Volcanic Gold Mines (TSXV: VGI) says it has discovered high-grade gold at surface on its Mila prospect, part of the greenfields Motagua Norte project under option from Radius Gold (TSXV: RDU).

“I think we’ve got a significant discovery here. It’s early stage, but I think it will develop into a mine of what size, time will tell,” company founder and prospector financier Simon Ridgway tells The Northern Miner in an interview.

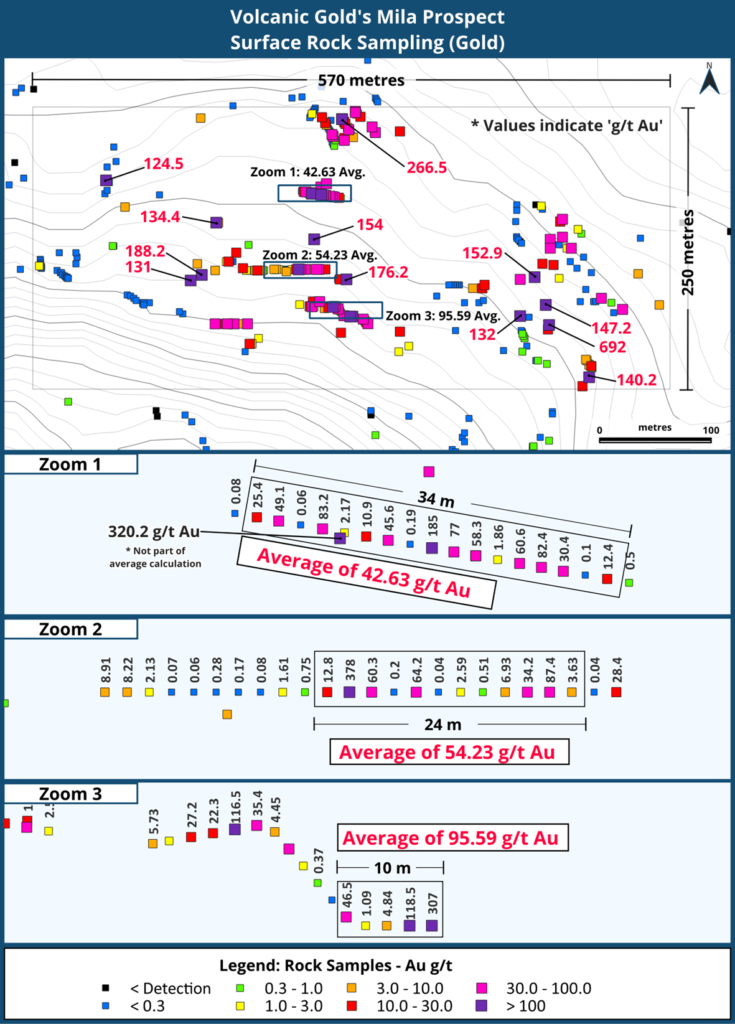

At the Mila prospect, the Volcanic team discovered significant concentrations of bonanza-grade and visible gold within a 250 x 570-metre zone, notably in quartz veins. Recent rock chip sampling across varied terrains returned continual 2 metre chip sample averages of 42 grams gold per tonne over 34 metres and 54 grams gold over 24 metres.

This high-grade gold in the quartz veins and adjacent areas suggests extensive gold mineralization zones.

The location boasts a gold-silver deposit with profound potential, according to Ridgway. The results indicate that high-grade gold mineralization appears to be focused within two north-south structures, roughly 200 metres apart, with each spanning at least 250 metres in length.

Current assessments suggest that one or possibly both structures house several quartz veins over a breadth of 25 to 50 metres.

To uncover the genuine structure, dimensions, and quality of these mineralized veins and adjacent areas, trenching and drilling work will soon start to follow up on the early September reports of exceptional gold grades at Mila. The initial samples, in several instances, exceeded 1 oz. gold per tonne, prompting comprehensive 2 metre-spaced chip sampling to verify the extent and distribution of the gold and prioritize future exploration activities.

Ridgway, who has worked in Guatemala since 1998 and has several successful mining discoveries to his credit, suggested the possibility of a sizeable orogenic system being present that promises depth and significant discovery potential.

Although obtaining mining concessions in Guatemala is no cakewalk, and despite rigorous approval processes and a waiting period stretching up to a year, Ridgway remains optimistic.

“There’s a silver lining,” he said, hinting at the potential restart of Pan American Silver’s (TSX: PAAS; NYSE: PAAS) Escobal silver mine “hopefully before year-end,” and possibly signalling a positive shift in Guatemala’s mining landscape. Operations are on hold awaiting an ILO 169 (Indigenous) consultation, with no set timeline for its completion or Escobal’s operational restart, according to Pan American.

Beyond the geology and potential of the Mila prospect, in Ridgway’s view, the larger picture focuses on Guatemala’s socio-economic scenario. With a staggering unemployment rate and an economy desperately needing a shot in the arm, newly elected President Bernardo Arevalo’s administration emphasizes job creation.

Here, mining emerges as a beacon of hope. Ridgway observed that reopening mines could be a pivotal move, “creating employment and wealth in the country.”

As the next steps, Volcanic is gearing up for drilling at the Mila prospect, with an initial plan spanning 1,000 to 3,000 meters to be announced soon, according to Ridgway.

Shares in Volcanic jumped 30% during intra-day trading in Toronto before settling at 20.5¢ apiece by the closing bell. It has touched 12¢ and 25¢ per share over the past 12 months. Volcanic has a market capitalization of $9.3 million.

Be the first to comment on "Volcanic Gold rises on Guatemala Mila discovery"