Skeena Resources (TSX: SKE; NYSE: SKE) has signed a cash-and-stock deal to acquire B.C.-based QuestEx Gold & Copper (TSXV: QEX; US-OTC: QEX) for about $48.6 million.

Following the acquisition, Skeena will sell QuestEx’s Heart Peaks, Castle/Moat and North ROK/Coyote properties to Newmont (TSX:NGT; NYSE: NEM) for about $27 million as per a separate agreement inked by the two companies.

The transaction will add over 740 sq. km. of land to Skeena’s holding, for a sevenfold increase. It will also provide the company “one of the largest land positions” in the Golden Triangle in B.C., the company’s CEO Walter Coles said in a press release.

“The KSP and Kingpin properties are proximal to our Eskay Creek and Snip projects and appear to have the same geological hallmarks that have hosted other large gold systems in the area,” said Coles. “Involving Newmont on these transactions has allowed Skeena to acquire these strategically important land packages while minimizing share dilution.”

Newmont said that portions of the properties it plans to acquire will be to “protect and conserve lands” under the Tahltan Stewardship Initiative, a program that deals with the protection of natural resources in Tahltan territory. The approach rose from British Columbia’s Declaration on the Rights of Indigenous People’s Act (DRIPA) in 2019.

“We are acquiring the land in an effort to address concerns raised by the Tahltan Nation. The mining claims around Iskut are not being purchased for development or their mineral potential,” Newmont CEO Tom Palmer said in a press release.

In 2021, Newmont acquired the Saddle North deposit in the Tahltan territory within B.C.’s Golden Triangle and adjacent to QuestEx’s Castle property. Back then, the company said that the project has the potential to contribute “significant gold and copper” production at an “attractive all-in sustaining costs over a long mining life.”

The terms of the deal between Skeena and QuestEx state that each of QuestEx’s shares will be exchanged for $0.65 cash and 0.0367 of a Skeena share.

Based on a 2014 technical report, QuestEx’s North Rok property has an inferred resource of 142 million tonnes grading 0.22% copper and 0.26 gram per tonne gold for contained metal of 690 million lb. copper and 1.1 million oz. gold.

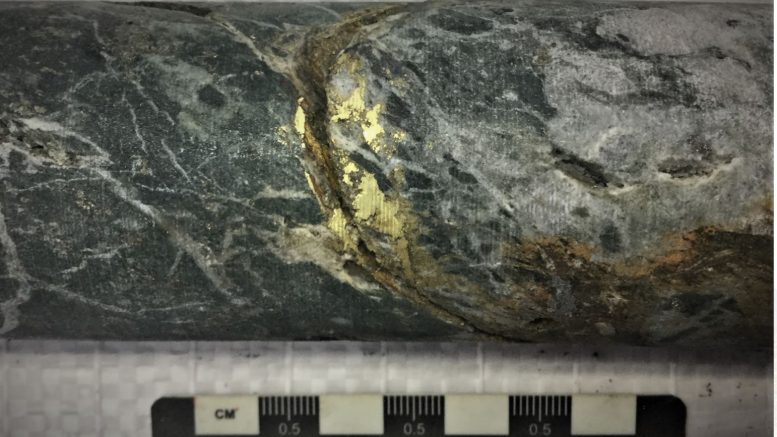

In February, the company reported drill results from its KSP property, which covers 312 sq. km. Highlights included 23.4 metres grading 2.65 grams gold per tonne, 6 grams silver, 0.12% zinc and 0.026% copper starting from 12.8 metres in drillhole INDDH21-166; and 5 metres grading 18.3 grams gold, 26.2 grams silver, 0.29% zinc and 0.166% copper starting from 59 metres in drillhole INDDH21-174.

QuestEx’s other properties include Sofia in the Toodoggone district and Hit in southwestern B.C.

Skeena is looking to restart the Eskay Creek mine in northwest B.C., which produced about 3.3 million oz. gold and 160 million oz. silver between 1988 and 2008 at average grades of 45 grams gold per tonne and 2,224 grams silver per tonne. The company aims to complete a feasibility study for the property in the next few months.

It is working with the Tahltan Nation and the British Columbia to get the environmental assessment approval through a relatively new process where the First Nation will have the legal decision-making authority for the permit.

At presstime in Toronto, Skeena was trading at $14.30 per share within a 52-week trading range of $11.24 and $17.11. QuestEx was trading at $1.13, up 37¢ or 49%, within a 52-week trading range of 54¢ and $1.37.

Be the first to comment on "Skeena inks deals to acquire BC-based QuestEx and sell selected properties to Newmont "