Bank of America expects the gold price rally to persist despite a challenging macro backdrop.

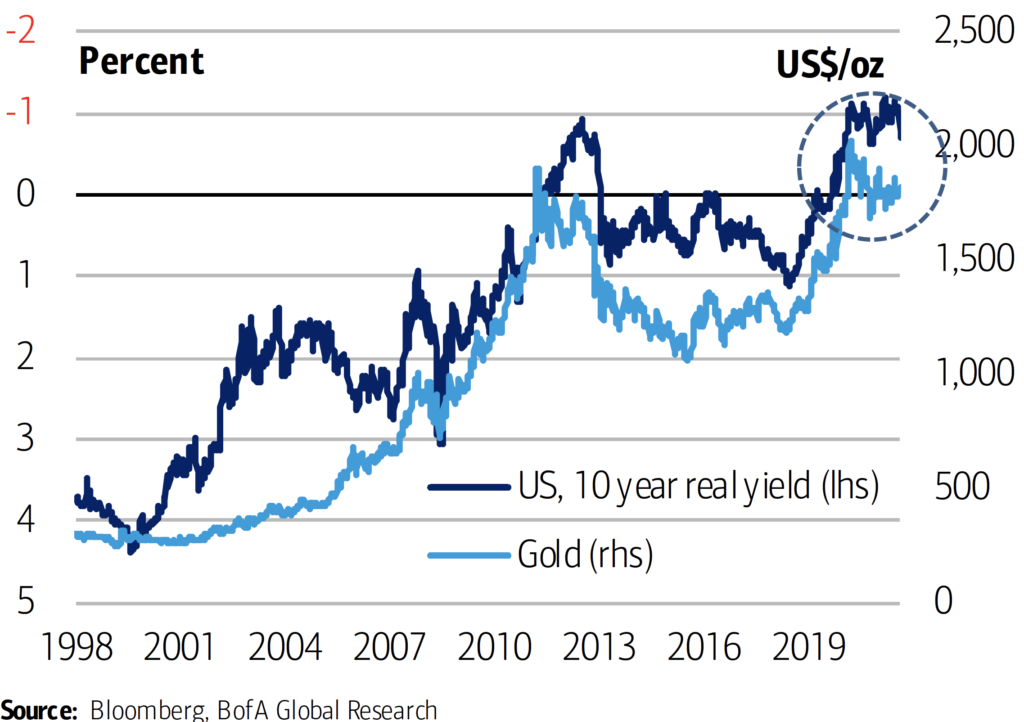

Gold continues trading above $1,800 per ounce despite the respective 10-year interest rates and Dollar Index rising from intra-year lows of -1.25 and 89.5 in 2021 to -0.54 and 95.7. The bank views the sustained price performance as “remarkable” since yields and the dollar tend to be the most critical price drivers of the yellow metal.

Further supporting the gold price are investment flows, which have been “very resilient,” according to BofA analyst and lead author Michael Widmer.

In the bank’s Global Metals Weekly report, he said gold had disconnected from its traditional drivers because of significant dislocations buried beneath headline inflation, interest rates and currency moves. These market forces raised the appeal for investors to hold gold in a portfolio.

BofA expects the gold price to average $1,925 per ounce in 2022.

Widmer said inflation at 7% put the US Fed in a difficult position but cautioned that tighter monetary policy might not be the silver bullet to fix the problem.

“While some of the inflation is driven by domestic factors, others, including supply chain dislocations, are not; also, a mix of temporary and more persistent drivers are at play. We also note that the Fed’s reaction function has changed.

“Gradual hikes, accompanied by declining inflation, steady economic growth, and stable markets may be the ideal scenario for US monetary policy, but this is a difficult path. The risk of a policy mistake is high, and rising equity volatility tends to support perceived safe havens, gold included,” said Widmer.

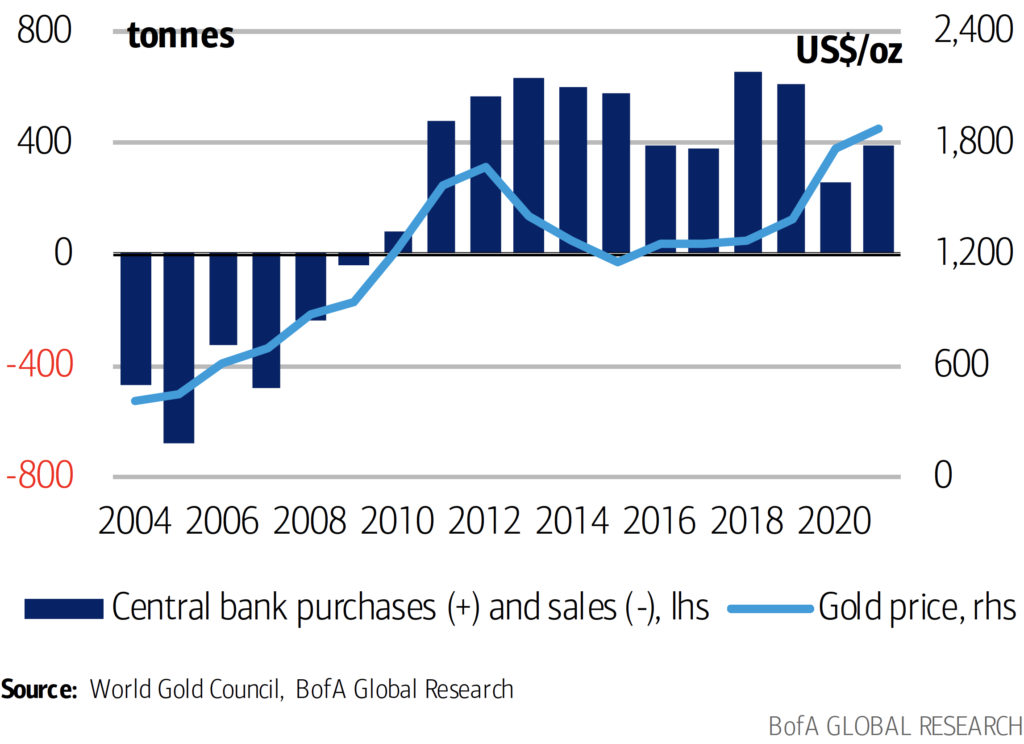

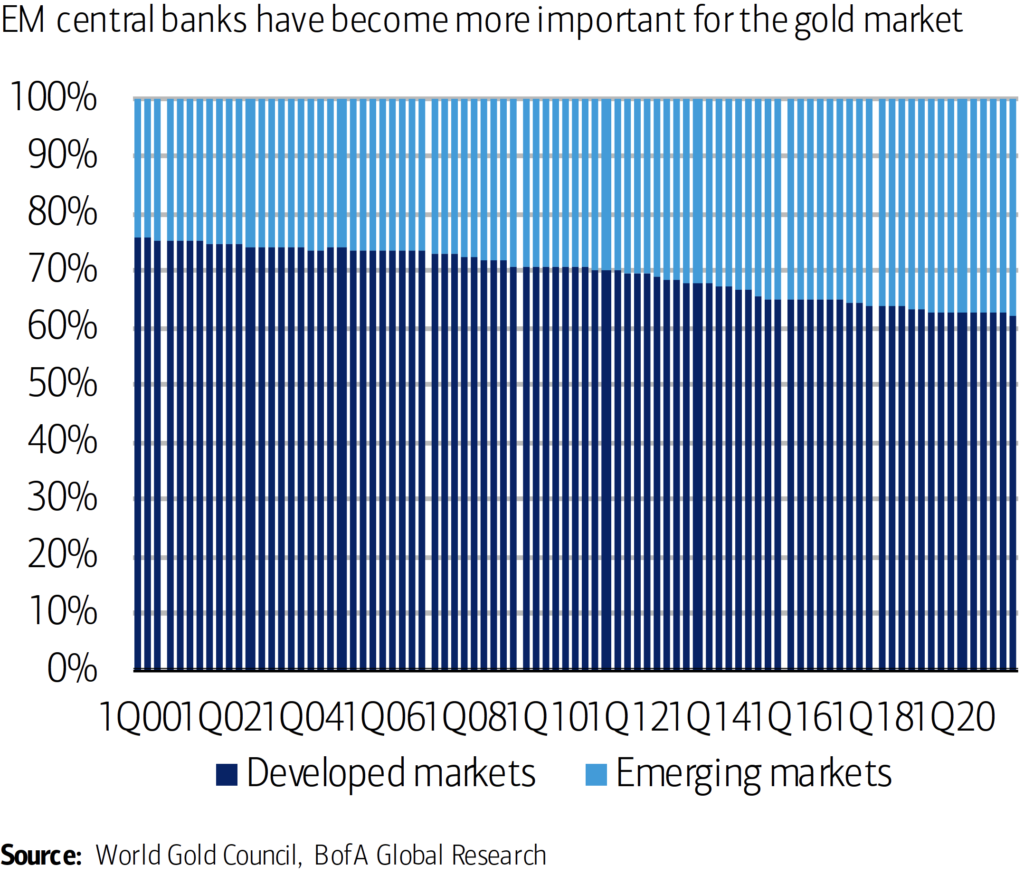

The bank also observed that policy normalization contributed to a nearly 50% drop in bitcoin and crypto assets, which is another factor likely supporting robust gold inflows. Moreover, emerging market countries have been net gold buyers in recent years, partially over concerns about how the shift away from ultra-lose monetary policy in DMs would impact their portfolios. While EM central banks allocate 6% of their portfolio to the yellow metal, owning around 12% would optimize the risk-return profile.

“So, EMs have significant scope for gold additions, particularly after the recent crypto fiasco in El Salvador. Gold is a hedge for investors and EM central banks alike. And this matters as global imbalances make a comeback, particularly when geopolitics are flaring up,” said Widmer.

The bank noted these global imbalances as rising, as was the VIX.

I don’t know how the Fed can raise rates enough to dampen inflation. Rising rates are certain to affect the real estate market and any sudden drop in property prices cannot be tolerated. Gold seems to be reflecting this perception. $2200/oz this year would not be a surprise.