Four months after closing the acquisition of Canada’s Noront Resources and its Eagle’s Nest project in Ontario’s Ring of Fire, one of the world’s largest undeveloped high-grade nickel sulphide deposits, privately held Wyloo Metals is investing A$150 million in Hastings Technology Metals (ASX: HAS), a rare earths developer in Australia.

Hastings Technology, which hopes to become the world’s next producer of neodymium and praseodymium concentrate used in permanent magnets, will use Wyloo’s funds to acquire a 22.1% stake in Neo Performance Materials (TSX: NE), a global rare earth processing and advanced permanent magnets producer, from an affiliate of Oaktree Capital Management, L.P.

Toronto-based Neo produces magnetic powders and magnets, specialty chemicals, metals and alloys that are key in technologies ranging from hybrid and electric vehicles to pollution control systems to energy-efficient lighting and water purification.

“This transaction with Hastings spans the value chain, from mining to magnet manufacturing,” Wyloo CEO Luca Giacovazzi said in a press release announcing its cornerstone investment. “As the owner of the only commercial rare earth metals facility in Europe, Neo is strategically placed to help Europe meet its goal to become climate-neutral by 2050.”

Hasting’s flagship rare earths project —Yangibana — spans 650 sq. km in Western Australia’s Gascoyne region, roughly 250 km northeast of Carnarvon. The project has a JORC-compliant measured resource of 3.9 million tonnes grading 1.19% total rare earth oxides (TREO); indicated resources of 8.6 million tonnes of 1.25% TREO; and inferred resources of 8.4 million tonnes at 1.09% TREO, including 0.4% neodymium oxide (Nd2O3) and praseodymium (Pr6O11).

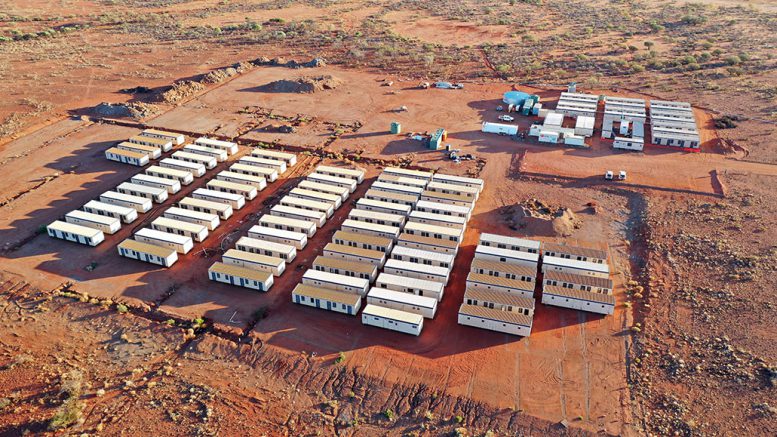

According to Hastings, Yangibana will be a conventional open pit mine and the ore will be crushed, milled and processed at a beneficiation plant on site into a rare earth concentrate, which will then be transported 450 km to a proposed hydrometallurgical plant in the Pilbara region for processing into a mixed rare earth carbonate product and shipped overseas.

In a project update in October 2021, Hastings said it is focused on bringing the project into production in 2024.

Wyloo’s investment in Hastings gives it the right to appoint a director to its board and keep the director in place as long as its equity interest is 12.5% or higher.

The three-year notes can be exchanged after 60 days into Hastings ordinary shares at a price of $5.50 per share. The notes will earn an annual coupon equivalent to the three-month bank swap rate plus 9%, payable in kind through the issue of additional notes.

Wyloo’s investment in Hastings follows a commitment it announced in March to spend $4.9 million on exploration at Orford Mining’s (TSXV: ORM) nickel-copper-platinum group metals West Raglan property in Nunavik, Que.

Under an option and joint-venture agreement in January 2021, Wyloo has the right to earn up to 80% of Orford’s 100%-owned West Raglan project for a total expenditure of $25 million over seven years. The 707-sq.-km West Raglan project lies in the same west-central portion of the Cape Smith Belt that hosts Glencore’s (LSE: GLEN) Raglan mine and Canadian Royalties’ Nunavik nickel mine.

In February, Wyloo entered into an agreement with IGO Ltd. (ASX: IGO) to jointly evaluate opportunities for downstream nickel processing in Australia. Wyloo has investments in Mincor Resources, a nickel sulphide developer and explorer with assets in Kambalda and Widgiemooltha in Western Australia, and in Queen’s Road Capital Metals & Mining in Canada. Queen’s Road is a financier to the global resource sector.

Be the first to comment on "Wyloo Metals invests A$150M in rare earths developer to fund stake in Neo Performance Materials"