Egypt has granted Aton Resources (TSXV: AAN) a mining licence for its Hamama development project — the second time in a decade that the government has greenlighted a mine since Centamin’s (TSX: CEE; US-OTC: CELTF) Sukari gold mine started commercial production in 2010.

The 20-year mining licence can be renewed for an additional ten years.

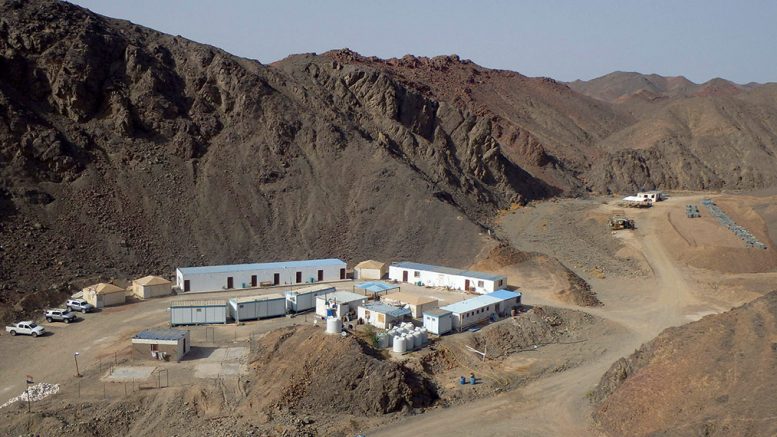

The Hamama project in Egypt’s Eastern Desert includes the Hamama West deposit and is situated about 35 km to the southwest of the company’s other major deposit, Abu Marawat.

Both deposits are on Aton’s 600-sq.-km Abu Marawat concession in Egypt’s Arabian-Nubian Shield, 200 km north of Centamin’s Sukari mine, which produces about 500,000 oz. gold a year.

The licence approval “underscores Egypt’s new commitment to developing its exploration and mining sector,” Aton CEO Mark Campbell said in a statement. “Egypt is a country that is blessed by having huge untapped mineral potential, not only in gold, but across all precious, base and industrial minerals, along with having world-class infrastructure, a great pool of skilled and semi-skilled labour, all within a strong and stable country.”

The Hamama West deposit has been the focus of Aton’s recent exploration efforts and will be developed into a small open-pit operation. The Volcanogenic Massive Sulphide (VMS) deposit contains 3.8 million indicated tonnes grading 0.72 gram gold per tonne and 27.6 grams silver per tonne for 88,000 contained oz. gold and 3.37 million contained oz. silver.

The mineralization extends below a gold-oxide cap and has been traced to a depth of 180 metres. Hamama West represents 750 metres of a 3 km strike length and remains open to the east and west.

Aton’s Abu Marawat gold-copper deposit to the north of Hamami has an inferred resource of 2.9 million tonnes grading 1.75 grams gold per tonne, 29.3 grams silver per tonne, 0.77% copper and 1.15% zinc.

The junior is also advancing its Rodruin exploration prospect, which it discovered 18 km east of Hamama West in 2017. Abundant visible gold was identified in hand specimens from outcrops and ancient dumps and underground workings.

Drill results released early last year from Rodruin included 61 metres of 1.55 grams gold per tonne, 8.9 grams silver per tonne and 0.86% zinc starting from 111 metres, which included an 11-metre interval of 5.01 grams gold, 25.8 grams silver, 0.20% copper and 2.27% zinc from 158 metres in drill hole ROP-050. Another hole, ROP-039, returned 29 metres of 1.59 grams gold and 40 metres of 0.74 gram gold from surface.

The Rodruin area, part of Aton Resources’ Abu Marawat gold concession in Egypt. Credit: Aton Resources.

Other exploration prospects on its concession include Safaga South, 14 km northeast of the Abu Marawat deposit, where Aton has identified mineralized quartz veins on the ground over several square kilometres. There is also evidence of partial workings from ancient times, including ancient dwellings and alluvial workings. Grab sampling in the area has returned assays of up to 102.5 grams gold.

The company believes Rodruin presents an opportunity for a large bulk mineable deposit with good grades and high-grade shoots interspersed within it.

Campbell is optimistic about Egypt as an emerging mining industry and notes that over the last few years, President Abdel Fattah el-Sisi and Tarek El Molla, the Minister of Petroleum and Mineral Resources, have taken steps to create a better mining regulatory regime.

“They realized that something radical needed to be done and that a complete overhaul was required to kick start the sector, where, except for Sukari, no new precious or base metal mines have been developed in Egypt in 100 years,” Campbell wrote in a letter to shareholders on Jan. 6.

In May 2018, the government hired Wood Mackenzie to look at the country’s mineral resource sector and determine what was holding back development, and in August 2019, President Sisi ratified amendments to the mining law, although these have yet to be finalized.

The government also created a new position within the Ministry of Petroleum last year. The new position — Deputy Minister of Mineral Resources — was given to Alaa Khashab, a well-known businessman and former CEO of ENPPI. The move elevates the sector and underscores its importance to the economy, Campbell said.

But the most exciting change so far, he noted, is that the government has done away with the Production Sharing Agreement (PSA) in the oil and gas sector and has moved to a tax, rent and royalty regime, “which gets rid of the 50% joint-venture and the involvement of the government in companies businesses.”

“Junior exploration companies are the venture capital arm of the mining industry, and require constant financing over the long period of exploration,” he stated in a Jan. 30 update to investors. “If you are starting out with a 50% partner from day one, you only really have one option, to turn yourself into a mining company, as Centamin did. By getting rid of this exploration investment destroying regime, the government has really taken a huge step forward in being in a position to attract investment.”

While he admits that the new executive regulations include a 5% royalty on gold, 6% royalty on zinc and 8% on copper, “5% is neither unworkable nor unheard of.”

Be the first to comment on "Egypt approves Aton Resources’ Hamama"