the primary reasons we bought Mercedes in the first place was because of Marianas, which we’re currently drilling from underground and surface, and constructing a ramp that hopefully will become a production decline,” Downie says. “Our goal is to start mining Marianas next year, which is a bit behind our original schedule. We had hoped to get it started this year, but the ground conditions encountered while driving the decline were worse than we expected, and for safety purposes we have taken it slow.”

Drill results released in May represented initial underground drilling at the east margin of the Marianas zone, within 100 metres of the ramp. Highlights include 31 metres of 4.96 grams gold and 71.06 grams silver, including 3 metres of 25.65 grams gold and 171.30 grams silver in hole 19-011, starting from 87 metres downhole, and 21 metres of 4.51 grams gold and 64.09 grams silver, including 4 metres of 11.04 grams gold and 94.09 grams silver in 19-007, starting 92 metres downhole.

“What we really need are some more high-grade zones to get to, so that the mine performs better than it has,” Downie says.

In the second quarter, Mercedes produced 15,532 oz. gold and 51,354 oz. silver, compared to 13,780 oz. gold and 44,366 oz. silver during the second quarter of 2018. For the first half of 2019, cash costs, on a coproduct basis, were US$911 per oz., and all-in sustaining costs were US$1,173 per ounce.

Higher gold production owed to higher mined grades upon transitioning to the Rey de Oro and Lupita zones, as well as consistent stope production from the Diluvio zone.

For the full year, Mercedes is expected to produce between 75,000 and 85,000 oz. gold and between 225,000 and 250,000 oz. silver, at cash costs of US$730 to US$780 per oz. gold sold, and all-in sustaining costs (AISCs) of US$900 to US$950 per oz. gold sold.

“Last year, and so far this year, mine performance has been up and down, based primarily on what zone most of the ore is coming out of, and the Diluvio zone, which is expected to make up 50% of our production this year, is lower grade,” Downie says. “We anticipate getting into higher-grade mineralization in the second half of this year — that’s our plan.”

In addition to the Marianas zone, another exciting exploration target at Mercedes is the recently discovered San Martin zone. Drilling at San Martin has returned 7 metres of 4.64 grams gold and 30.45 grams silver starting at 197 metres downhole in 19-400D, and 1 metre of 5.56 grams gold and 37.66 grams silver in 19-396D starting from a depth of 220 metres.

Other assay highlights from San Martin include 3 metres of 14.02 grams gold per tonne and 136 grams silver per tonne, starting at a depth of 208 metres in drill hole 19-422D. Drill hole 19-424D returned 4 metres of 8.41 grams gold and 67.64 grams silver, starting 224 metres downhole, including 1 metre of 16.20 grams gold and 92 grams silver.

“A real focus for us now is more holes in the Lupita Extension and San Martin target area to see how big this zone might be, and commence infill drilling to bring it into resource and reserve, and start mining it,” Downie says. “Based on the drilling we’ve done at San Martin and the Lupita Extension, the indications are that the grades may be at the high end of our current reserve grade, or higher, so they’ve moved up to be a high priority for us, too.”

Surface exploration has identified a 2.5 km mineralized corridor, east and west of the Lupita deposit.

The Lupita Extension drill program was designed to expand the Lupita resource and test the continuity of the vein to the west. Drilling started earlier this year, and results from 60-metre stepouts included 5 metres grading 4.57 grams gold and 27.07 grams silver starting from 129 metres downhole in drill hole 19-414D. The company plans more stepout holes to define the western extension of the zone, and another infill drill program to delineate at 30-metre centres, starting from the 2018 resource limits.

Premier is also drilling the Lupita, Diluvio and Rey de Oro deposits this year to offset mining depletion, and grow resources. The Lupita and Diluvio deposits are 4 km northeast of the main Mercedes trend in an underexplored basin. The Lupita vein outcrops on surface for 1,300 metres, has an average width of 3 metres and locally extends downdip up to 450 metres.

In May the company reported 1 metre of 10.75 grams gold and 89.31 grams silver in drill hole 19-016 from 118 metres downhole in the Lupita zone, and 30 metres of 6.43 grams gold and 11.91 grams silver, including 4 metres of 13.79 grams gold and 21.93 grams silver in 19-056 in Diluvio West, starting from 94 metres downhole.

Drilling has also discovered veining and mineralization in areas at Margarita, 1.2 km east of Lupita.

The first drilling at Margarita returned 1 metre of 2.98 grams gold and 61.93 grams silver in 19-395D. Subsequent drilling has intersected 6.30 grams gold over 2 metres, 284 metres downhole in drill hole 19-415D, and 2 metres of 3.51 grams gold starting 255 metres downhole in 19-409D.

In addition to identifying potential targets close to infrastructure on the property, exploration this year aims to test along the several kilometres of the unexplored main northwest vein systems that host the existing mines, as well as other regional targets.

One prospective area is La Mesa, 24 km northeast of the main Mercedes mine. Premier says La Mesa exhibits the same stratigraphy that hosts Agnico Eagle Mines’ (TSX: AEM; NYSE: AEM) deposits on its Santa Gertrudis property.

Be the first to comment on "Premier hits exploration hard at Mercedes"