Copper scarcity may emerge as a key destabilizing threat to international security in the 21st Century an analysis by S&P Global found this week.

“Projected annual shortfalls will place unprecedented strain on supply chains. The challenges this poses are reminiscent of the 20th-century scramble for oil but may be accentuated by an even higher geographic concentration for copper resources and the downstream industry to refine it into products,” according to the report entitled ‘The future of copper: Will the looming supply gap short-circuit the energy transition?’

Copper is seen as the ‘metal of electrification’ and is essential to all energy transition plans. Despite its critical status the potential supply-demand gap is expected to be “very large” as the energy transition intensifies. Substitution and recycling will not be enough to meet the demands of electric vehicles, power infrastructure, and renewable generation.

“Unless massive new supply comes online in a timely way, the goal of Net-Zero Emissions by 2050 will be short-circuited and remain out of reach,” warned S&P in its report.

According to the firm, copper demand is projected to grow from 25 million tonnes today to about 50 million tonnes by 2035, a record-high level that will be sustained and continue to grow to 53 million tonnes by 2050. The report notes that power and automotive applications will have to be deployed at scale by 2035 in order to meet the 2050 net-zero targets.

The chronic gap between worldwide copper supply and demand projected to begin in the middle of this decade will have serious consequences across the global economy and will affect the timing of achieving Net-Zero Emissions by 2050. The shortfall is expected to reach as high as 9.9 million tonnes in 2035 in its ‘Rocky Road Scenario,’ which is based on a continuation of current trends in capacity utilization of mines and recycling of recovered copper.

“This would mean a 20% shortfall from the supply level required for the Net-Zero Emissions by 2050 target,” said S&P in its report.

“The gap arises even under assumptions of aggressive capacity utilization rates and all-time-high recycling rates in the ‘High Ambition Scenario.’ Even with these aggressive assumptions, refined copper demand will outpace supply in the forecast period up to 2035.”

Mining leader BHP (NYSE: BHP; LSE: BHP; ASX: BHP) sees the copper market “take-off” by the mid-2020s “if not earlier,” it recently stated.

S&P Global Market Intelligence senior analyst Sean DeCoff suggested during a webinar on Thursday that increases in LME copper stocks and rising interest rates were conspiring to weaken copper prices during the three months ended June. He noted that spot treatment charges had been under pressure since the restart of the Xiangguang copper smelter in China, hinting at softer metal prices.

Copper prices have declined from record highs but remain relatively robust, above US$8,000 per tonne.

Source: S&P Global.

Source: S&P Global.

However, a weakened demand outlook and market surpluses are expected to weigh on copper prices in the second half, according to S&P.

“Refined copper consumption growth for 2022 has been lowered to 2.7% due to the global economic slowdown. The global copper concentrate deficit contrasts with the refined copper surplus in 2022,” DeCoff said.

The analyst noted strong near-term supply growth for the red metal, whose supply growth momentum is expected to lose steam by 2025 when the supply-side will be hard-pressed to maintain 2025 output levels.

The market is expected to struggle to meet demand post-2025 when a 2.5% deficit would open to 2030. Over the next two to three years, DeCoff sees “very strong” growth mainly due to the start of new quality projects and ramp-ups, most notably Freeport’s Grasberg expansion in Indonesia and First Quantum Minerals‘ (TSX: FM) Cobre Panama mine, in Panama.

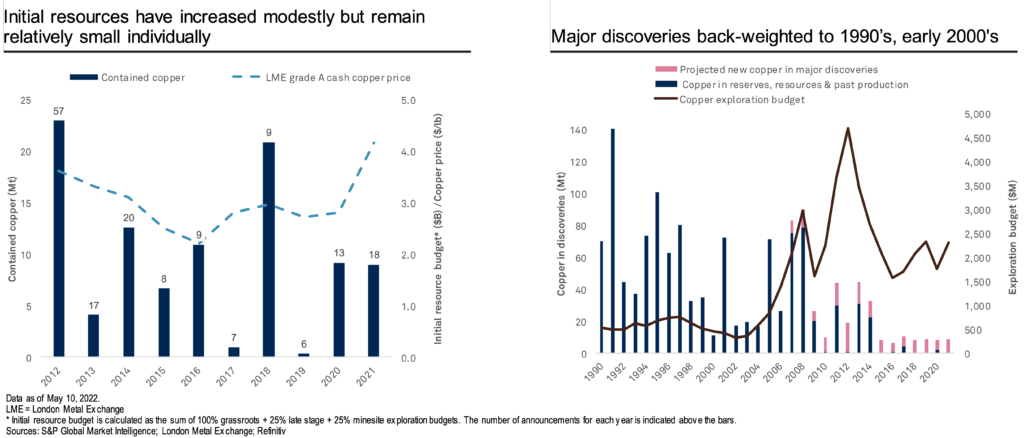

Exploration shifts are partly to blame, said the analyst.

“Copper exploration well below comparable years. Additionally, exploration has shifted to mine site assets instead of grassroots projects. Exploration efforts are struggling to find new deposits,” stressed DeCoff.

Further, the analyst noted that reports of initial copper resources had increased modestly, but the volumes of contained metal remained relatively small individually. Nearly all major discoveries are back-weighted to the 1990s and early 2000s.

Compounding matters is that the average head grade trends are not expected to improve, DeCoff said. “Head grades at all copper producing assets have declined 10% over the past decade.”

Be the first to comment on "Copper deficit a critical destabilizing threat to international security, says S&P Global"