As the world moves away from fossil fuels, battery metals are in high demand, especially with a shortage of supply from low-geopolitical risk jurisdictions. For instance, earlier this year, Canada announced its Critical Minerals List, with 31 minerals that are key to the country’s economy, are available in Canada and are expected to play an important role in moving to a low-carbon future. These include cobalt, copper, lithium and nickel.

Canada Nickel

Canada Nickel Company’s core shed office in Timmins. Credit: Canada Nickel Company.

Canada Nickel (TSXV: CNC; US-OTC: CNIKF) is working to deliver a preliminary economic assessment on its Crawford nickel-cobalt sulphide project in the Timmins area in Ontario by the end of April, which would be followed by a feasibility study by the end of this year.

March metallurgical test results suggest that a 20% increase in the material grind size did not impact recoveries when compared with earlier test results. According to Canada Nickel chairman and CEO Mark Selby, this improvement in primary grind requirements could reduce the energy needed to grind each tonne by 15%, potentially allowing for both higher throughputs and lower unit costs.

Processing test results from January suggest nickel recoveries of 52%, with 46% of the recovered nickel reporting to a high-grade nickel concentrate, at 37% nickel. These numbers indicate potential for the high-grade concentrate to be the highest-grade nickel sulphide concentrate worldwide, based on data from Wood Mackenzie. The high-grade nickel product could be targeted at battery metal consumers, while the lower-grade concentrate would be used to generate a ferronickel product for the stainless steel market.

A January 2021 non-binding memorandum of understanding (MOU) with Glencore (LSE: GLEN) could allow the nickel developer to use the 12,500-tonne-per-day Kidd Creek concentrator and metallurgical site to treat and process material from the Crawford site, 40 km away. This option would be a smaller-scale start-up option for Crawford with lower capital costs.

Measured and indicated resources at Crawford total 653 million tonnes grading 0.26% nickel, 0.013% cobalt, 0.028 gram palladium per tonne and 0.012 gram per tonne platinum. There are a further 497 million inferred tonnes grading 0.24% nickel, 0.013% cobalt, 0.026 gram palladium and 0.013 gram platinum. These resources are contained within the Main and East zones and include a higher-grade core of approximately 201 million tonnes grading 0.34% nickel.

In mid-February, Canada Nickel and Noble Mineral Exploration (TSXV: NOB; US-OTC: NLPKF) entered into a binding letter of intent to consolidate the ownership of a new priority nickel target in MacDiarmid township. The MacDiarmid target, based on airborne geophysics and a compilation of historical exploration records, is approximately 1.8 km long and 400 metres wide, making it over 15% larger than the original Crawford Main zone. Nickel mineralization has been traced over a total of 7 km at Craword.

Canada Nickel has also established NetZero Metals, a division aimed at developing a zero-carbon footprint operation.

The nickel developer listed on the TSX Venture in March 2020.

Canada Nickel has a $262.7 million market capitalization.

Cypress Development

The view looking northeast toward Clayton Valley Ridge with claystone outcrops visible in the foreground. Credit: Cypress Development.

Cypress Development (TSXV: CYP; US-OTC: CYDVF) is working to complete a feasibility study on its Clayton Valley lithium project in southwestern Nevada in the second half of this year. Clayton Valley lies directly east of Albemarle’s (NYSE: ALB) Silver Peak mine, the only lithium brine operation in North America.

Pit-constrained resources at the project include 929.6 million measured and indicated tonnes grading 1,062 parts per million (ppm) lithium. Inferred resources add 100.4 million tonnes at 986 ppm lithium. The resources are contained in mudstones, claystones and siltstones.

The flat-lying sedimentary deposit is expected to allow low-strip ratio surface mining without drilling and blasting.

A May 2020 prefeasibility outlined a 40-year, 15,000 tonne-a-day mine, producing 27,400 tonnes of lithium carbonate-equivalent annually at cash costs of US$3,329 per tonne of lithium carbonate-equivalent. With an initial capital cost estimate of US$493 million and based on a lithium carbonate price of US$9,500 per tonne, the after-tax net present value estimate for the project comes in at US$1 billion, using an 8% discount rate, with a 25.8% internal rate of return.

In March, the company announced that it had started purchasing materials to start up a lithium pilot plant and extraction facility, targeted towards the lithium-bearing claystones. The tonne-a-day plant would be aimed at testing the components of the extraction process and assessing the lithium products as well as generating marketing samples. This plant, at a metallurgical facility in Nevada, is expected to be completed by the end of the second quarter of this year

Based on the results of an internal scoping study, Cypress is looking at a chloride-based leaching approach to lithium extraction.

Metallurgical tests results reported in November 2020 suggest an 80.2% lithium extraction using a sodium chloride solution, and an extraction of 85.3% using hydrochloric acid to leach the claystone. The prefeasibility looked at using distilled water in a sulphuric acid leach process. According to CEO Bill Willoughby, these test results are “significant” and suggest potential to extract lithium using high-saline water.

In March, Cypress closed a $19.6 million upsized bought deal public offering.

Cypress Development has a $123.6 million market capitalization.

First Cobalt

Inside the processing facilities at First Cobalt’s refinery in northern Ontario. Credit: First Cobalt.

First Cobalt (TSXV: FCC; US-OTC: FTSSF) is planning to restart its Ontario cobalt refinery in October 2022 and become North America’s first producer of cobalt sulphate for the electric vehicle market.

The facility operated between 1996 and 2015, producing cobalt, nickel and silver. First Cobalt is expanding and modifying the prior flowsheet for cobalt hydroxide refining.

In late March, the company announced that it had entered into an agreement with a lender for US$45 million in debt financing to fund the refinery restart. Financing, led by CIBC Capital Markets, is expected to be complete before a formal construction decision announcement. With the permitting process on schedule, construction is expected to start mid-year.

Also towards the end of March, First Cobalt signed a five-year offtake agreement with London-based metals trader Stratton Metals for the sale of cobalt sulphate from the Temiskaming Shores hydrometallurgical facility.

This contract allows First Cobalt to sell up to 100% of the cobalt sulphate generated in a year to Stratton. Sale prices would be based on the market prices at the time of the shipment. First Cobalt still has flexibility to enter into offtake contracts with original equipment manufacturers (OEMs).

The contract’s five-year term matches the five-year term of the supply agreements with Glencore and IXM (a subsidiary of China Molybdenum Company) that were announced in January and provide for 4,500 tonnes of contained cobalt a year starting in 2022. The cobalt hydroxide feed would be sourced from the two companies’ mines in the Democratic Republic of Congo and covers approximately 90% of the refinery’s projected capacity.

Based on a May 2020 feasibility, the facility could generate 5,000 tonnes of cobalt a year (25,000 tonnes of cobalt sulphate) with an initial capital investment of US$56 million. The refinery would generate cobalt sulphate at a minimum cobalt grade of 20.5% at total operating costs of US$2.72 per cobalt lb. Using US$25 per lb. cobalt and an 8% discount rate, the feasibility derived an after-tax net present value estimate of US$139 million.

In Idaho, the company holds the Iron Creek project, with indicated resources of 2.2 million tonnes at 0.32% cobalt-equivalent and 2.7 million inferred tonnes at 0.28% cobalt-equivalent. There are three adits and 600 metres of underground development at the site.

First Cobalt has a $173.6 million market capitalization.

Lithium South Development

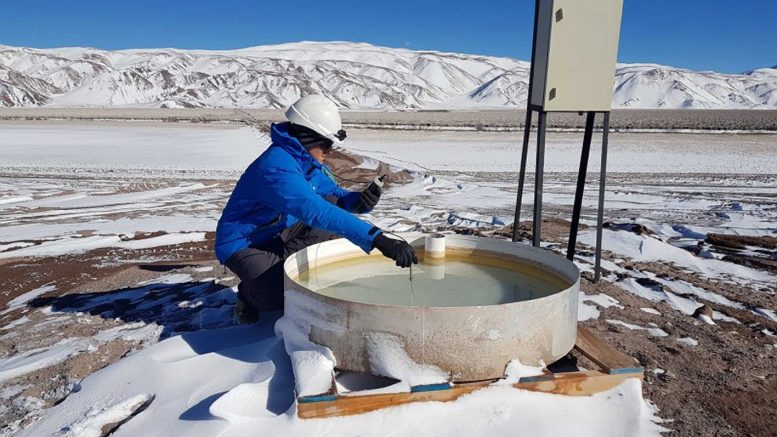

Lithium South’s Hombre Muerto North Project in Argentina. Credit: Lithium South.

Lithium South Development (TSXV: LIS; US-OTC: LISMF) is focused on advancing its Hombre Muerto North (HMN) lithium brine project in northwestern Argentina, 12 km from the Fenix lithium mine held by U.S.-based Livent (NYSE: LTHM).

The developer has in place a strategic partnership with Chemphys, a China-based company specializing in the production of high-purity lithium carbonate and battery-grade lithium hydroxide for the battery market. SinoLithium, parent of Chemphys, is expected to fund 30% of the feasibility and the entirety of a direct lithium extraction (DLE) lab and pilot program, which would earn it up to a 30% interest in the HMN project.

DLE technology that selectively extracts lithium ions from brine within the Chemphys process has potential to recover lithium with a reduced footprint when compared to conventional evaporation ponds.

In March, Lithium South announced average lithium recoveries of 80% from Chemphys testwork that produced a lithium sulphate product. According to Lithium South, this represents almost a 100% increase in lithium extraction when compared with its results from a conventional lithium evaporation process. Chemphys also determined that the lithium sulphate was in line with feed requirements for battery-grade lithium carbonate production.

Follow-up plans include cycle tests with synthetic brine at a pilot plant (scheduled for the second quarter) and validation with a bulk sample of HMN brine.

With a HMN offtake agreement in place with Chemphys, the lithium generated would be sold at prices “related to market prices,” based on a November 2017 agreement.

A 2019 preliminary economic assessment for HMN, based on an evaporation scenario, suggests a 30-year mine, producing an average of 5,000 tonnes of lithium carbonate a year. Based on cash operating costs of US$3,112 per metric tonne of lithium carbonate, an initial capital outlay of US$93.4 million and a lithium price assumption of US$12,420 a tonne, the after-tax net present value estimate for the project comes in at US$217 million, using an 8% discount rate.

Measured and indicated resources at HMN total 141.8 million cubic metres grading 756 mg per litre lithium and contain 571,000 tonnes of lithium carbonate-equivalent.

In February, Lithium South closed the second of a two-tranche private placement, raising a total of $3.4 million in the two tranches.

Lithium South has a $52.8 million market capitalization.

Neo Lithium

Inside the processing plant at Neo Lithium’s Tres Quebradas (3Q) lithium brine project in Argentina. Credit: Neo Lithium.

Neo Lithium (TSXV: NLC; US-OTC: NTTHF) is working to deliver a feasibility study for its 3Q lithium brine project in Argentina’s Catamarca province, 100 km from the town of Fiambala, in the third quarter of this year. The 350-sq.-km site includes a 160-sq.-km salar (dry lake) complex.

A 2019 prefeasibility study for the project suggests a 35-year conventional evaporation operation that would then purify and precipitate lithium carbonate. The brine would be processed at two locations, Fiambala, 100 km from 3Q, and at Recreo, 465 km from Fiambala.

The mine would generate an average of 20,000 tonnes of lithium carbonate a year at cash operating costs of US$2,914 per tonne. Based on an initial capital cost estimate of US$319 million, and lithium carbonate prices between US$11,500 and US$16,000 a tonne, the after-tax net present value estimate for this project stands at US$1.1 billion, at an 8% discount rate, with a 49.9% internal rate of return.

The feasibility study will focus on a scenario producing 20,000 tonnes of lithium carbonate a year, with an optional expansion to 40,000 tonnes a year once the first phase is established.

In January, the company announced that its lithium carbonate pilot plant in Fiambala produced battery-grade lithium carbonate, with 99.797% purity, that meets “worldwide premium specifications.” Neo Lithium plans to continue optimizing the plant process for the feasibility.

The project includes a measured and indicated resource of 1.2 billion cubic metres grading 614 milligrams lithium per litre that contain 4 million tonnes of lithium carbonate and inferred resources of 939 million cubic metres at 584 milligrams lithium that add 2.9 million tonnes of lithium carbonate. The project’s reserves include 1.3 million tonnes of lithium carbonate.

According to Neo Lithium’s corporate presentation, the average grade of the 3Q project positions it as the fourth-highest grade lithium project worldwide.

In February, the company closed a $30.2 million bought deal financing.

In mid-March, Neo Lithium closed a $2.6 million equity investment by publicly traded China-headquartered Contemporary Amperex Technology Co. (CATL); the company has an 8% equity stake in Neo Lithium with a participation right to maintain its percentage holding. CATL is involved in the manufacturing of lithium-ion batteries.

Neo Lithium has a $369.2 million market capitalization.

Nickel 28 Capital

The Basamuk processing plant, which is part of the Ramu nickel-cobalt mine in Papua New Guinea. Credit: Highlands Pacific.

Nickel 28 Capital’s (TSXV: NKL) most advanced asset is an 8.56% joint venture interest in the Ramu nickel-cobalt open pit operation in Papua New Guinea. China Metallurgical Group is the project operator. The mine has been operating since 2012 and Nickel 28 expects to start receiving 35% of its attributable cash flow from this asset in 2022. Once Nickel 28’s share of project debt is repaid, the company would receive its entire share of project cash flows and its interest in the joint venture would increase to 11.3%.

In mid-March, Nickel 28 announced that it had purchased 52,500 carbon offsets, expected to fully offset its share of 2021 greenhouse gas emissions from the Ramu mine and refinery. According to the press release, Nickel 28 “believes this will make it the mining industry’s first carbon-neutral refined nickel-cobalt producer.”

The Toronto-based company also holds a portfolio of 13 nickel-cobalt royalties on projects in Canada, Australia and Papua New Guinea.

Canadian royalties include a 1.75% net smelter return (NSR) royalty on the construction-ready Dumont nickel-cobalt project, held by Waterton Global Resource Management, which hosts one of the “largest undeveloped nickel and cobalt reserves in the world,” according to Nickel 28. The portfolio also includes a 2% NSR on Giga Metals’ (TSXV: GIGA; US-OTC: HNCKF) Turnagain nickel-cobalt project in B.C. Additional Canadian royalty holdings include a 2% cobalt NSR on Fireweed Zinc’s (TSXV: FWZ) North Canol properties in the Yukon and a 2% cobalt NSR on New Found Gold’s (TSXV: NFG; US-OTC: NFGFF) Triangle project in Ontario.

In Australia, Nickel 28 has royalties on two pre-production nickel-cobalt assets. The construction-ready Nyngan nickel-cobalt-scandium project, where Conic holds a 1.7% gross revenue royalty, is permitted and held by U.S.-based Scandium International Mining (TSX: SCY).

The company also has a 2.2% interest in Minerva Intelligence (TSXV: MVAI), an artificial intelligence software company.

Earlier this year, Nickel 28 completed a formal name change, from Conic Metals.

Nickel 28 has a $55.1 million market capitalization.

United Lithium

Lithium mineralization at the Bergby project near central Sweden. Credit: United Lithium.

United Lithium (OTC: ULTH) is a lithium explorer focused on assets in Sweden and Canada.

In February, the junior entered into a definitive agreement with Leading Edge Materials (TSXV: LEM) to acquire the Bergby lithium project in central Sweden, 25 km north of the city of Gavle. This acquisition is expected to be completed in the second quarter.

The consideration includes a $250,000 payment on closing as well as the issue of 1 million United Lithium shares and 400,000 warrants. An additional $250,000 payment would be due six months after closing. United Lithium has also agreed to grant Leading Edge Materials a 2% net smelter return (NSR) royalty and, if Leading Edge acquires additional mineral claims in the area, United Lithium would issue the vendor $250,000 worth of warrants.

Bergby, at 19 sq. km, was originally staked in 2016. Prospecting has traced an “extensive” lithium-mineralized spodumene pegmatite boulder field with outcrops. A 1,525-metre, 33-hole drill campaign completed in 2017 hit lithium mineralization in 28 holes along 450 metres of strike. These holes tested depths of up to 65 metres. Drill highlights included 8.2 metres of 2.06% lithium oxide; 10.5 metres of 1.57% lithium oxide; and 18.8 metres of 1.14% lithium oxide.

Once it completes the acquisition, United Lithium plans to start a three-phase drill campaign at Bergby. The first, 3,000-metre portion would focus on areas along strike and down-dip of the prior mineralization. The company also plans to complete an airborne survey. Phase two would aim at drilling 3,000 metres at a spacing that would support a resource calculation. Drilling in the third phase is planned to test areas at depth, target strike step-outs and test for potential parallel zones.

In March, United Lithium signed a partnership with Mississauga-based Process Research Ortech to develop an initial leaching and purification process flow-sheet for lithium mineralization hosted in hard rock spodumene. Results on the recoveries of lithium carbonate are expected within approximately 16 to 22 weeks.

United Lithium’s Canadian asset is the Barbara Lake lithium project, 160 km northeast of Thunder Bay.

Earlier in March, the company closed a $9.2 million private placement of special warrants.

United Lithium has a $41.6 million market capitalization.

Vital Metals

Vital Metals’ Nechalacho rare earth project. Credit: Vital Metals.

Sydney-based Vital Metals (ASX: VML) is focused on starting up its Nechalacho rare earths project in the Northwest Territories, 100 km southeast of Yellowknife.

Based on a resource update from December 2019, the Upper zone at Nechalacho includes a total of 94.7 million tonnes grading 1.46% total rare earth oxides (TREO) – this includes measured, indicated and inferred resources based on the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012). The North T zone at Nechalacho hosts 101,000 tonnes of measured and indicated resources at 9.01% rare earth oxides, which, according to Vital, makes it one of the highest-grade rare earth deposits worldwide.

In March, the company started mining operations at Nechalacho by mobilizing its fleet. The mining contractor is expected to start up at the high-grade North T zone shortly, and will access the site from the 110-km Nechalacho ice road on Great Slave Lake.

Mining and crushing are scheduled to take place between March and September. This material will then be stockpiled for ore sorting, planned for the next three summers.

Vital expects to complete a second mining campaign in 2024.

Vital has a two-stage development vision for the rare earths asset. The first would focus on mining of the North T zone as an open pit while the second would develop the larger Tardiff deposit. Material from the first-stage pit operation would be sorted on-site to generate a product for off-site processing at Vital’s rare earth extraction plant, planned to be built in Saskatoon, producing a rate earth carbonate product for sale.

In February 2021, Vital signed a definitive agreement with REEtec, a Norwegian rare earths separation company, to provide 1,000 tonnes of rare earth oxide over five years, with the option to increase the offtake up to 5,000 tonnes of rare earth oxide over 10 years.

Also in March, the developer completed a A$43 million share placement with institutional investors. The proceeds are intended to fund construction, mining and operations at the NWT project. Funds are also allocated for the construction of an extraction plant in Saskatoon and a drilling program for a stage-two mine plan, among others.

Vital also holds the Wigu Hill rare earth project in Tanzania, where mining license discussions are underway with the government.

Vital Metals has a A$181.9 million market capitalization.

In addition checkout NioBay Metals http://www.niobaymetals.com The company has published a positive Economic Assessment and is looking to partner with Moose Cree First Nation to advance the James Bay Niobium Project. Niobium Oxide batteries will be a game changer with less than 6 minute charge.