Cor Coe might be the Maytag repairman of mining. He’s sure he’s got a good product but no one’s calling.

The CEO of Sitka Gold (CSE: SIG) is sitting on the RC gold project in the Yukon with visible gold in assays, 1.3 million inferred oz. and a road right to his door. Yet Sitka’s share price has been stuck near 12¢ for eight months while Snowline Gold (TSXV: SGD), farther east in the territory about 200 km from the nearest main road, and without a resource estimate, has a $19-million investment from B2Gold (TSX: BTO) and a stock that’s surged 81% since the end of May.

“It’s tough when you’ve got the market where it’s not really interested in gold deposits except for Snowline so I think if so if it wasn’t around, we’d be the golden boy here,” Coe told a tour group on site. “We got knocked off the pedestal.”

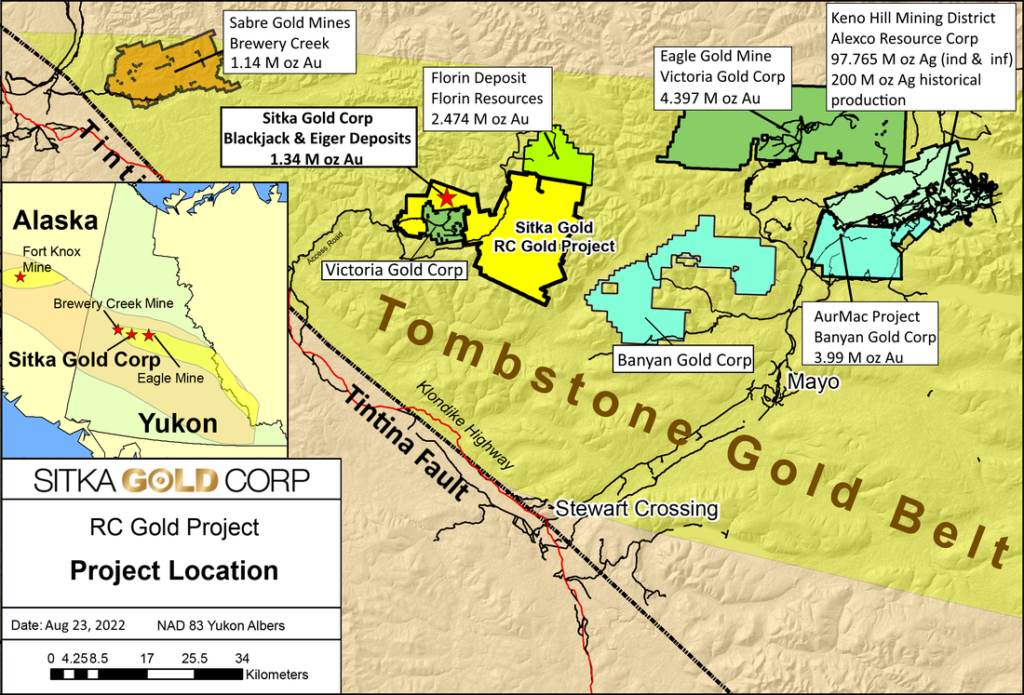

Sitka is part of the surging Tombstone Gold Belt east of historical Dawson City that includes several early-stage projects such as those by Snowline, Banyan Gold (TSXV: BYN; US-OTC: BYAGF), Sabre Gold Mines (TSX: SGLD; US-OTC: SGLDF) and St. James Gold (TSXV: LORD). Victoria Gold’s (TSX: VGCX) Eagle mine is its only current Yukon hard rock producer in the belt that arcs from northern British Columbia, along the border with the Northwest Territories then west to Kinross Gold’s (TSX: K; NYSE: KGC) Fort Knox mine near Fairbanks, Alaska.

Boosters say area production could drown Dawson’s gold rush output 125 years ago and mark a new bonanza for the territory. But junior miners face an uncertain fundraising environment in markets where even strong drill results and a large resource like Sitka’s don’t necessarily translate into higher stock values. Snowline’s performance is an outlier.

Sitka’s 376-sq.-km RC project, about 100 km east of Dawson, has 61.1 million inferred tonnes grading 0.7 gram per tonne for 1.3 million oz. gold, according to a resource estimate in January. While Snowline hasn’t filed a resource estimate, it has shown consistently strong drill results, such as the top gold assay globally during the first week of July. Hole V-23-034 returned 418.3 metres grading 1.88 grams gold per tonne from 5.7 metres depth.

Vancouver-based Sitka’s low share price also limits its attractiveness to investors who may want to buy 10% or less for their fund, but find the cash outlay is too small for their investment strategy, Coe said.

“It’s not enough to get a good position, so that’s been one of the handicaps,” he said in an interview with The Northern Miner. “But Snowline is a very good positive for us because it opened the belt up to eyes. The thing is it opened them up up so much, they all went for Snowline.”

Hecla Mining now owns the Alexco Resource property in top right, St. James Gold is optioning the Florin deposit north of Sitka’s RC project. Credit: Sitka Gold

Hecla Mining now owns the Alexco Resource property in top right, St. James Gold is optioning the Florin deposit north of Sitka’s RC project. Credit: Sitka Gold

Nonetheless, the RC project’s Blackjack and Eiger deposits start at surface and are open in all directions. Both have potential for open pit mining and heap leaching. RC is at the headwaters of Clear Creek and Big Creek, an active placer mining district serviced by a network of gravel roads and trails.

The company is in the midst of 10,000 metres of step-out drilling this year focused on the Saddle zone, midway between Blackjack and Eiger and not included in the resource. Last month, Sitka reported Blackjack drill hole DDRCCC-23-043 cut 111.7 metres of 1.24 grams gold per tonne starting from 315 metres downhole. A resource update could be in the works to generate more interest, he said.

“When we put our resource out, we didn’t get a good reaction in the market, it was almost like a liquidity event” when some shareholders sold down their stakes at the same time, he said. “It was kind of frustrating for us.”

Shares in Sitka Gold were at 9.5¢ apiece on Monday, within a 52-week window of 8.5¢ and 27¢, valuing the company at $16.6 million.

This month, Sitka is raising more than $1.2 million with an oversubscribed share sale that includes warrants and shows at least some investors see value in the low price, Coe said. Institutional funds, including lead investor Sprott Asset Management with 10.8%, make up 45% of stockholders. Retail investors hold about 35% of the stock while management and unnamed high-net-worth investors own the balance, he said.

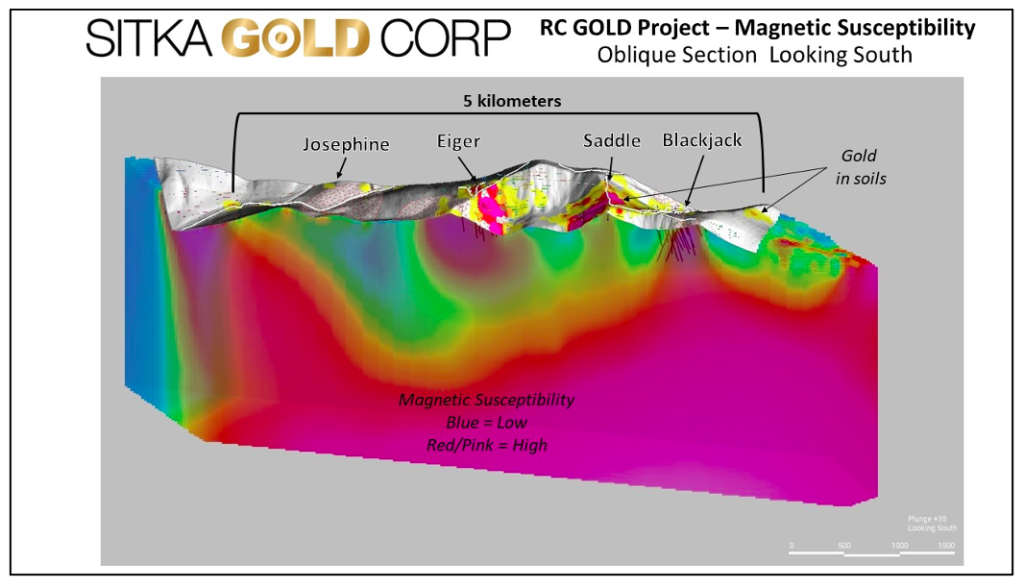

Image courtesy of Sitka Gold.

Three-dimensional modelling suggests the Saddle, Eiger, Josephine and Pukelman intrusions coalesce at depth, the CEO said. It also extends the mineralized corridor from about 2 km to more than 5 km to encompass the Saddle, Eiger and Josephine intrusions.

Sitka acquired the property in 2019 after mapping and surveying for the past two decades by Thor Exploration (TSXV: THX; LSE: THX), StrataGold (now part of Victoria Gold), Golden Predator (now in Sabre Gold), Pacific Ridge (CVE: PEX) and Kestral Gold (CVE: KGC).

In the 1990s, explorers on the site or nearby included Noranda (eventually owned by Glencore [LSE: GLEN]), Ivanhoe Mines (TSX: IVN; US-OTC: IVPAF), Kennecott (now a unit of Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO)) and Newmont (TSX: NGT; NYSE: NEM). Historical mining dates to the late 1800s followed by dredging on Clear Creek from 1943 to 1954 and from 1981 to 1987. There are placer mines operating in the Clear Creek drainage and in Big Creek.

The company’s other early-stage projects include the Coppermine River project in Nunavut, about 600 km north of Yellowknife, N.W.T., which this month acquired permits for water use and drilling, Coe said. Initial geophysical surveys suggest a large sediment-hosted copper deposit that could rival projects in the Democratic Republic of Congo, he said.

There’s also the OGI property 50 km east of Dawson and 1 km north of Sabre’s Brewery Creek project, the Burro gold project about 150 km northwest of Phoenix and the Alpha gold project in Nevada, 400 km east of Reno.

Even if the company’s stock performance has been lacklustre, Coe, who’s been in the Yukon mining industry for decades, is upbeat about the RC project’s potential.

“Six months ago, we didn’t have a deposit here. We’ve got one and a half million ounces now of gold that is 43-101 certified,” he grinned. “Well, that’s huge.”

Clarification: The story has been edited to relate how junior miners such as Sitka are not alone in facing difficult times to raise money on stock markets. Also, the last quote has been edited for clarity.

Great article. Thanks